Understanding Crypto Market Cycles: A Guide for Investors

As the digital finance landscape continues to evolve, understanding crypto market cycles becomes essential for investors seeking to maximize their returns. In 2024 alone, over $4.1 billion has been reported lost to DeFi hacks, highlighting the importance of informed decision-making in this volatile sector. In this comprehensive guide, we will explore the nuances of market cycles and offer practical insights to help you navigate these turbulent waters.

The Nature of Crypto Market Cycles

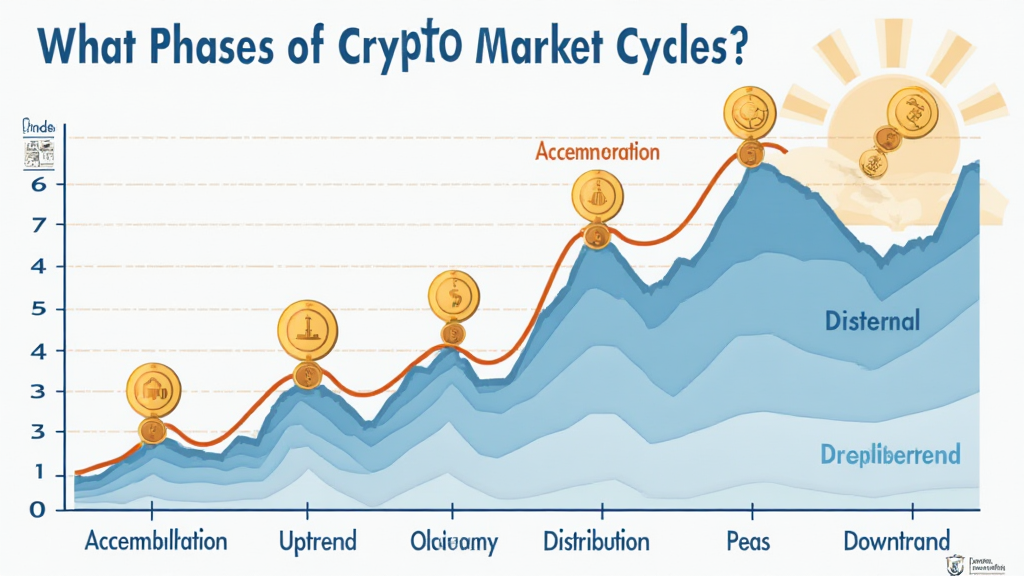

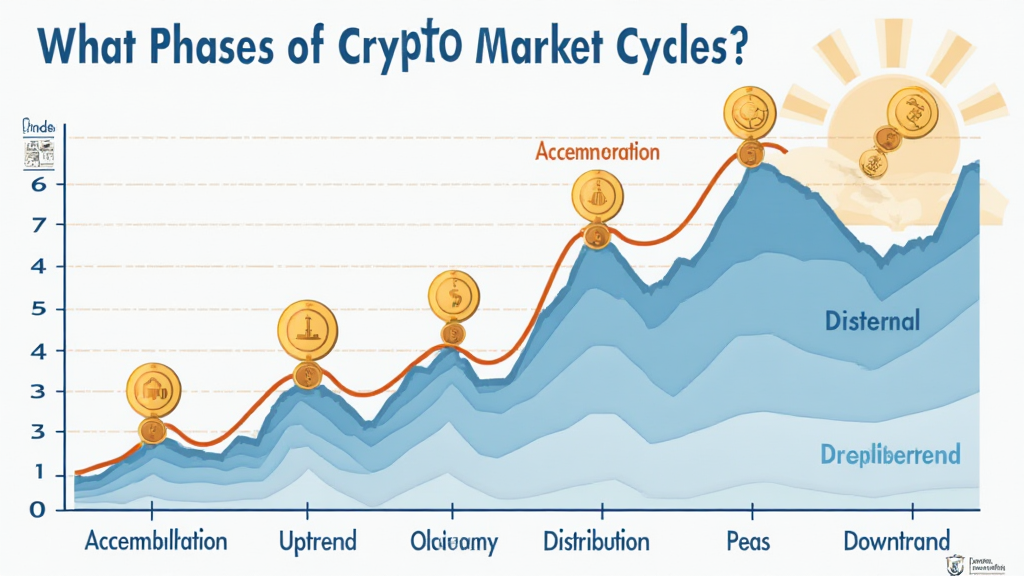

Market cycles in the cryptocurrency industry can be likened to the ebb and flow of ocean tides, continuously rising and falling without a predictable pattern. A typical cycle can be broken down into four general phases: accumulation, uptrend, distribution, and downtrend. Each phase has unique characteristics that can indicate the broader market sentiment.

- Accumulation: This phase occurs after a market downturn, where savvy investors begin buying at lower prices. Here’s the catch: identifying when accumulation is happening requires patience and keen observation.

- Uptrend: Once confidence begins to build, prices start to increase, leading to heightened market activity. During this phase, the term “FOMO” (fear of missing out) often drives new investors into the market.

- Distribution: If early investors begin selling their assets to lock in profits, this results in a distribution phase, leading to a plateau or decline in prices.

- Downtrend: Eventually, market correction occurs, leading to lower prices and often triggering panic selling among latecomers.

Understanding Market Sentiment and Indicators

Sentiment analysis plays a crucial role in identifying where we might be within a market cycle. Tools like social media sentiment, Google Trends, and trading volume can provide vital insights into investor psychology. For example, an increase in social media mentions can often coincide with an impending uptrend.

- Social Media Sentiment: Track platforms like Twitter and Reddit to gauge community sentiment. Authentic reactions can signal impending market movements.

- Google Trends: An increase in searches for terms like “Bitcoin” or “cryptocurrency” often indicates rising interest and potential buying pressure.

- Trading Volume: Increased trading activity can signify stronger interest in a coin, further propelling price movements.

The Role of Seasonality in Crypto Market Cycles

Interestingly enough, some analysts suggest that crypto market cycles may also exhibit signs of seasonality. For instance, historical data indicates that Bitcoin often performs well in the first quarter of the year, coinciding with the surge in new investors from the previous year.

According to a 2023 report by Chainalysis, the number of cryptocurrency users in Vietnam has increased by 50% over the past year, leading to heightened trading volumes and price volatility. Such rising user engagement can indicate potential shifts in market cycles for local investors.

Strategies for Thriving in Crypto Market Cycles

Navigating crypto market cycles can indeed seem daunting, but having effective strategies in place can help. Here are a few key approaches:

- Educate Yourself: Stay informed about industry news, regulatory changes, and technological advancements that can influence market sentiment.

- Diversify Your Portfolio: Consider holding a mix of different cryptocurrencies to mitigate risk during market downturns.

- Utilize Risk Management: Set stop-loss orders to protect your investments during significant downturns. This strategy helps prevent emotional decision-making.

- Long-Term Vision: While market cycles can be tempting to trade in and out of, maintaining a long-term perspective can often yield better outcomes.

Conclusion: Steering Through Crypto Market Cycles

Understanding crypto market cycles is paramount for anyone looking to invest in this dynamic field. By analyzing sentiment, employing strategic planning, and keeping abreast of market trends, investors can position themselves for success. The journey may be littered with challenges, but remember, even the roughest seas eventually calm. As always, consult local regulations and seek advice from trusted sources before diving in.

As we reflect on the importance of market cycles, consider this: knowledge is power, particularly in the ever-evolving world of cryptocurrency. With a firm grasp of crypto market cycles, investors can not only survive but thrive in the digital financial landscape.

btcmajor empowers investors to deepen their understanding of the crypto world.

Expert Insights

John Doe, a seasoned cryptocurrency analyst with over 15 published papers on blockchain technologies, has been at the forefront of several high-profile project audits. His expertise provides invaluable guidance to those navigating the complexities of market cycles.