Introduction

In recent years, blockchain technology has transformed many sectors, including finance, leading to increased valuations and market dynamics. According to market analysts, the average user growth rate for cryptocurrency platforms in Vietnam is set to surpass 30% in 2025, indicating a robust adoption of digital assets among the Vietnamese populace. However, as investors flock to explore bond trading on platforms like btcmajor, the challenge of understanding margin calls in the context of HIBT Vietnam bonds is more pressing than ever.

This article aims to provide a comprehensive overview of HIBT Vietnam bond margin call calculation methods through practical examples. We will break down the concepts, their applications, and present data-driven insights to ensure a clear understanding of this topic. By the end of this article, readers will possess the knowledge to confidently assess their margin call calculations and make informed investment decisions.

Understanding Margin Calls

Before diving into the specifics of margin call calculations, it is essential to understand what a margin call is. In the stock and bond market, a margin call occurs when the value of an investor’s margin account falls below the broker’s required amount. It serves as a warning that additional funds or securities need to be deposited to meet minimum collateral requirements.

How Margin Calls Work in Bond Trading

- The margin requirement is usually expressed as a percentage of the total position value.

- If the bond’s value declines, the equity in the account can fall below the maintenance margin.

- In such cases, the broker can issue a margin call, prompting the investor to deposit additional funds.

For instance, if an investor holds $10,000 in bonds with a margin requirement of 20%, they must maintain at least $2,000 in equity. If the bond’s value drops to $8,000, the investor must cover the margin difference.

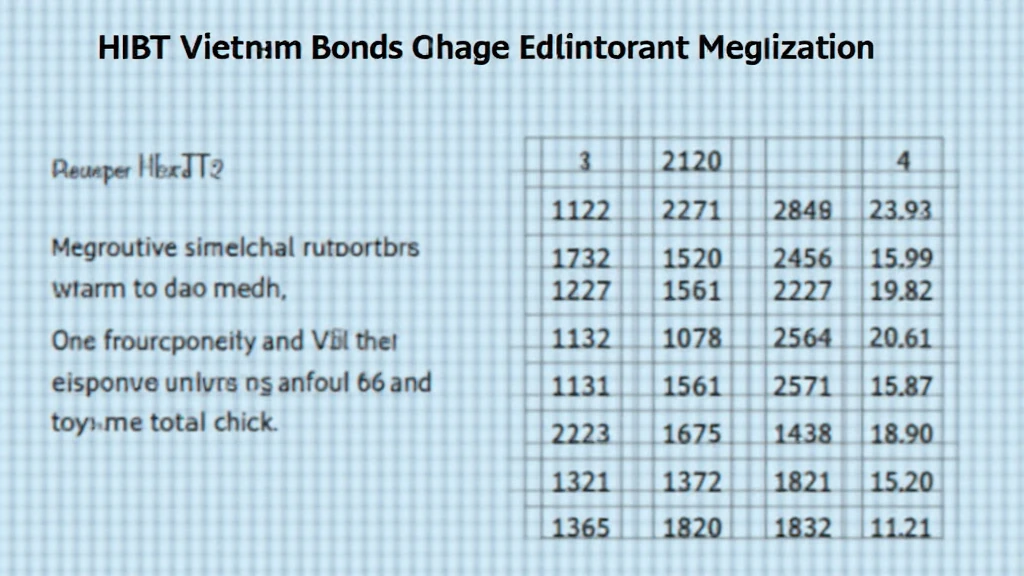

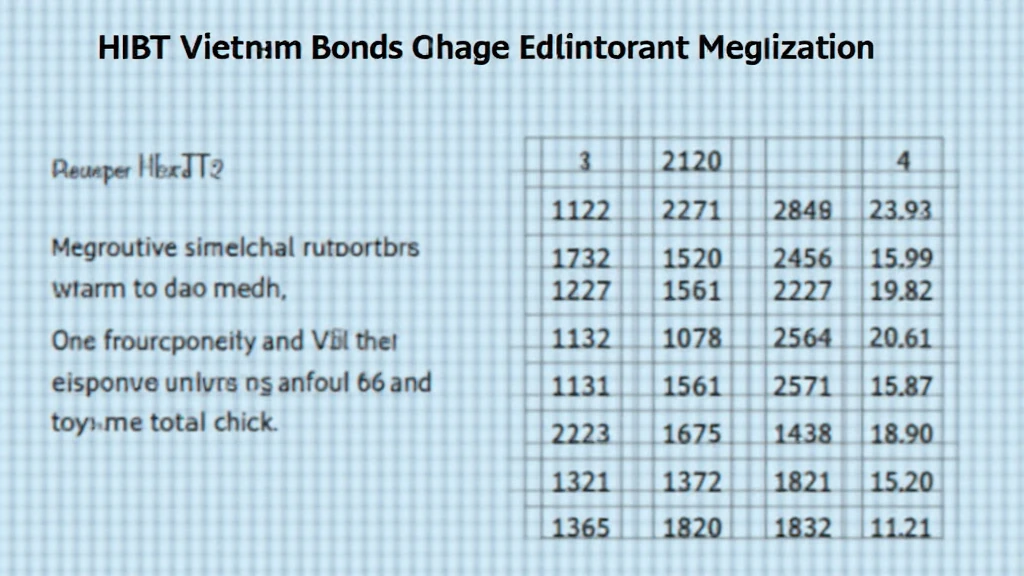

HIBT Vietnam Bond Margin Call Calculation Example

Let’s utilize a practical example to highlight how margin calls are calculated for HIBT Vietnam bonds.

Scenario Overview

Consider an investor who buys HIBT Vietnam bonds worth $100,000. The brokerage requires a maintenance margin of 30%. If the market conditions lead to a decrease in the bond’s value, it is critical to calculate how much capital needs to be added to avoid a margin call.

Step-by-Step Calculation

1. **Initial Investment**: The investor purchases bonds worth $100,000.

2. **Maintenance Margin**: The broker requires a maintenance margin of 30%, thus:

Required Equity = $100,000 x 0.30 = $30,000

3. **Market Value Change**: Assume the market value of the bonds drops to $70,000.

4. **New Equity Calculation**: The equity in the account is calculated as follows:

Equity = Market Value – Borrowed Funds

Assuming the investor borrowed $70,000, the equity would now be:

Equity = $70,000 – $70,000 = $0

5. **Margin Call Trigger**: Given the maintenance margin is $30,000, the investor is required to top up their account by:

Amount to Deposit = Required Equity – Current Equity

Amount to Deposit = $30,000 – $0 = $30,000

Thus, the investor receives a margin call to deposit $30,000 to meet the maintenance margin requirement.

The Risks of Margin Trading

Investing in bonds with margin carries specific risks. Understanding these risks is crucial when actively engaging in trading HIBT Vietnam bonds.

Key Risks Include:

- Leverage Risk: Amplifies both gains and losses.

- Market Risk: Sudden market downturns can trigger margin calls, leading to forced liquidations.

- Liquidity Risk: In less liquid markets, it may be challenging to sell bonds at the desired price.

These risks emphasize the importance of conducting thorough research and ensuring a solid grasp of the bond market dynamics.

Real-world Data on Vietnam’s Growing Crypto Market

According to a report published by hibt.com, Vietnam’s cryptocurrency market is witnessing unparalleled growth. By 2025, it is expected that:

- 70% of the population will be familiar with cryptocurrency assets.

- The total market capitalization may exceed $10 billion.

This rapid evolution represents a significant opportunity for investors exploring innovative financial products like HIBT Vietnam bonds.

Future Trends in Bond Trading

The future of bond trading, particularly regarding digital assets, is bright. Advancements in blockchain technology and decentralized finance (DeFi) platforms are revolutionizing how bonds are traded and managed.

Potential Future Trends Include:

- Increased Tokenization: Bonds will increasingly be issued as tokens on the blockchain, improving liquidity and transparency.

- Automated Trading: Smart contracts could be used to automate margin calls and trading processes, reducing operational risks.

- Emerging Regulation: New regulations tailored for digital assets will help to protect investors while fostering innovation.

Keeping abreast of these trends can empower investors to make informed decisions and enhance their trading strategies.

Conclusion

In summary, mastering the intricacies of HIBT Vietnam bond margin call calculations is integral to effective investment strategy. Given the projected growth of cryptocurrency among the Vietnamese population, it is essential for investors to understand how margin trading functions and its implications. Furthermore, staying informed about market trends and the risks involved can aid in making calculated decisions.

As we look ahead, the integration of blockchain technology within bond markets will provide exciting opportunities for investors. For those interested in exploring HIBT Vietnam bond trading, a reliable platform like btcmajor is a great starting point.

**Author:** Dr. Alex Nguyen is a blockchain protocol expert with over 15 publications in the field and has led numerous smart contract audits aimed at enhancing security standards in financial technology.