Btcmajor HIBT Vietnam Bond Dispute Resolution Steps

With cryptocurrency investments becoming increasingly prevalent, the need for robust resolution mechanisms is more crucial than ever. In Vietnam, where the crypto market is witnessing significant growth, particularly the increasing user engagement in blockchain services, understanding the bond dispute resolution steps is essential. In this comprehensive guide, we will explore the processes and practices that can help ensure fair resolution of disputes in the rapidly evolving Vietnamese crypto landscape.

Understanding Bond Disputes in Vietnam’s Crypto Market

As the crypto market in Vietnam expands, so do the complexities associated with bond transactions. Bonds offer a way for entities to raise funds while providing investors with a promise of repayment. However, bonds in the crypto space often come with their own set of challenges, including regulatory scrutiny, valuation issues, and default risks.

Reasons Behind Bond Disputes

- Regulatory Ambiguities: The lack of clear regulations often leads to disputes.

- Contractual Misinterpretations: Different interpretations of terms can trigger legal conflicts.

- Market Volatility: Sudden market shifts can impact bond valuations and payment obligations.

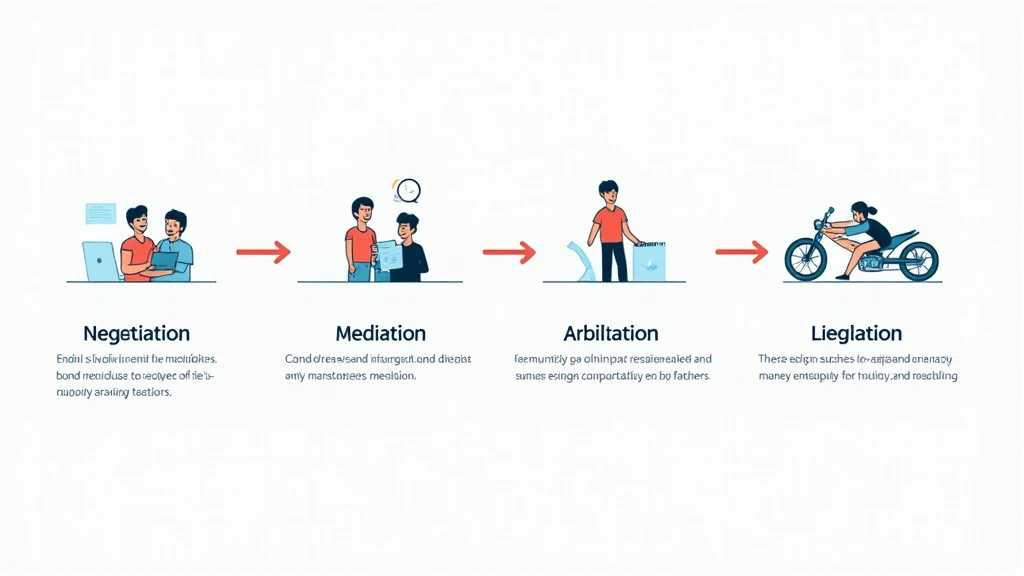

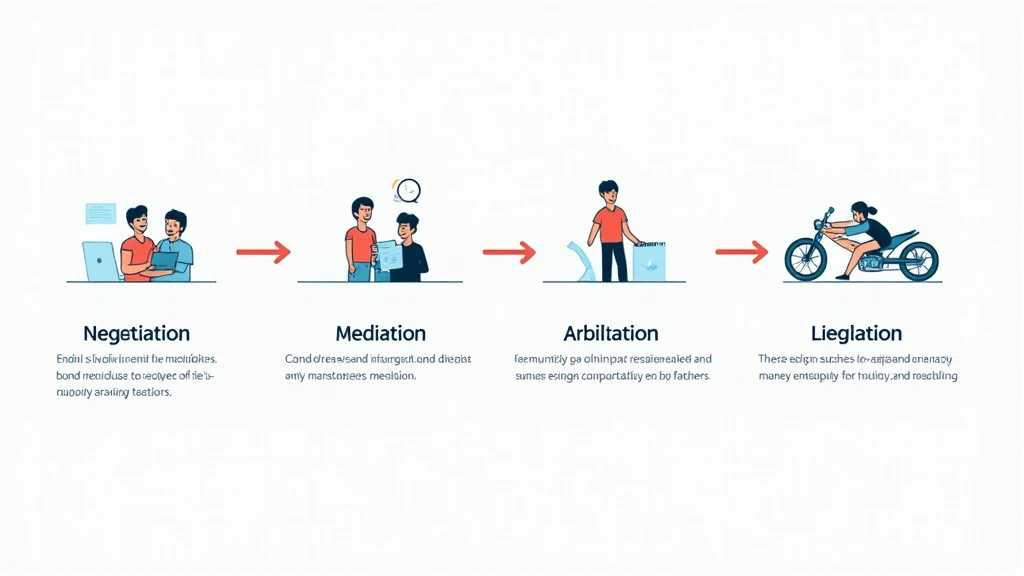

Essential Steps for Dispute Resolution

When faced with a bond dispute, the following steps should be taken to ensure a fair resolution:

Step 1: Review the Bond Agreement

The first step in resolving a bond dispute is to thoroughly review the bond agreement. This document should clearly outline the rights and obligations of both parties. Key areas to focus on include:

- Payment Terms

- Default Clauses

- Dispute Resolution Mechanisms

Step 2: Engage in Negotiation

Direct negotiation between the parties involved is often the most practical first step. Open communication can lead to solutions that are acceptable to both sides. Here are a few tips for effective negotiation:

- Be open and honest about your stance.

- Seek a win-win outcome.

- Consider alternative solutions that may satisfy both parties.

Step 3: Mediation

If negotiation fails, mediation is a recommended next step. A neutral third-party mediator can help facilitate the discussion, guide the parties toward a consensus, and avoid the more complex and costly process of litigation. Mediation benefits include:

- Confidentiality of discussions.

- Less time-consuming than arbitration or litigation.

- Preservation of business relationships.

Step 4: Arbitration

If mediation does not yield a satisfactory result, arbitration may be necessitated as per the bond agreement’s stipulated resolution mechanism. Arbitration involves a neutral arbitrator or a panel making a binding decision based on the evidence presented. Key facets of arbitration include:

- Speedier than litigation.

- Experts in the field may oversee the proceedings.

- Finality of the decision, with limited room for appeal.

Step 5: Litigation

As a last resort, parties can pursue litigation through the judicial system. This process tends to be lengthy and costly but may be necessary for enforcing rights that are not upheld through alternative means. Important factors to consider include:

- Choosing a jurisdiction that is favorable to your case.

- Understanding the implications of court rulings on future bonds.

- Preparing for public scrutiny and potential reputation damage.

Case Study: Vietnam’s Growing Crypto Market

The cryptocurrency landscape in Vietnam is rapidly evolving, with a growth rate of approximately 45% in the user base in 2024. This surge highlights the importance of robust dispute resolution mechanisms, specifically in bond transactions linked to digital assets.

Evaluating Your Options: When to Consult Professionals

It is crucial to assess when professional advice is necessary. Engaging experts early can often save time and money in the long run. Experts like those at HIBT can provide valuable insights into regulatory compliance and dispute resolution strategies tailored to the Vietnamese market.

Final Thoughts

In conclusion, as the Vietnamese crypto market continues to grow, understanding the various bond dispute resolution steps is imperative for both investors and issuers. Implementing these practices not only enhances the credibility of the market but also fosters trust among participants. For more information on navigating crypto regulations and resolving disputes effectively, visit btcmajor.