Understanding Bollinger Bands Strategies in the BTCMajor Context

With cryptocurrency trading evolving rapidly, effective strategies are essential for traders. The integration of Bollinger Bands as a key trading indicator has proven valuable in navigating market fluctuations.

Bollinger Bands: A Brief Overview

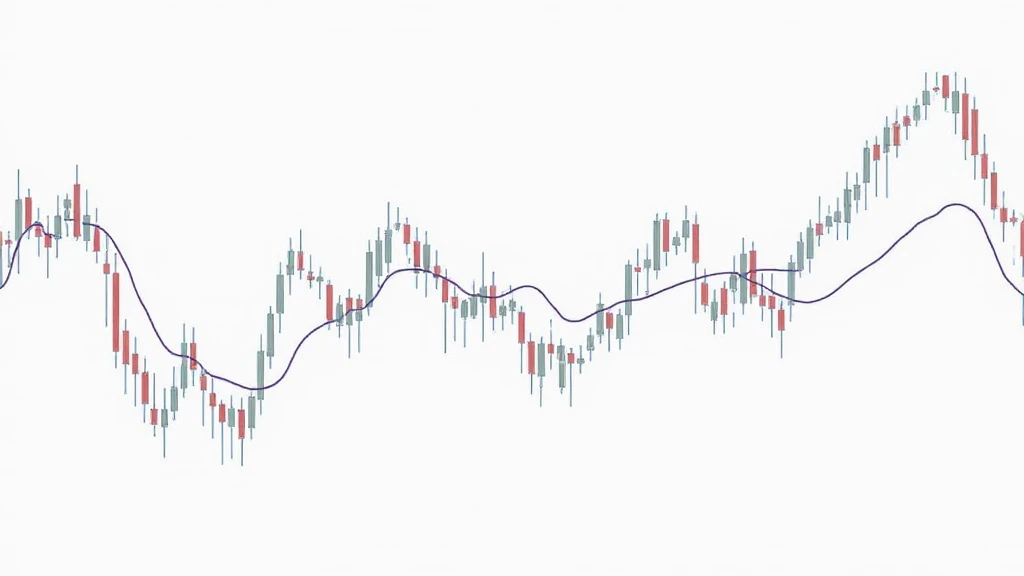

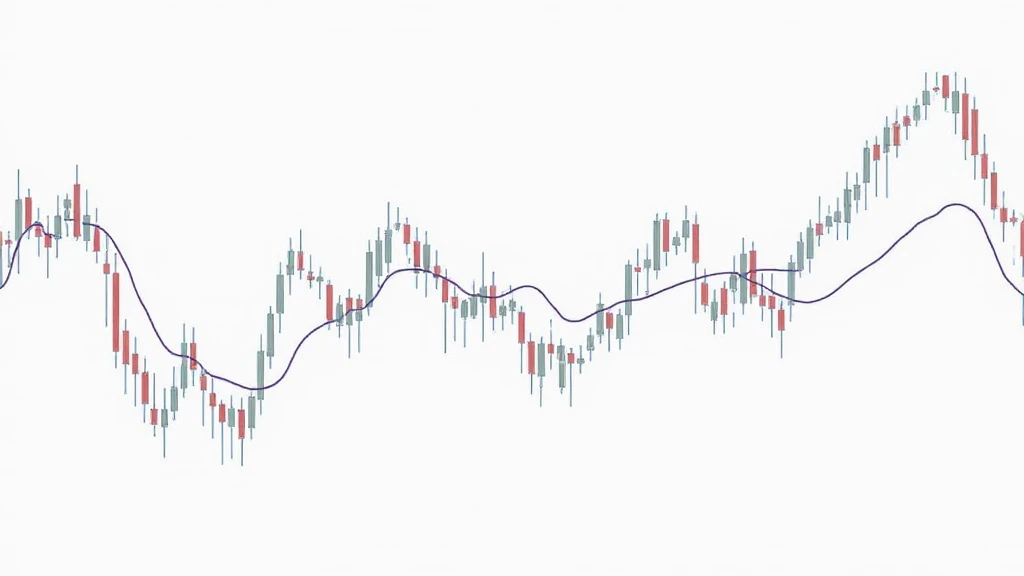

Bollinger Bands are a popular technical analysis tool created by John Bollinger in the 1980s. They consist of a middle band (the simple moving average) and two outer bands that are standard deviations away from the middle band. This setup helps to identify overbought or oversold conditions.

The Components of Bollinger Bands

- Middle Band: A 20-period simple moving average (SMA) acts as the base line.

- Upper Band: This band is the SMA plus two standard deviations.

- Lower Band: This band is the SMA minus two standard deviations.

Why Use Bollinger Bands in Cryptocurrency Trading?

The volatile nature of cryptocurrencies makes Bollinger Bands invaluable. They provide a visual representation of market volatility that can guide traders’ decisions.

Benefits of Using Bollinger Bands

- Volatility Measurement: Helps traders assess the market’s volatility.

- Trend Identification: Indicates potential market reversals.

- Entry and Exit Points: Assists in determining optimal entry and exit points.

Implementing Bollinger Bands Strategies on BTCMajor

Trading on the BTCMajor platform involves unique strategies tailored to its user base. As Vietnam’s cryptocurrency market continues to grow, leveraging Bollinger Bands can enhance trading performance.

Key Strategies for BTCMajor Users

- Using Bollinger Bands for Breakouts: Traders look for prices to breach the upper or lower bands, indicating potential breakouts.

- Combining with Other Indicators: Enhance Bollinger Bands strategies by pairing with MACD or RSI.

Market Insights: Vietnam’s Cryptocurrency Landscape

Vietnam is witnessing significant growth in cryptocurrency adoption. According to a recent report, Vietnam’s user growth rate in the cryptocurrency sector stood at 62% in 2023, showcasing the country’s enthusiasm for digital assets.

The Adopted Strategies in Vietnam

- Local Market Adaptation: Strategies often incorporate local news and regulations.

- Community Trading Groups: Many traders share insights on platforms like Telegram.

Analyzing the Risks with Bollinger Bands

While Bollinger Bands provide significant insights, traders must also recognize the risks involved.

Common Pitfalls

- False Signals: In volatile markets, price movement may revert quickly.

- Dependency on Historical Data: Over-reliance on past performance can lead to poor outcomes.

Conclusion

Bollinger Bands are a versatile tool that can enhance trading strategies on platforms like BTCMajor. By understanding volatility and price movement, traders can make informed decisions that lead to successful outcomes.

As Vietnam continues to embrace cryptocurrency, mastering tools like Bollinger Bands will be crucial for navigating this dynamic market.

Final Thoughts

Incorporating Bollinger Bands strategies into your trading toolkit can significantly improve trading effectiveness. Always proceed with caution and seek guidance from local regulations.

BTCMajor offers various resources to empower traders in the ever-evolving cryptocurrency landscape.

About the Author

Dr. Nguyen Minh, a blockchain expert with over 15 published papers and extensive experience in auditing major projects, shares insights on effective trading strategies.