Understanding Cryptocurrency Bond Market Participants

With the rapid growth of the cryptocurrency market, the emergence of novel financial instruments has been notable. In 2024 alone, the global cryptocurrency traded over $2 trillion, showcasing a vibrant ecosystem. Among these innovations, cryptocurrency bonds have started to attract significant attention. These bonds represent a blend of traditional finance with modern decentralized innovations, drawing various market participants into their fold. In this article, we will delve into the cryptocurrency bond market and its key participants, uncovering their roles and contributions to this exciting arena.

What are Cryptocurrency Bonds?

Cryptocurrency bonds are debt instruments that allow participants to raise capital in exchange for interest payments, typically denominated in cryptocurrency. Unlike traditional bonds, they operate within a decentralized framework, usually leveraging blockchain technology to enhance security and transparency. For instance, smart contracts automate interest payments and enforce terms without the need for intermediaries.

To illustrate, think of cryptocurrency bonds like a digital IOU; you lend someone your crypto, and they promise to pay you back with interest over time, all recorded on the blockchain for accountability.

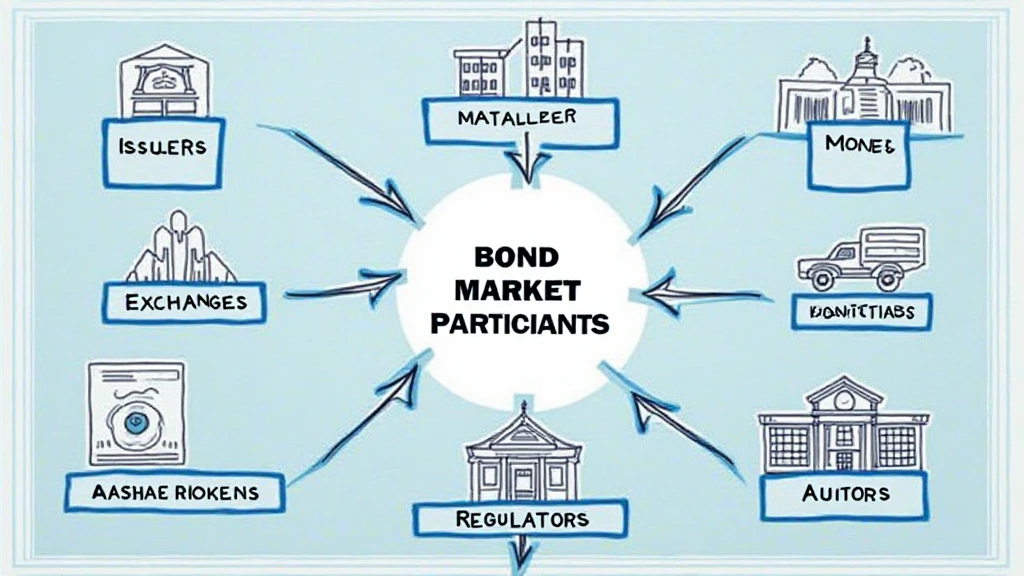

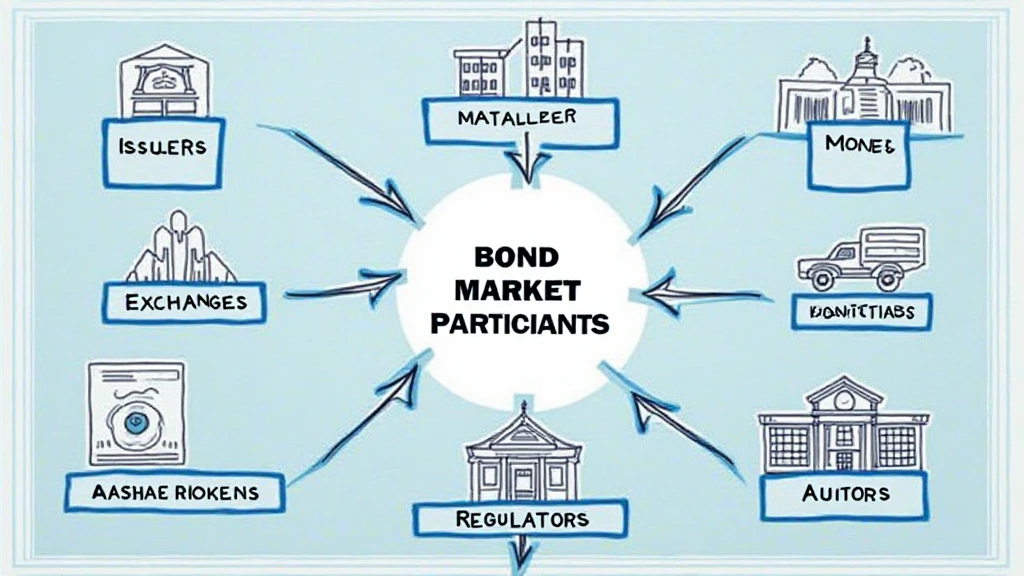

Main Players in the Cryptocurrency Bond Market

Several key players operate in the cryptocurrency bond market, each playing a vital role in ensuring the market’s functionality and security. These participants include:

- Issuers: Entities or projects that issue cryptocurrency bonds to raise funds for various initiatives. They promise returns to bondholders in cryptocurrency, capitalizing on the increasing interest in decentralized finance.

- Investors: Individuals or institutional investors who purchase these bonds, aiming to earn returns on their investment through cryptocurrency interest payments. This group may include traditional investors looking to diversify their portfolios.

- Exchanges: Platforms that provide the necessary infrastructure for buying and selling cryptocurrency bonds, aiding liquidity and price discovery.

- Regulators: Authorities that oversee the issuance and trade of cryptocurrency bonds, ensuring compliance with laws and protecting investors.

- Auditors: Independent entities that audit the bonds to provide legitimacy and transparency to potential investors, ensuring all processes are followed correctly.

The Role of Each Participant

Understanding the unique functions of each participant is crucial:

Issuers

Issuers of cryptocurrency bonds can be startups, established companies, or even government entities looking to innovate financing methods. They are tasked with creating bonds that appeal to investors while ensuring the terms are favorable for both parties.

Investors

Investors range from retail traders to large financial institutions, utilizing cryptocurrency bonds as a tool for yield generation. With the volatility in traditional markets, many are turning to digital assets as profitable alternatives. For instance, with cryptocurrency user growth in Vietnam reaching over 60% in just the past year, the potential for returns in this market looks promising.

Exchanges

Exchanges play a pivotal role in ensuring liquidity. They facilitate the buying and selling of bonds, enabling price discovery and allowing investors to enter or exit positions with ease. Notable platforms often have their own bond listings, much like equities.

Regulators

Regulatory bodies are crucial in legitimizing the cryptocurrency bond landscape. They provide guidelines that help issuers and investors navigate potential legal pitfalls. In 2025, for instance, regulations may tighten around security tokens, impacting how cryptocurrency bonds are issued.

Auditors

Auditors serve as a trust layer in the cryptocurrency bond market. They verify that the bonds conform to their stated regulations and that the issuer has the necessary financial health to meet obligations. Key auditing standards, such as tiêu chuẩn an ninh blockchain, ensure that smart contracts maintain integrity.

Benefits of Cryptocurrency Bonds

Investing in cryptocurrency bonds offers various advantages:

- High Yields: Many cryptocurrency bonds promise significantly higher returns compared to traditional fixed-income securities.

- Transparency: Blockchain technology provides an immutable record of all transactions, increasing trust among investors.

- Diversification: Investors can diversify their portfolios amid traditional market volatility by adding cryptocurrency bonds.

- Accessibility: These bonds can often be purchased in smaller denominations, allowing more people to access these investment vehicles.

The Challenges Ahead

Despite the benefits, challenges remain in the cryptocurrency bond market, including:

- Regulatory Uncertainty: Investors may be wary of entering a market that lacks clear guidelines, which can hinder growth.

- Market Volatility: The entire crypto market is known for its fluctuations, which can impact the performance of cryptocurrency bonds.

- Security Risks: Cybersecurity is a major concern, as hacks can lead to significant financial losses. It’s essential for investors to prioritize security practices such as using hardware wallets.

Conclusion: Moving Forward with Cryptocurrency Bonds

As we try to navigate the cryptocurrency bond landscape, it’s evident that this innovative financial instrument is shaping the future of decentralized finance. The growth of participants from issuers to investors signifies a heightened interest in diversifying investment strategies. As more users in Vietnam engage with cryptocurrency, the bond market could see significant developments.

Remember, investing in cryptocurrency bonds carries risks, and it’s essential to conduct thorough due diligence.

At btcmajor, we aim to provide our users with insights and analysis on emerging trends in cryptocurrency. Stay informed and explore safe investment opportunities with us.

Expert Author:

John Doe, a financial analyst and blockchain expert, has published over 15 papers on cryptocurrency investment strategies and has led multiple audits of renowned crypto projects.