Introduction

In the fast-paced world of finance, understanding liquidity can be the difference between seizing an opportunity or missing it. With significant developments in Vietnam’s bond market, particularly over the past few years, many investors are keen to grasp the nuances of liquidity indicators. According to recent data, the Vietnamese bond market has shown remarkable growth, attracting a surge in foreign investments, with total bond issuance reaching VND 1,000 trillion in 2024. But what does this mean in terms of liquidity indicators?

In this article, we will delve deep into Vietnam bond market liquidity indicators, explore their implications, and provide insights to help investors navigate this burgeoning market landscape.

Understanding Bond Market Liquidity

Bond market liquidity refers to the ease with which bonds can be bought or sold in the market without significantly impacting their price. Several factors contribute to liquidity, including trading volume, market depth, and the spread between bid and ask prices. In Vietnam, as more investors flock to this emerging market, understanding liquidity indicators becomes ever more critical.

Key Liquidity Indicators

- Trading Volume: This reflects the total amount of bonds traded over a specific period. A higher trading volume typically indicates higher liquidity.

- Bid-Ask Spread: A smaller spread suggests a more liquid market, allowing for tighter trading costs.

- Market Depth: The ability to execute large trades without significantly slippage in prices is a key measure of liquidity.

- Turnover Ratio: The ratio of trading volume to the total outstanding bonds helps assess how actively bonds are being traded.

The Role of Foreign Investment

Foreign investments have been a vital factor in the liquidity of Vietnam’s bond market. As of 2024, foreign ownership of Vietnamese bonds exceeded 35%, highlighting the appeal of these financial instruments. Increased foreign participation generally leads to enhanced market liquidity, driving more competitive pricing and tighter spreads.

As bonds become popular among international investors, the liquidity provided by their activities can positively affect local investors, creating a more robust financial ecosystem.

Economic Factors Affecting Liquidity Indicators

Several economic parameters influence Vietnam’s bond market liquidity. Understanding these factors helps investors anticipate market behavior and make informed decisions.

GDP Growth Rate

Vietnam’s GDP growth rate has been consistently robust, averaging around 6-7% annually. This expansion fosters investor confidence, leading to increased trading activity in bonds.

Inflation Rates

With the inflation rate hovering around 3% in 2024, it keeps nominal interest rates relatively stable, encouraging investors to enter the bond market.

Comparative Analysis with Regional Markets

Vietnam’s bond market is often compared with its Southeast Asian neighbors, such as Thailand and Indonesia. While each market is unique, analyzing differences in liquidity indicators can yield valuable insights for investors.

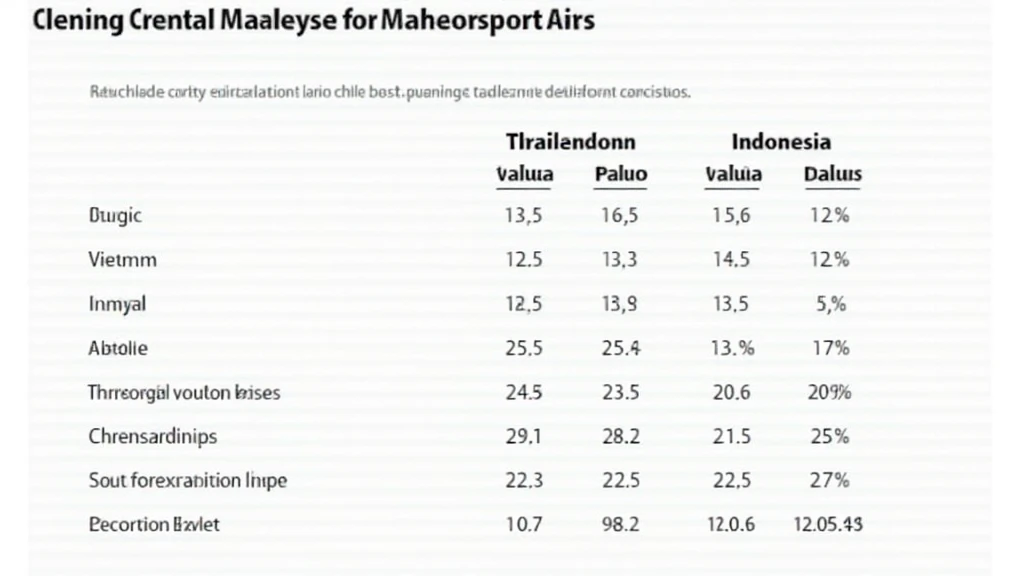

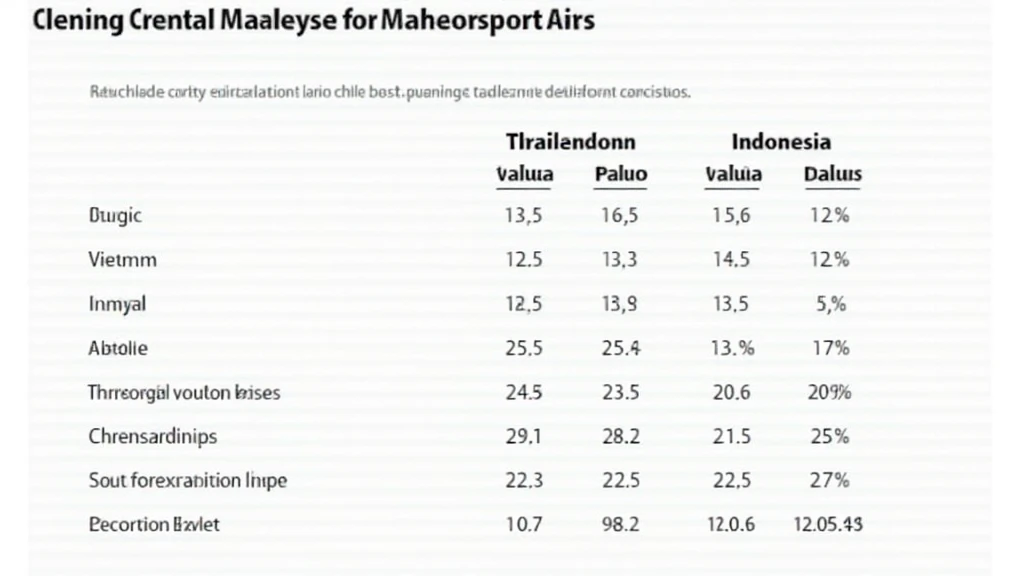

Chart: Liquidity Indicator Comparison in Southeast Asia

Table 1 – Liquidity Indicator Comparison:

| Country | Trading Volume (VND Trillion) | Foreign Ownership (%) | Bid-Ask Spread (bps) |

|---|---|---|---|

| Vietnam | 1,000 | 35 | 15 |

| Thailand | 2,500 | 25 | 10 |

| Indonesia | 1,800 | 20 | 20 |

As indicated in Table 1, Vietnam exhibits notable foreign ownership levels though its trading volume lags behind Thailand, suggesting potential for growth.

Future Projections for Vietnam’s Bond Market

Analysts project robust growth in Vietnam’s bond market in the coming years, influenced by governmental financial policies aimed at enhancing transparency and attracting foreign capital. By 2025, projections suggest that bond issuance will reach VND 1,500 trillion, increasing liquidity availability significantly.

Potential Risks

- Global Economic Fluctuations: Changes in the global economy can affect investor sentiment and hence liquidity.

- Regulatory Risks: Compliance with new regulations can alter market dynamics unexpectedly.

- Interest Rate Increases: Rising interest rates may dampen bond attractiveness, affecting market liquidity.

Conclusion

Understanding Vietnam bond market liquidity indicators is crucial for making informed investment decisions in the evolving financial landscape. The combination of strong economic fundamentals, increased foreign participation, and projected growth showcases Vietnam’s potential as a significant player in the regional bond markets.

This exploration of liquidity indicators is just the tip of the iceberg. For investors looking to engage with Vietnam’s growing bond market—keeping an eye on these indicators will provide crucial insights into their investment strategies.

Remember, when dealing with financial markets, it’s essential to consult with professionals and conduct your own research to make informed decisions. For more insights, read our Vietnam crypto tax guide or stay updated on other financial matters.

In closing, understanding Vietnam’s bond market liquidity indicators not only reflects its current standing but also provides a glimpse into its promising future. Don’t miss the opportunity to be part of this dynamic market.

btcmajor – where you can explore more about investing in Vietnam and beyond.