Introduction

As the landscape of finance continues to evolve, decentralized finance (DeFi) has emerged as a significant player. In 2024 alone, the DeFi sector saw a staggering $4.1 billion lost due to hacks, prompting the need for greater awareness and security measures. Vietnam, with its burgeoning tech ecosystem, is making noteworthy contributions to this rapidly growing market. This article aims to explore the intricate relationship between Vietnam DeFi economics and its future, while addressing critical questions about security, user growth, and the overall economic implications.

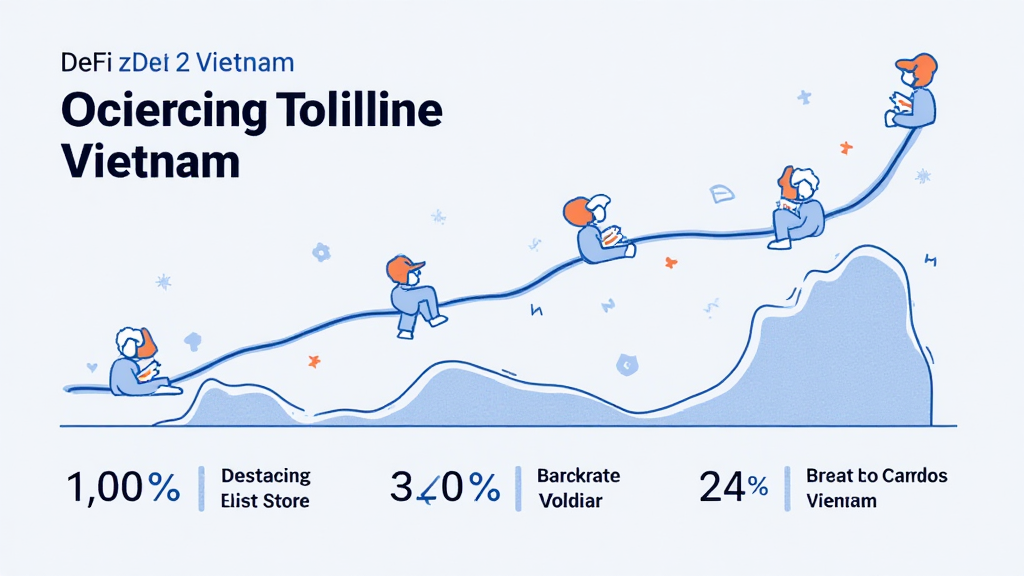

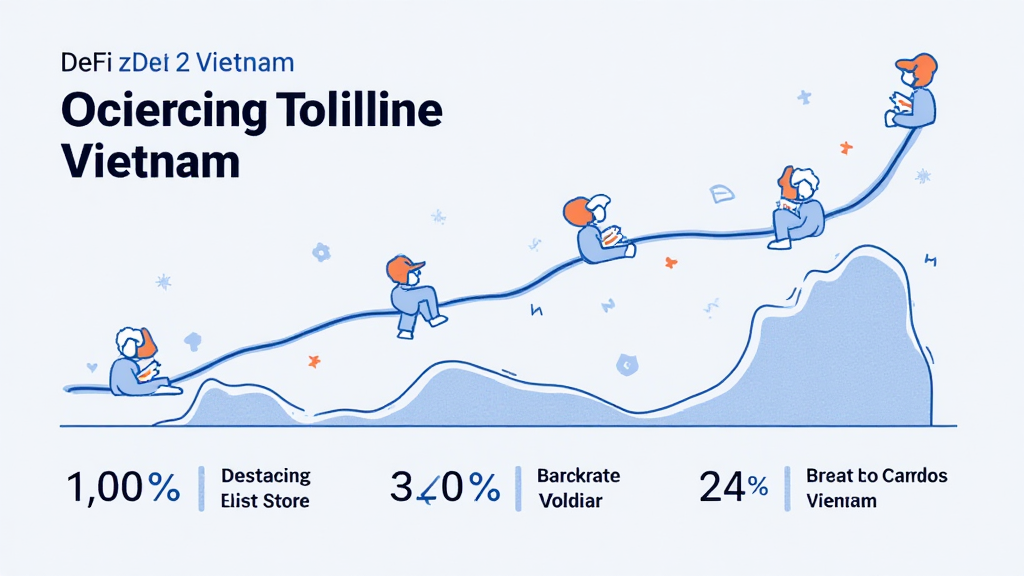

Vietnam’s Cryptocurrency Market Overview

Vietnam has seen a remarkable rise in cryptocurrency adoption, particularly in the DeFi sector. According to recent data, the number of crypto users in Vietnam is on track to exceed 10 million by 2025, creating a substantial community for decentralized finance projects. This growth is fueled by a tech-savvy younger generation and an increasing number of startups entering the blockchain space.

- Market Growth: Vietnam’s cryptocurrency market was valued at approximately $1 billion in 2023.

- User Engagement: The engagement rate among Vietnamese crypto users is estimated to be 40%, significantly higher than in many other countries.

The Dynamics of DeFi in Vietnam

Understanding DeFi Mechanisms

Decentralized finance encompasses a range of financial services such as lending, borrowing, and trading, all facilitated without intermediaries. For Vietnamese users, DeFi presents an opportunity to participate in global financial systems that are otherwise inaccessible. This mechanism is similar to having a personal bank vault but with added layers of security and flexibility. However, the unregulated nature of these platforms also invites risks and vulnerabilities.

Key Benefits and Challenges

- Lower Financial Barriers: DeFi reduces the need for traditional banks, allowing more individuals to engage in financial activities.

- Security Risks: The proliferation of DeFi projects has exposed users to significant risks, such as smart contract vulnerabilities and liquidity pool exploits.

Regulatory Landscape

The Vietnamese government has started to recognize the potential of blockchain technology and is gradually implementing frameworks to govern the usage of cryptocurrencies and DeFi applications. In 2023, the Ministry of Finance announced plans to establish a comprehensive regulatory framework to enhance investor protection and promote sustainable growth in the sector.

Security Practices for DeFi Users

Essential Security Standards

With cryptocurrencies being prone to hacks and scams, adhering to security standards, such as tiêu chuẩn an ninh blockchain, is vital. Below are some essential practices:

- Use Hardware Wallets: Solutions like the Ledger Nano X can reduce hacks by 70%.

- Regular Audits: Engaging third-party services to audit smart contracts and liquidity pools is crucial for identifying vulnerabilities.

2025: Future Projections

As we look ahead, projections indicate that Vietnam’s DeFi ecosystem will continue to grow at an exponential rate. By 2025, it is anticipated that the market will reach a value of approximately $5 billion, with millions more users participating in decentralized financial services.

Conclusion

Vietnam’s evolving DeFi landscape presents an array of opportunities and challenges. As the country embraces decentralized finance, it will be essential for users to stay informed about economic impacts, security standards, and regulatory developments. By adhering to best practices and engaging actively, Vietnam can position itself as a front-runner in the global DeFi economy. Understanding how to navigate this landscape will become increasingly crucial for all participants. For further insights, visit btcmajor.