2024 Trends in Vietnam’s Crypto Bonds Market: Insights from BTCMajor

As the global digital economy adapts to the impacts of digital assets and crypto bonds, Vietnam is poised for significant growth in this sector. With a remarkable increase in investor interest and the integration of blockchain technology, it is essential to understand the market dynamics and trends that will shape the crypto bonds landscape in Vietnam in 2024.

The Rise of Crypto Bonds in Vietnam

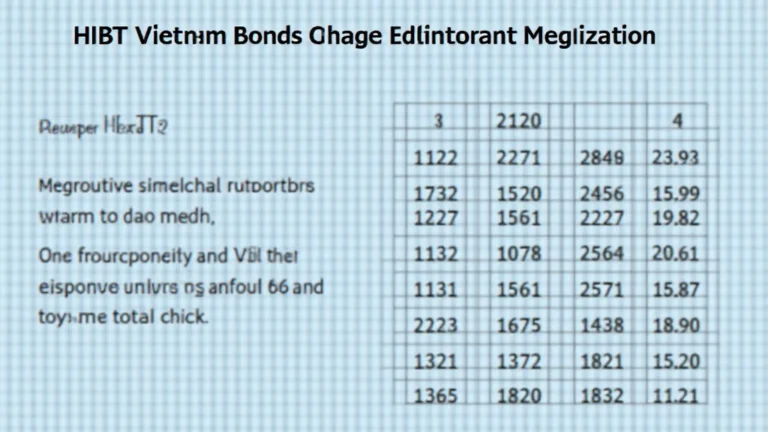

With the Vietnamese economy projected to grow by 6.5% in 2024, the crypto bonds market has emerged as a lucrative investment opportunity. According to a recent report, over 30% of Vietnamese investors are now interested in blockchain-based financial instruments. This translates to a burgeoning market that could reshape traditional finance in the region.

- Growing Adoption of Blockchain: The Vietnamese government is increasingly supportive of blockchain initiatives. Laws and regulations are modernizing, leading to a friendlier investment climate.

- Market Data: In 2023, Vietnam’s crypto market saw a 50% increase in user participation, according to Chainalysis.

- Investor Interest: Surveys indicate that more than 70% of millennials in Vietnam are interested in blockchain investments, making it crucial for platforms like BTCMajor to cater to their needs.

Understanding Crypto Bonds

Crypto bonds are essentially debt securities backed by digital assets. These bonds allow investors to receive interest in the form of cryptocurrencies, often with enhanced security features provided by blockchain technology such as tiêu chuẩn an ninh blockchain. They represent a crossroad of traditional finance and cryptocurrency technology, presenting unique opportunities for both issuers and investors.

How Crypto Bonds Work

Crypto bonds function similarly to traditional bonds but utilize smart contracts for transaction execution. Here’s a simplified breakdown:

- Issuance: Companies issue bonds backed by their crypto assets.

- Valuation: The bonds are valued based on the underlying asset’s blockchain-based data.

- Investors: Individuals can purchase these bonds, providing capital to the issuer in exchange for interest payments.

Market Trends in 2024

1. Increased Regulatory Support

Vietnam’s evolving regulatory framework surrounding cryptocurrencies will play a crucial role in shaping the future of crypto bonds. In 2024, expect to see:

- Adoption of clear guidelines on crypto bonds.

- Greater protection for investors, enhancing their confidence.

- Government-backed initiatives to promote blockchain adoption.

2. Emergence of Diverse Investment Products

In Vietnam, we expect to see an influx of crypto bond products catering to various risk appetites. This might include:

- Short-term bonds for quick returns.

- Long-term bonds appealing to investors looking for stability.

3. Technological Integration

Investors will favor platforms that utilize advanced blockchain technologies. Notable features might include:

- Real-time transaction monitoring.

- Enhanced privacy features for sensitive investor information.

- AI-driven insights into market trends.

Challenges to Consider

While the regulatory landscape is warming to crypto bonds, challenges still exist. Notably:

- Market Volatility: Like all cryptocurrencies, crypto bonds are subject to market fluctuations.

- Misunderstanding of the Product: Many potential investors might not fully understand the workings of crypto bonds.

- Technological Barriers: Not all investors may be familiar with blockchain technology, posing a risk to widespread adoption.

BTCMajor’s Role in the Crypto Bonds Market

As a leading player in the crypto platform space, BTCMajor is focusing on how to bridge traditional finance with blockchain technology in the context of crypto bonds. Here’s how BTCMajor is planning to lead:

- Educational Resources: BTCMajor aims to provide comprehensive guides for investors on understanding crypto bonds and their potential.

- Partnerships: By collaborating with regulatory bodies, BTCMajor will ensure compliance and offer secure investment options.

- Innovative Products: BTCMajor plans to introduce user-friendly platforms for investors interested in crypto bonds.

Conclusion

As Vietnam embraces digital transformation in the financial sector, the crypto bonds market represents a promising investment avenue. With the growing interest from a tech-savvy younger population, especially in 2024, now is the time for investors to explore BTCMajor and understand how they can participate in this evolving landscape. To stay ahead, keep an eye on the evolving regulatory framework and emerging investment opportunities.

BTCMajor is committed to guiding you through this fascinating world of crypto bonds and ensuring that you and your investments are secure. For more insights and updates, be sure to check back regularly.