Introduction

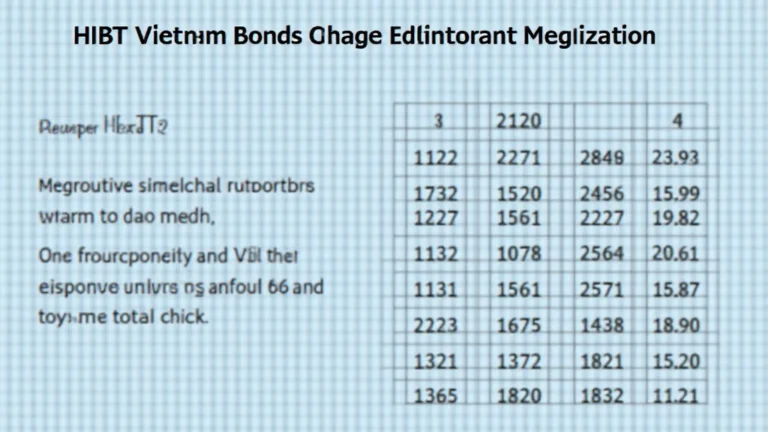

As the cryptocurrency landscape evolves, understanding taxation, especially regarding crypto bonds, becomes increasingly vital. Amid the rapid rise of the digital finance sector, Vietnam has attracted significant attention with initiatives like the HIBT (Vietnam’s High-Interest Bitcoin Tokens). In 2024 alone, an estimated $4.1 billion was lost to DeFi hacks—an eye-opening statistic that prompts regulators globally, including those in Vietnam, to refine their frameworks.

In this article, we delve into the nuances of btcmajor HIBT Vietnam crypto bond taxes Q3 2024, offering invaluable insights into compliance, tax strategies, and anticipating regulatory shifts that could affect investors and businesses alike.

Understanding HIBT and Its Tax Implications

What exactly is HIBT? It’s vital for anyone looking to invest in this promising market to grasp both its potential and the accompanying tax obligations. HIBT represents a novel approach to securing returns through blockchain technology, targeting Vietnamese investors keen on maximizing their returns.

As the saying goes, “knowledge is power,” especially when navigating the complexities of taxation. Tax compliance ensures that your investments in HIBT do not come with unexpected penalties. With that in mind, here are some key elements:

- Taxable Event: Investments in HIBT may trigger capital gains tax upon selling or exchanging tokens for profit.

- Income Recognition: Interest earned on HIBT holdings may also be subject to personal income tax, depending on the investor’s total income.

- Record Keeping: Maintaining meticulous records of transactions is essential to minimize liabilities and substantiate claims when filing taxes.

Market Growth in Vietnam: Opportunities and Challenges

With over 50% of its population still unbanked, Vietnam provides fertile ground for cryptocurrency adoption. In 2024, reports from the Central Bank indicated a staggering 300% growth in crypto user adoption over the past three years. This presents both opportunities and challenges.

Investors looking to capitalize on such growth should be mindful of the evolving regulatory environment:

- Iterations of Legislation: The Vietnamese government has undertaken multiple revisions of its regulations surrounding cryptocurrency. It’s essential for investors to stay updated.

- Public Awareness: With increasing adoption comes the need for education around security practices and risks associated with cryptocurrency investments.

Tax Strategies for HIBT in Q3 2024

Here’s where effective tax strategies play a significant role for investors in Vietnam contemplating HIBT. Crafting a personalized tax strategy can lead to substantial savings. Consider the following:

- Long-Term Holding: Keeping your HIBT investments for over a year may qualify you for favorable long-term capital gains tax rates.

- Loss Harvesting: If you face losses in other crypto investments, you might balance these losses against your HIBT gains to lower overall tax liability.

- Explore Tax Treaties: Vietnam has established tax treaties with various nations, potentially reducing withholding tax on certain investments.

The Future of Crypto Taxation in Vietnam

As we move further into Q3 2024, the dynamic landscape of crypto taxation indicates that regulatory bodies, including the Ministry of Finance, are likely to implement clearer guidelines on cryptocurrency bonds. A well-informed investor can navigate these waters safely.

Here are some focal points:

- Enhanced Regulations: As the crypto market matures, updated regulations will provide clearer tax frameworks that encourage compliance.

- Increased Global Cooperation: Vietnam’s participation in international tax discussions emphasizes an evolving global approach towards cryptocurrency taxation.

Conclusion

Navigating the complexities of btcmajor HIBT Vietnam crypto bond taxes Q3 2024 requires a combination of vigilance, knowledge, and expert guidance. As Vietnam becomes a regional powerhouse for cryptocurrency investments, staying ahead of regulatory shifts is essential for all investors.

This guide aims to equip you with actionable insights as you explore investment opportunities while ensuring compliance with local tax obligations. Remember, in this fast-paced industry, staying informed is your best strategy for success.

For more information, visit hibt.com.

Author: Dr. Minh Nguyen, PhD in Blockchain Technology, with over 15 publications in the field of cryptocurrency taxation, and has led significant audits on various fintech projects.