Understanding HIBT Property Insurance in Vietnam: Your Essential Guide

Introduction

With $4.1 billion lost to DeFi hacks in recent years, securing digital assets has never been more critical. As the crypto landscape grows, understanding concepts like HIBT property insurance in Vietnam becomes pivotal for both investors and asset holders. This guide aims to clarify the intricacies of HIBT property insurance and its relevance to the increasing number of blockchain users in Vietnam.

The Rise of Blockchain in Vietnam

Vietnam has experienced a significant surge in blockchain adoption, with over 2 million active crypto users as of 2023. This growth can be attributed to both international interest and local startups leveraging blockchain technology for various applications.

According to a recent report, Vietnam’s blockchain user growth rate is estimated at 35% annually, highlighting a robust interest in digital asset management and insurance measures such as tiêu chuẩn an ninh blockchain.

Why HIBT Property Insurance Matters?

HIBT property insurance serves as a safety net for crypto investors by safeguarding their physical and digital assets. Much like traditional property insurance, HIBT focuses on protecting properties and assets against unforeseen risks, including theft and cyber-attacks.

Understanding HIBT Property Insurance

At its core, HIBT property insurance offers coverage for various risks that digital asset holders face. Various policies can be tailored to meet individual needs, ensuring maximum protection against potential financial losses.

What Does HIBT Property Insurance Cover?

- Theft of digital assets

- Damage to physical assets

- Cyber-attack losses

- Data breaches and liabilities

The Local Context: A Case for Vietnam

In Vietnam, the regulatory environment is still evolving. As regulations tighten, property insurance like HIBT becomes essential for safeguarding digital assets. With a burgeoning tech scene, investors can better mitigate risks by opting for comprehensive insurance policies.

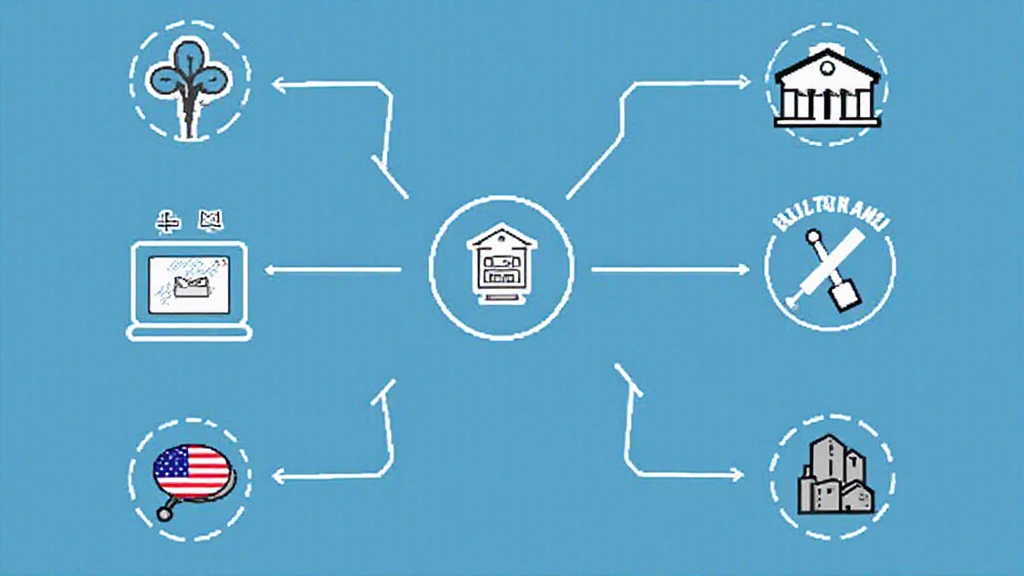

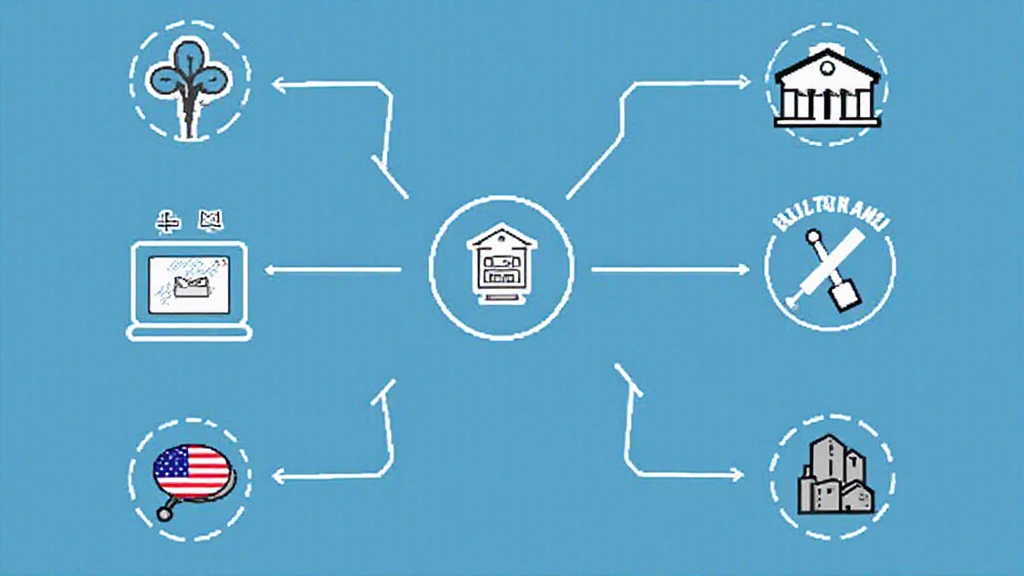

Navigating the HIBT Insurance Landscape

When considering HIBT property insurance in Vietnam, it is important to evaluate different providers, assess their offerings, and consider the level of cover they provide for both physical and digital entities.

Choosing the Right Provider

Look for insurance providers with strong industry reputations and comprehensive policies. Here are some tips:

- Evaluate customer reviews and ratings.

- Check compliance with local regulations.

- Compare pricing and coverage options.

Real-World Examples

For instance, an emerging crypto startup in Ho Chi Minh City recently opted for HIBT property insurance and successfully mitigated losses following a minor cyber-attack. This case showcases the efficacy of such insurance in practical scenarios.

Global Comparisons: HIBT Insurance Worldwide

While HIBT property insurance is gaining traction in Vietnam, it is important to understand its global counterparts. Regions like the US and Europe have established insurance frameworks that set benchmarks for what might emerge in Vietnam.

Keywords and Practices

Terms like 2025年最具潜力的山寨币 and how to audit smart contracts are becoming essential for crypto investors and those in the insurance realm. HIBT insurance plays a crucial role in raising awareness and guiding investors toward making informed decisions.

Conclusion

In a rapidly changing digital landscape, HIBT property insurance in Vietnam provides an essential layer of protection for both physical and digital assets. As Vietnam continues to embrace blockchain technology, the need for robust insurance solutions like HIBT becomes even more pressing.

Seeking out the right coverage is key to mitigating potential risks, especially as the market evolves. Keep an eye on local regulations and insurance providers to ensure you are making informed decisions. Ultimately, HIBT property insurance is not just an option; it’s becoming a necessity for securing your digital future.

In conclusion, understanding HIBT property insurance is vital for anyone navigating the world of digital assets in Vietnam. For more information on digital asset insurance, visit HIBT.

By Dr. Nguyen Thi Hoa, a recognized expert in blockchain technology and insurance, with over 15 published papers on risk management and cybersecurity. Her insights have shaped several well-known audits in the blockchain industry.