Vietnam Crypto Real Estate Loans: Opportunities and Trends

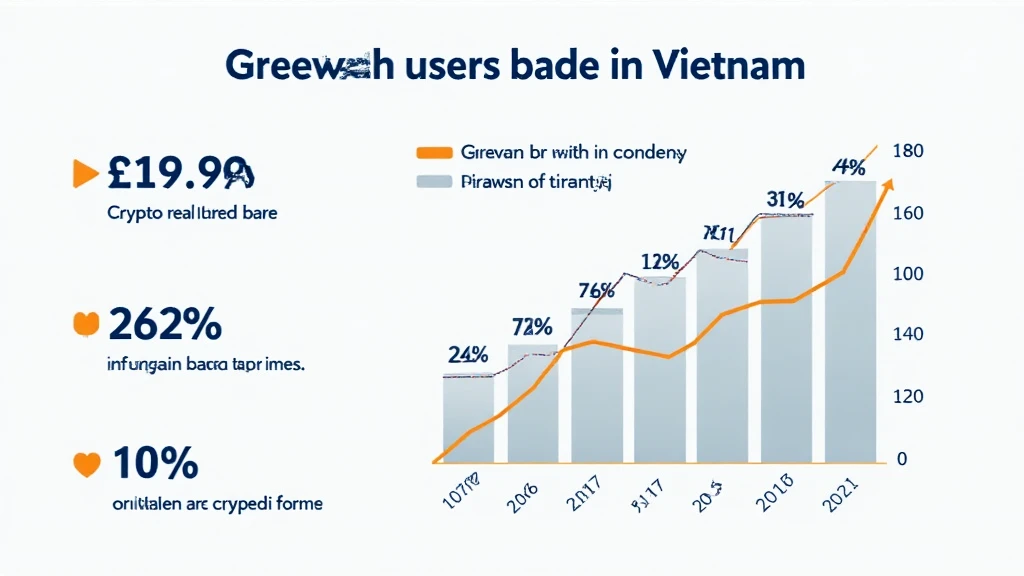

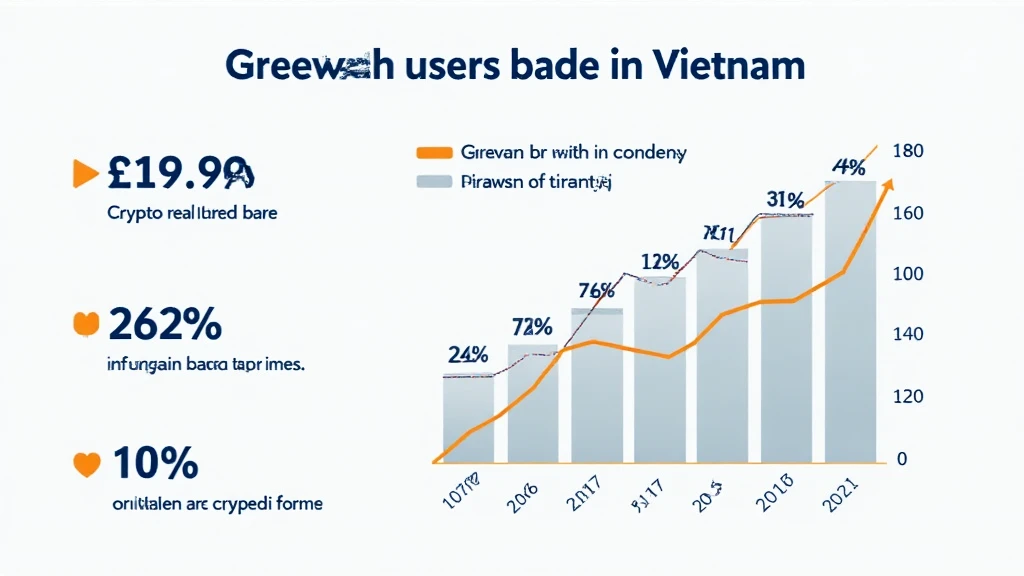

In recent years, Vietnam has emerged as a significant player in the global cryptocurrency space. With approximately 5 million cryptocurrency users as of 2023, growing at a remarkable rate of 45% per year, the need for innovative financial solutions in this field has never been more pressing. One such area is crypto real estate loans, where investors leverage digital assets to acquire property. This guide aims to delve into the potential of crypto-backed real estate loans in Vietnam, the challenges involved, and strategies for successfully navigating this evolving market.

Understanding Crypto Real Estate Loans

Crypto real estate loans allow investors to use their cryptocurrency holdings as collateral to secure financing for purchasing property. This model is gaining traction as it offers the possibility to maintain exposure to crypto assets while unlocking liquidity for traditional investments.

- Benefits of Crypto Real Estate Loans:

- Access to funds without the need to liquidate crypto holdings

- Potentially lower interest rates compared to traditional loans

- Flexible repayment options based on the performance of crypto assets

How Do Crypto Loans Work?

Similar to traditional loans, a borrower takes a loan secured by their crypto assets, usually at a predetermined loan-to-value (LTV) ratio. If the borrower fails to repay, the lender can liquidate the crypto to recover their funds. However, this model carries significant risks, particularly due to the volatility of cryptocurrencies.

The Vietnamese Market for Crypto Real Estate Loans

Vietnam’s increasing acceptance of cryptocurrencies and a burgeoning real estate market present ample opportunities for investors. As mentioned earlier, the number of crypto users is on the rise, accompanied by heightened interest in property investments, particularly in major cities like Ho Chi Minh City and Hanoi.

Incorporating local data into our understanding, over 30% of Vietnamese investors are considering investing in real estate using cryptocurrencies, highlighting a growing trend that is hard to ignore.

Challenges to Consider

While the prospects seem promising, several challenges must be addressed:

- Regulatory Uncertainty: The legal framework for using cryptocurrencies in property transactions remains unclear, which can pose risks for buyers and lenders.

- Market Volatility: Fluctuations in cryptocurrency values can impact the reliability of crypto-backed loans, leading to potential losses.

- Lack of Awareness: Many investors may still be unaware of the benefits and mechanisms of crypto real estate loans.

Navigating the Legal Landscape in Vietnam

In Vietnam, navigating the regulatory environment is crucial for gaining traction in the crypto real estate loan market. Although the government has shown interest in blockchain technology, the lack of comprehensive regulations can discourage adoption.

It’s important for potential investors to stay informed about developments in the regulatory landscape, including new laws and guidelines such as the tiêu chuẩn an ninh blockchain, which refers to the security standards related to blockchain technology.

Practical Steps for Investors

Investors interested in crypto real estate loans should consider the following:

- Conduct Thorough Research: Understand the local market dynamics and regulatory aspects that could impact your investment.

- Consult Professionals: Engage with legal experts familiar with cryptocurrency and real estate law.

- Diversify: Consider diversifying your portfolio to mitigate risks associated with market volatility.

Leveraging Technology for Better Outcomes

With the advancements in technology, various platforms now offer tools that simplify the process of securing crypto real estate loans. From automated credit assessments to smart contracts, these technologies enhance the efficiency and security of financial transactions.

For example, using a ledger device can significantly decrease the chances of hacking, making your investment more secure. By incorporating these technologies, investors can ensure better management of their assets.

Looking Ahead: The Future of Crypto Real Estate Loans in Vietnam

The future of crypto real estate loans in Vietnam is poised for growth. As more educational resources become available and technology continues to evolve, investors are likely to embrace these financial instruments enthusiastically.

It’s anticipated that by 2025, Vietnam will witness an increase in crypto adoption rates by approximately 50% in the real estate sector, creating a new frontier for investment opportunities.

The Role of Awareness and Education

Awareness is critical. Various hyperlocal workshops and webinars focused on educating potential investors can effectively demystify the concept of crypto loans for real estate.

Consider participating in local seminars or joining online communities where you can share knowledge and learn about real-world applications of crypto real estate loans.

Conclusion: Seizing the Opportunity

In conclusion, the intersection of cryptocurrency and real estate provides an exciting opportunity for Vietnamese investors. As the market matures, understanding the dynamics involved in crypto real estate loans will be essential for leveraging this growth effectively.

With increasing awareness, robust regulatory frameworks, and technological advancements, the path ahead looks promising. If you’re looking to capitalize on this trend, it’s time to start your research and prepare for an exciting investment journey in the Vietnamese market.

Visit btcmajor for more insights into crypto investments and stay updated with the latest trends.

Authored by: Dr. Minh Nguyen, a blockchain technology expert and consultant, with a background in financial audits and multiple published articles on the intersection of real estate and cryptocurrency.