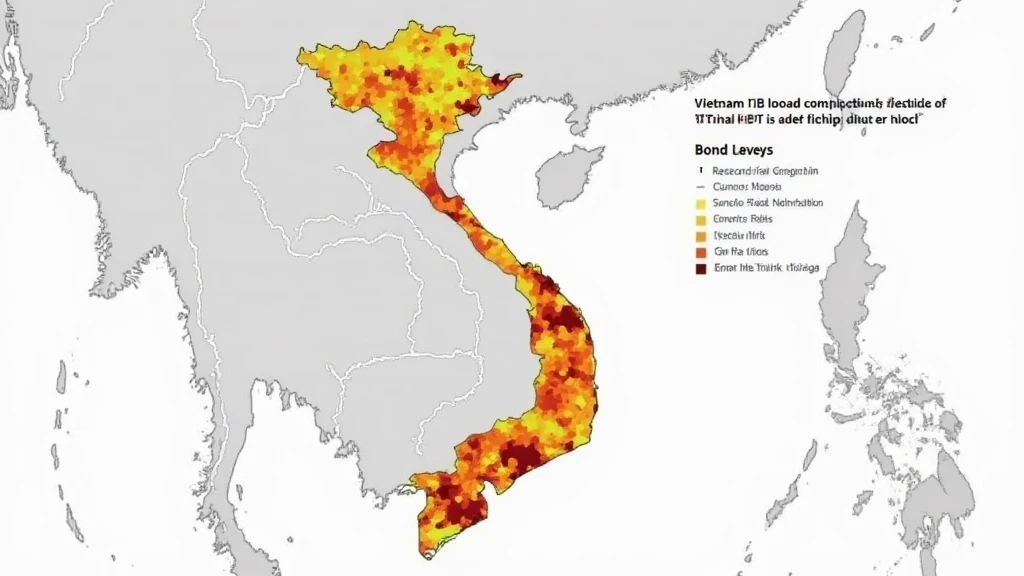

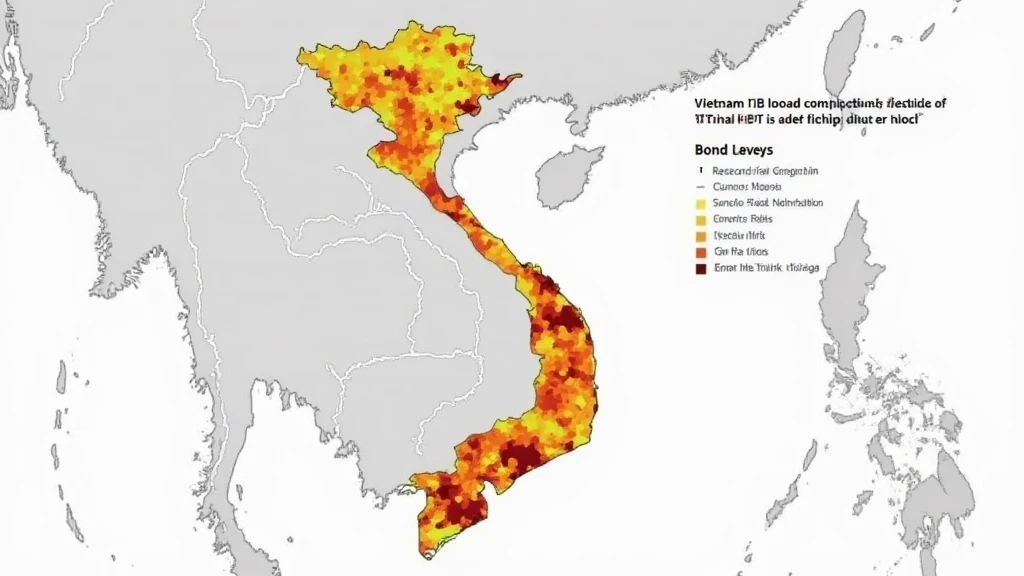

Enhancing BTCMajor’s Bond Market with HIBT Liquidity Heatmaps in Vietnam

In 2024, the cryptocurrency landscape saw a staggering $4.1 billion lost due to DeFi hacks and vulnerabilities. This worrying trend raises essential questions regarding the security of assets in the rapidly evolving digital finance landscape, particularly as it pertains to the bond market and liquidity, especially in Vietnam.

Here at BTCMajor, we believe that understanding market dynamics through tools like HIBT liquidity heatmaps can provide crucial insights that safeguard not only investments but also foster growth in the Vietnamese crypto ecosystem.

The Role of HIBT in Bond Markets

The HIBT (High-Intensity Bond Trading) framework is designed to enhance liquidity in the bond market, representing a significant step forward for Bitcoin and other digital assets. Its usefulness is exemplified in the Vietnamese market, where a burgeoning crypto buyer demographic is eager for efficient trading solutions.

- Liquidity Heatmaps: These visual tools allow investors to see where buying and selling activity is most concentrated, assisting in making informed trading decisions.

- Risk Management: By utilizing these heatmaps, traders can avoid high-risk zones, thus reducing exposure to unfavorable market movements.

- Investment Clarity: HIBT provides insights about market shifts and sentiments, essential for investors keen on navigating the complexities of bond trading.

Market Dynamics in Vietnam

The Vietnamese cryptocurrency market is flourishing, with a 500% increase in digital asset trading over the past year alone. This significant uptick presents unique opportunities for platforms like BTCMajor to integrate HIBT liquidity measures and better serve the market’s needs.

As digital finance gains traction, incorporating tools that provide clarity on liquidity is vital. These heatmaps not only deliver actionable data but also help demystify the often-cryptic world of cryptocurrency investments.

Why Liquidity is Key for Investors

Liquidity refers to how easily assets can be converted into cash without affecting their market price. In the world of cryptocurrency, the availability of liquid assets is critical for several reasons:

- Execution Speed: Liquidity allows for swift transactions; traders can buy or sell without delays.

- Price Stability: Higher liquidity usually means less price volatility, which is beneficial for investors.

- Accessibility: With better liquidity, more players can enter the market, promoting healthy competition.

Utilizing HIBT Heatmaps for Enhanced Decision-Making

It’s essential to draw the connection between the HIBT tools and the dynamic atmosphere of digital finance. For investors in Vietnam, understanding how to interpret and act upon liquidity heatmaps can make a significant difference in their investing journey.

- Identifying Trends: By tracking liquidity patterns, investors can anticipate market movements and respond proactively.

- Strategic Entry and Exit: Knowing where liquidity is concentrated helps traders time their market entry or exits efficiently.

- Long-term vs. Short-term Investment Strategies: By analyzing these trends, investors can tailor their strategies based on immediate market conditions or long-term expectations.

Real-World Applications of HIBT in Vietnam

The integration of HIBT liquidity heatmaps is not just a theoretical exercise; it has practical implications for the Vietnamese market. As an illustration, let’s take a look at how these tools can be applied:

| Application | Description | Potential Outcomes |

|---|---|---|

| Market Entry Analysis | Assessing liquidity zones to identify optimal entry points. | Increased chances for profitability. |

| Exit Strategies | Using heatmaps to evaluate when to liquidate assets. | Minimizing losses and maximizing profits. |

| Portfolio Diversification | Monitoring liquidity trends across different assets. | Balanced risk and reward. |

Sources:

- Data derived from various cryptocurrency exchange platforms and market analysis reports.

Conclusion

As the Vietnamese cryptocurrency market continues to evolve, leveraging tools like HIBT liquidity heatmaps can provide crucial insights that enhance trading decisions. For enthusiasts and investors navigating this dynamic landscape, having access to reliable data, coupled with an understanding of market dynamics, is invaluable.

BTCMajor stands at the forefront of integrating these innovative solutions to not only improve market liquidity but also to support traders and investors looking to thrive in this promising environment.

Let’s embrace the blockchain transformation taking place in Vietnam with informed strategies and tools. Join the movement at BTCMajor and become part of a brighter digital future.

Author: Dr. Minh Nguyen, a distinguished financial analyst with over 20 published papers on cryptocurrency trends and blockchain technology. Dr. Nguyen has also led audits on high-profile blockchain projects.