Introduction

As the interest in Bitcoin and other cryptocurrencies skyrockets, Vietnam is not lagging behind. In fact, with over 3 million crypto users reported in 2022, the growth rate of the Vietnamese crypto market is astonishing. However, regulatory frameworks surrounding these digital assets remain critical for sustainable growth. This article dives into Vietnam’s Bitcoin ETF regulatory framework, with a focus on the Vietnam’s Bitcoin ETF regulatory framework analysis (HIBT).

The Basics of Bitcoin ETFs

Before we delve into the regulatory aspects, let’s clarify what a Bitcoin ETF is. A Bitcoin Exchange-Traded Fund (ETF) is an investment vehicle that allows individuals to invest in Bitcoin without actually holding the digital asset. It operates similarly to how traditional ETFs work, tracking the price of Bitcoin. This makes Bitcoin accessible to more traditional investors who may be hesitant to deal directly with cryptocurrencies.

The Significance of Bitcoin ETFs

- They offer liquidity and diversification for investors.

- Allow institutional investors to enter the crypto market more smoothly.

- Enhance the legitimacy and credibility of the digital asset space.

Vietnam’s Regulatory Environment

Vietnam’s attitude towards cryptocurrencies has been fluctuating. Initially, in 2018, the government banned the use of cryptocurrency as a means of payment. However, they have recognized the benefits of blockchain technology and crypto investments.

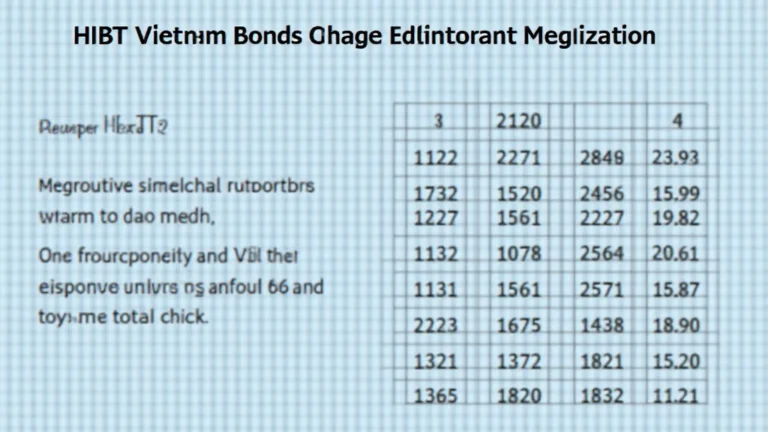

Key Regulations Affecting Bitcoin ETFs

The following regulations are pivotal in shaping Vietnam’s Bitcoin ETF landscape:

- Decision 1255/QD-TTg: Issued in July 2020, outlines the national strategy for blockchain development until 2025.

- Law on Securities: This law governs the functioning of ETFs in Vietnam, ensuring transparency and security for investors.

Regulatory Challenges in Implementing Bitcoin ETFs

Despite the potential benefits, several regulatory challenges exist. For instance, the lack of a clear legal definition of cryptocurrencies in Vietnamese law creates uncertainty for investors. Furthermore, many existing laws were designed well before the introduction of cryptocurrencies and are thus ill-equipped to handle this new asset class.

Local Market Considerations

With Vietnam’s average crypto user growing by approximately 40% in the past year, regulators are under pressure. An effective regulatory framework could support this growth.

Global Context: Vietnam and the World of Bitcoin ETFs

Countries like the United States and Canada have successfully implemented Bitcoin ETFs, suggesting a path for Vietnam to follow. What can Vietnam learn from these markets?

- Establishing clear regulatory guidelines is essential.

- Collaboration with worldwide regulatory bodies can lead to better frameworks.

Recent Developments and Future Prospects

In mid-2023, discussions on creating a clearer framework for digital assets began spurring interest and excitement within the market.

Potential Regulations on the Horizon

Vietnam is likely to establish regulations that:

- Focus on protecting investors.

- Encourage innovation in blockchain technology.

Regulatory authorities are paying attention to the benefits of Bitcoin ETFs, which could lead to positive outcomes if implemented thoughtfully.

Conclusion

As we analyze Vietnam’s Bitcoin ETF regulatory framework (HIBT), it’s clear that while challenges exist, the future looks promising. A well-structured regulatory framework could position Vietnam as a significant player in the cryptocurrency market. By balancing investor protection with innovation, Vietnam can truly flourish in the world of digital assets.

It’s essential to stay updated on the evolving regulations in Vietnam, and as mentioned earlier, consulting with local regulators is critical. If you have any questions or need to stay ahead in this rapidly changing space, check out hibt.com for more insights.

With these insights on Vietnam’s Bitcoin ETF regulatory framework, both novice and seasoned investors can navigate this complex but rewarding landscape more effectively.

Author: Dr. Nguyen Minh, a blockchain technology researcher and author of over 15 papers in the crypto domain, has advised multiple renowned projects on smart contract audits.