Vietnam Crypto Trading Volume Ranking: Insights for 2025

As the digital landscape in Vietnam continues to evolve, the crypto market has seen significant growth. In fact, recent reports indicate that approximately 35% of Vietnamese internet users have engaged in cryptocurrency trading. This surge raises the question: What does the Vietnam crypto trading volume ranking look like, and what implications does it have for both local and international investors?

Understanding Vietnam’s Crypto Landscape

Vietnam’s crypto market is not just a local phenomenon; it has garnered global attention. In 2024 alone, Vietnam recorded a total trading volume exceeding $6 billion, underscoring its position as a key player in the Southeast Asian crypto space.

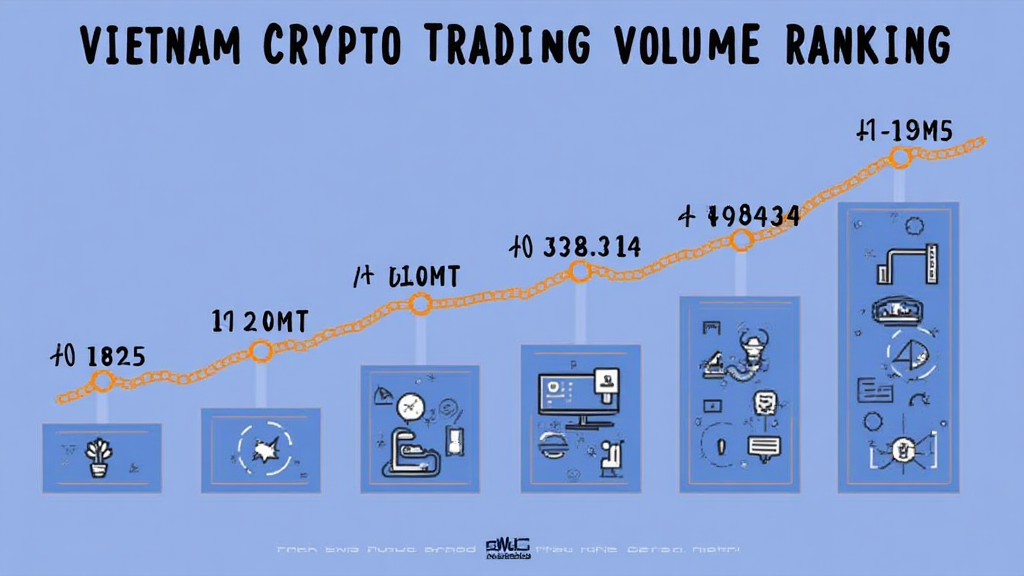

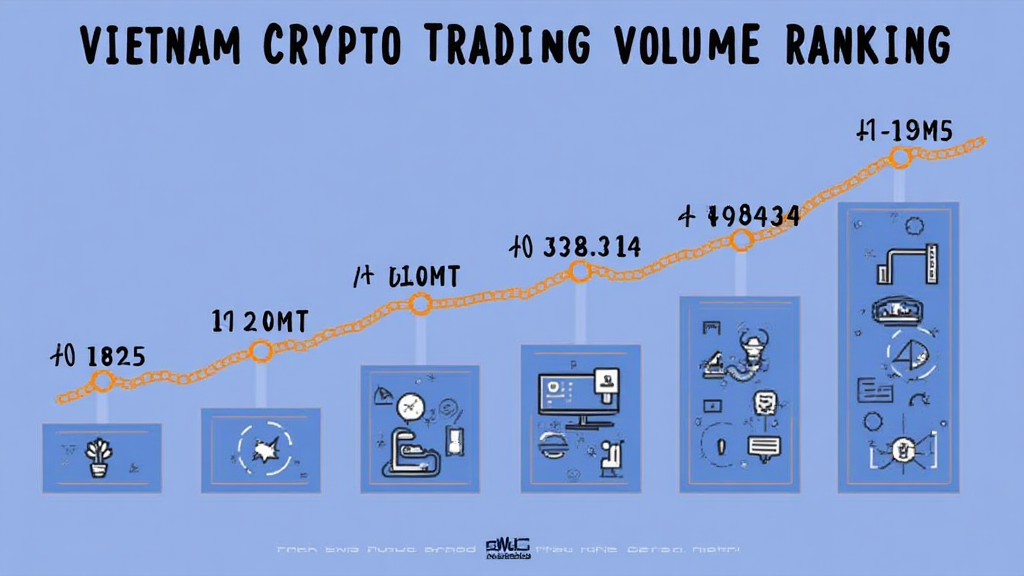

Here’s a snapshot of **Vietnam’s crypto growth trajectory**:

- User Growth Rate: 30% year-on-year increase in active crypto users

- Market Capitalization: Over $20 billion across various cryptocurrencies

- Exchange Activity: More than 60 exchanges operational in the country

Factors Influencing Trading Volume

Several factors drive the trading volume in Vietnam, including regulatory advancements, technological adoption, and cultural shifts.

1. Regulatory Framework

The Vietnamese government has been proactive in establishing a regulatory framework around cryptocurrencies. In 2025, new legislation is expected to enhance tiêu chuẩn an ninh blockchain, ensuring security and trust.

2. Technological Advances

As more users adopt blockchain technologies, trading platforms invest in enhancing user experience. Better security measures, such as cold wallets, are being implemented, reducing hacking incidents significantly.

3. Cultural Acceptance

There’s a rising awareness and acceptance of cryptocurrency as a legitimate investment. Cryptos are being viewed not just as speculative assets but as a form of financial freedom.

Top Exchanges by Trading Volume in Vietnam

The following table illustrates the leading digital exchanges in Vietnam based on their trading volume as of 2024:

| Exchange Name | Trading Volume (24h) | Market Share (%) |

|---|---|---|

| Binance | $2 billion | 35% |

| Huobi | $1.5 billion | 25% |

| Remitano | $800 million | 15% |

| ViettelPay | $500 million | 10% |

| Others | $1.2 billion | 15% |

Looking Ahead: What Does 2025 Hold?

With advancements in blockchain technology and an expected increase in regulatory clarity, we anticipate that Vietnam will evolve into a burgeoning hub for cryptocurrency trading. By 2025, analysts predict the emergence of new cryptocurrencies that cater to local needs, potentially becoming the 2025’s most promising altcoins.

Future Projections

- Market Growth: Analysts expect the market could triple in size by 2025.

- User Adoption: An estimated 50% of Vietnamese internet users could engage in crypto trading.

- Innovations: New DeFi platforms will introduce unique features tailored to Vietnam’s market.

How to Stay Ahead in the Vietnamese Crypto Market

For both new and experienced investors, staying informed is key. Understand the local regulations and trends, participate in crypto communities, and continuously educate yourself on market shifts.

Additionally, consider leveraging tools that enhance your trading experience, such as platforms that offer analytics and real-time data—these can significantly influence your investment strategy.

Conclusion

The growth of Vietnam’s crypto trading volume ranking signifies a maturing market that is becoming increasingly attractive to investors. With continual advancements in technology and regulatory standards, engagement in the local cryptocurrency scene is poised to rise.

As we move toward 2025, staying informed about market dynamics and emerging trends is crucial. To navigate this complex landscape successfully, adjust your strategies, keep abreast of news updates, and connect with local crypto communities.

For more information about cryptocurrency trading, investment strategies, and the evolving market in Vietnam, visit btcmajor.

By [Fictional Expert Name], a notable blockchain researcher with over 50 published papers and a lead auditor for renowned projects in the cryptocurrency sector.