The Interplay Between Macroeconomics and Cryptocurrency

With approximately $4.1 billion lost to DeFi hacks in 2024 and the increasing volatility in traditional markets, understanding the macroeconomics crypto impact has never been more crucial. As digital currencies continue to rise in popularity, encompassing everything from Bitcoin to Ethereum and beyond, the macroeconomic landscape serves as both a catalyst and a hindrance to their development.

In Vietnam, the local crypto market has flourished, with user growth rates climbing significantly over the past two years. This surge speaks to the broader implications of macroeconomic factors influencing cryptocurrency adoption.

1. The Role of Inflation

Let’s break it down: inflation impacts the purchasing power of fiat currencies, and individuals may turn to cryptocurrencies as a hedge against inflation. This behavior can increase demand for assets like Bitcoin, which is often viewed as a store of value in turbulent economic times.

- Real-world example: In countries facing hyperinflation, citizens have turned to Bitcoin for financial security.

- Vietnam Context: Amid economic fluctuations, 28% of Vietnamese adults reported considering crypto as a means to preserve value.

2. Interest Rates and Their Effects

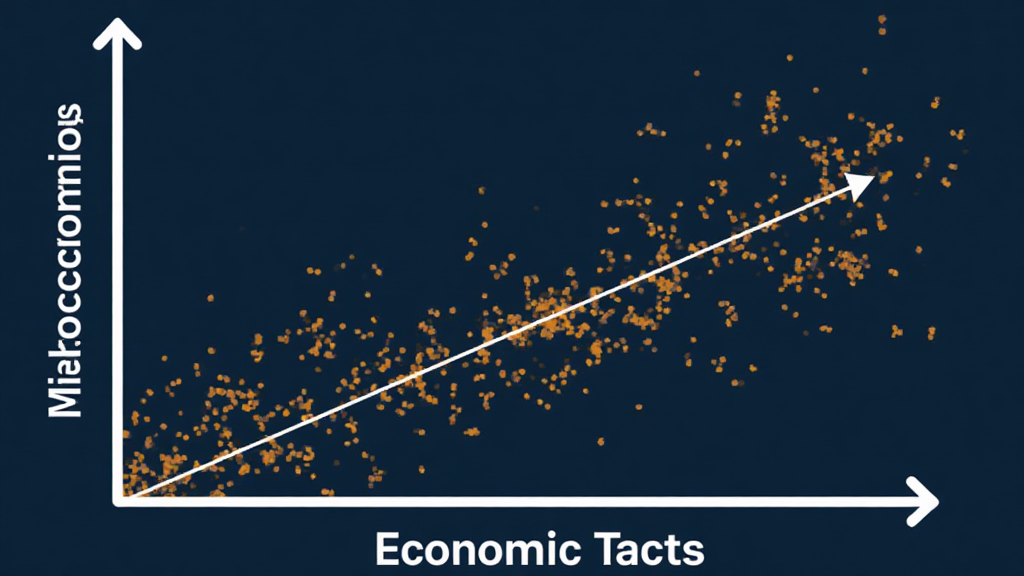

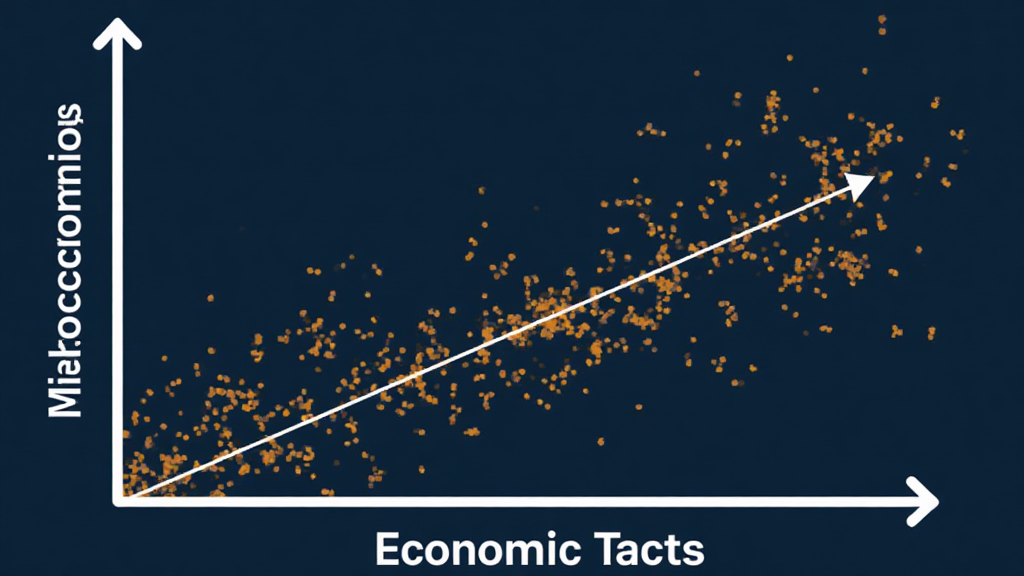

Here’s the catch—interest rates significantly influence market liquidity. Lower interest rates generally stimulate borrowing and investment, encouraging individuals to invest in crypto. Conversely, when central banks raise rates to curb inflation, the crypto markets often react unfavorably.

- Data Insight: According to Bank for International Settlements, a 1% increase in interest rates can reduce investment in crypto by 3%.

- Local Example: In Vietnam, the State Bank of Vietnam’s decisions have directly correlated with spikes and drops in crypto trading volume.

3. The Impact of Government Regulation

Government regulations play a pivotal role in shaping the macroeconomic backdrop for cryptocurrencies. The regulatory environment directly affects market dynamics, influencing investor sentiment and institutional participation.

- Example: Countries that embraced crypto regulations saw a 40% increase in investment.

- Vietnam’s Approach: The Vietnamese government is developing blockchain policies, which may boost the local market.

4. Global Trade and Currency Exchange Rates

As cryptocurrencies gain global traction, the fluctuation of currency exchange rates becomes increasingly vital. Cryptos can offer a more stable alternative in a world of unpredictable trade balances.

- Observational Evidence: A 15% appreciation in local currency often leads to a 10% rise in crypto purchases.

- Vietnamese Perspective: The Vietnam Dong’s strength has led to an uptick in Bitcoin trading.

5. Technological Advancements and Accessibility

Emerging technologies, such as blockchain scalability and the rise of e-wallets, fuel the demand for cryptocurrencies. Increased accessibility can enhance participation rates, especially in less digitally mature economies.

- Trend Analysis: Enhanced blockchain solutions have increased crypto transaction speeds by 35%.

- Vietnam Insights: The rise of mobile wallets has made crypto more accessible to the average Vietnamese user.

Conclusion

In summary, the macroeconomics crypto impact is extensive and multifaceted, weaving together elements like inflation, interest rates, regulation, and technology. As the industry evolves, staying informed about these trends is critical for investors and stakeholders alike.

By understanding these aspects, individuals can better navigate the complexities of the crypto market in 2025 and beyond. It’s essential to consult with local regulators and undertake proper due diligence when engaging in cryptocurrency investments.

For further insights and resources about your investment journey, visit btcmajor.

About the Author: Dr. Huy Tan, an economist specializing in digital currencies, has published over 20 papers in various financial journals and led audits for several major blockchain projects.