Introduction

In the world of cryptocurrency trading, understanding the various order types can significantly impact your investment strategy. As the market continues to evolve, a staggering $4.1 billion was lost to DeFi hacks in 2024, emphasizing the need for secure and informed trading practices. This guide will walk you through the HIBT crypto order types, equipping you with the knowledge to navigate this complex landscape effectively.

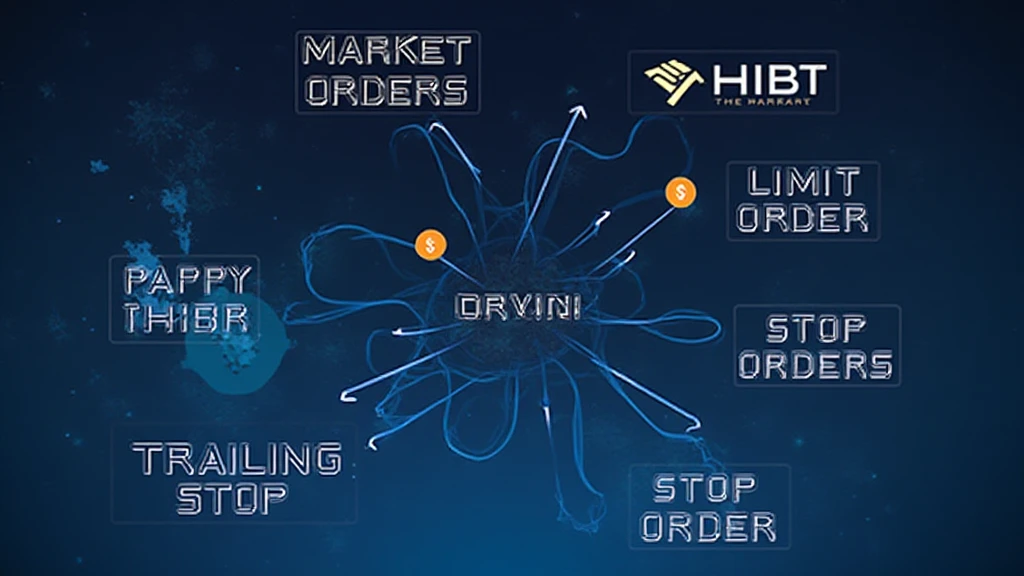

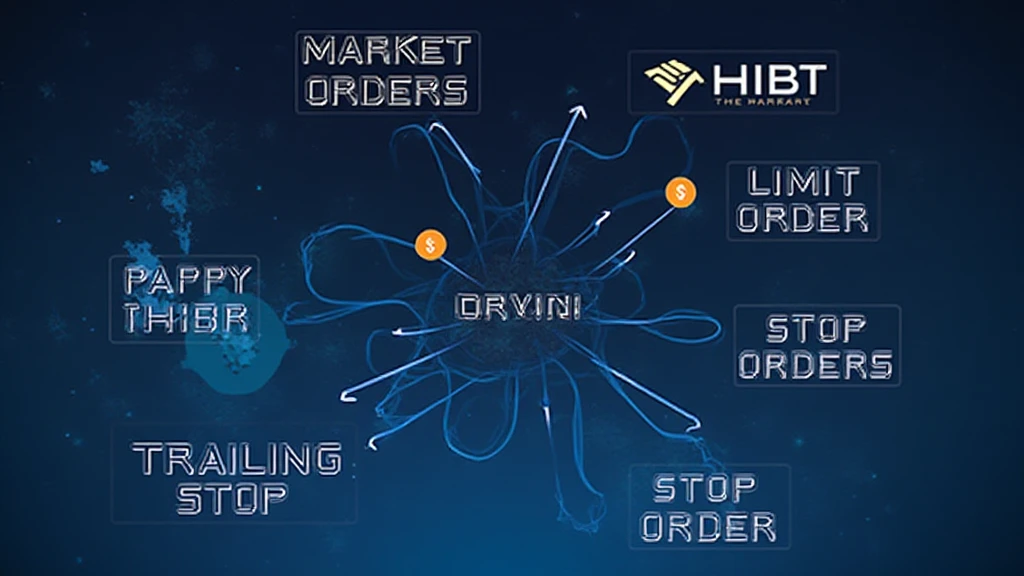

What are HIBT Crypto Order Types?

HIBT (Hybrid Intelligent Blockchain Trading) encompasses a range of tools that traders can utilize to execute their trading strategies. Whether you’re a seasoned investor or a newcomer, you’ll find that understanding these order types is crucial.

- Market Orders: These allow traders to buy or sell an asset immediately at the current market price. They are quick and convenient but can lead to slippage in highly volatile markets.

- Limit Orders: These orders enable traders to specify the price at which they want to buy or sell an asset. This can safeguard against unfavorable price movements.

- Stop Orders: Commonly used to limit losses, stop orders trigger a market order once a specific price is reached.

- Trailing Stop Orders: These orders adjust themselves as the market price changes, helping secure profits while allowing for potential gains.

The Importance of Order Types in Trading

Understanding HIBT crypto order types is vital for various reasons:

- Market Efficiency: The use of different order types contributes to the efficiency of the trading ecosystem, ensuring that prices accurately reflect the market sentiment.

- Risk Management: Implementing diverse order types can help mitigate risks and protect your investments.

- Strategic Execution: Different orders allow for a more refined approach to executing trades based on market conditions, enhancing overall trading strategies.

Vietnam’s Growing Crypto Market

The cryptocurrency landscape in Vietnam is witnessing rapid growth, with the crypto user adoption rate increasing significantly over the past few years. According to recent data, over 10% of the Vietnamese population has engaged with cryptocurrency, indicating an emerging market that could benefit from understanding HIBT crypto order types.

How to Use HIBT Crypto Order Types Effectively

Let’s break down how to implement each type effectively:

Market Orders

When using market orders, it’s essential to monitor market conditions closely, especially during high volatility. Although market orders are executed quickly, be aware that the price you receive may not match your expectations due to slippage.

Limit Orders

Using limit orders can be advantageous in volatile markets. For instance, if Bitcoin is trading at $50,000 and you believe it will dip to $48,000, setting a limit order at that price ensures you won’t buy at a less favorable rate.

Stop Orders

Stop orders are beneficial for minimizing losses. For example, if you buy a token for $100 and want to limit your loss to 10%, you would set a stop order at $90.

Trailing Stop Orders

These are beneficial for letting your profits run. If a crypto asset increases by 10%, for example, you can set a trailing stop of 5%, securing your profits while allowing room for price appreciation.

Real-World Applications of HIBT Crypto Order Types

Consider the following scenarios where understanding HIBT crypto order types could enhance trading success:

- Investment Recovery: Using stop orders effectively could recover investments during market downturns.

- Maximizing Gains: Limiting losses with a limit order while allowing profits to run with a trailing stop order can optimize portfolio growth.

- Real-Time Adaptability: Market orders can act quickly in highly dynamic markets, ensuring position adjustments happen instantly.

Risks and Considerations

Every trading method comes with its risks. Here are some considerations when using HIBT crypto order types:

- Market Volatility: Rapid market movements can cause unexpected results with market and limit orders.

- Execution Risks: Informs on the liquidity of the market are necessary, as low-volume assets may not fill orders as intended.

- Psychological Stress: Trading can be stressful; understanding how and when to use different order types can alleviate some of that stress.

Conclusion

In summary, mastering HIBT crypto order types enables traders to navigate the volatile landscape of cryptocurrencies with greater confidence and efficiency. With the growing interest in Vietnam’s crypto market, utilizing these trading strategies can enhance security and profitability for traders. As you embark on your trading journey, remember that these tools are not just for seasoned investors; they are accessible and effective for anyone looking to engage with digital assets. Ensure to stay informed and continually educate yourself about market trends and trading strategies, including the various HIBT order types that can make a difference in your trading experience.

If you want to explore more about cryptocurrency trading strategies, be sure to check out HIBT for comprehensive insights.

Author: Dr. Alex Mercer, a leading expert in blockchain technology, having published over 15 papers in blockchain security, and has led audits on several notable projects.