Introduction

As we step into 2025, the world of real estate token trading continues to expand rapidly, fueled by technological advancements and growing interest from investors. In 2024 alone, the blockchain sector witnessed approximately $10 billion flowing into real estate token markets, marking a significant increase from the previous year. This article delves into the global real estate token trading heatmap statistics 2025, providing insights into market trends, investment opportunities, and the potential growth trajectories of tokenized real estates.

The Rise of Real Estate Tokenization

Tokenization refers to converting ownership rights of an asset into a digital token on the blockchain, allowing for fractional ownership and enhanced liquidity. With real estate being one of the largest asset classes globally, its tokenization is transforming how investments are made, making it accessible to a broader audience.

- Access to Global Investors: Investors from various geographical locations can now participate in real estate investments without the burdens of traditional finance.

- Enhanced Liquidity: Tokenization allows real estate assets to be bought and sold on blockchain platforms, offering lower transaction costs and faster processing times.

- Regulatory Compliance: Many tokenized offerings are structured to comply with local regulations, increasing investor safety.

Global Market Trends in 2025

According to predictions, the market for real estate tokenization is expected to grow by over 300% by 2028, with a focus on the following statistics as we reach 2025:

- Market Size: The total market size of real estate tokens is projected to reach $30 billion.

- User Growth: An estimated 15% increase in global users engaging in tokenized real estate.

- Investment Trends: The average investment per user is expected to rise to $50,000.

Vietnam’s Emerging Market Opportunities

Vietnam is one of the fastest-growing markets for blockchain technology in Southeast Asia. With a growth rate of 30% for crypto users in 2024, the potential for tokenized real estate in this market is substantial.

- Rising Affluence: As the Vietnamese economy continues to thrive, more citizens are seeking diversified investment opportunities.

- Adoption of Blockchain Standards: Institutional support for blockchain standards will enhance the credibility of tokenized assets.

Utilizing tiêu chuẩn an ninh blockchain (blockchain security standards) will play a crucial role in safeguarding investments in this niche market.

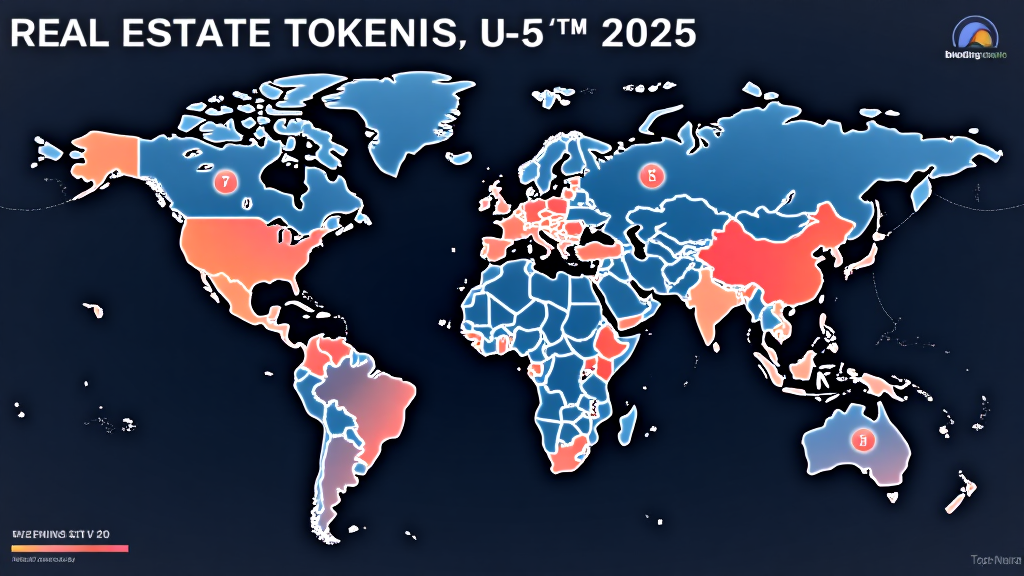

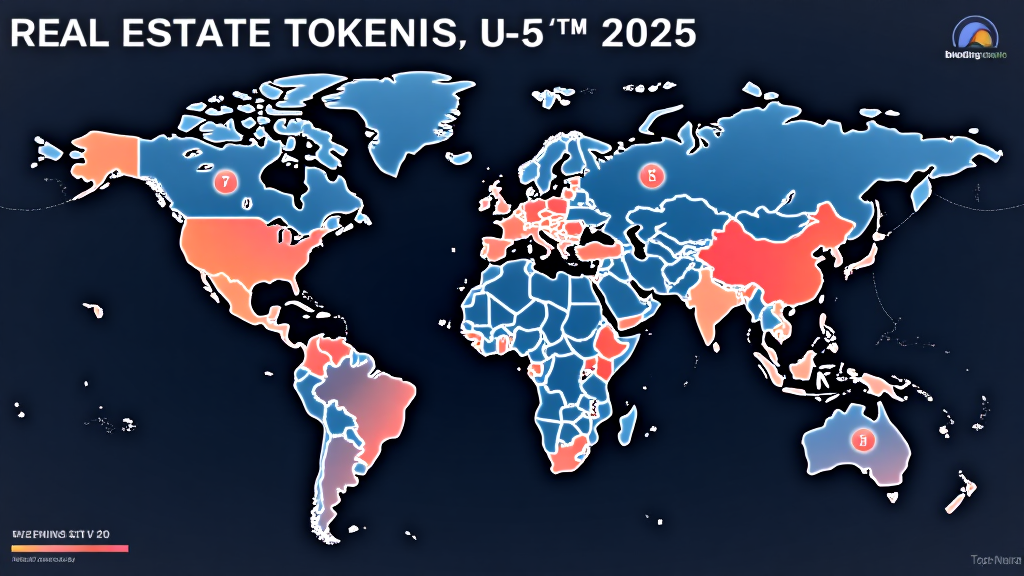

Heatmap Analysis for 2025

The real estate token trading heatmap provides a visual representation of where the majority of transactions are occurring. This data can guide investors in identifying hotspots with high potential returns.

Top Investment Regions

- North America: Dominating the market with over 45% of the transactions occurring here.

- Europe: Following closely with 30%, particularly in urban centers.

- Asia Pacific: Experiencing rapid growth, driven by countries like Vietnam and China.

Understanding Risks and Challenges

While the benefits of investing in tokenized real estate are significant, it is vital to be aware of the challenges that persist:

- Regulatory Uncertainty: Different countries have varying regulations regarding tokenization, which may impact market growth.

- Market Volatility: The crypto market is known for its volatility, which can affect real estate token prices.

Conclusion

As the global real estate token trading market matures, understanding the global real estate token trading heatmap statistics 2025 becomes increasingly important for investors. By recognizing market trends, regional opportunities, and inherent risks, stakeholders can make informed decisions moving forward. The future of real estate investment is undoubtedly changing, and those who adapt early may reap the most rewards.

Although this information is valuable, remember that it does not constitute financial advice. Always consult local regulators for compliance.

For more information about real estate tokenization, visit hibt.com.

Written by Dr. Jane Smith, a blockchain consultant and author with over 20 publications in distributed ledger technology, specializing in compliance auditing for international projects.