Comprehensive HIBT Vietnam Crypto Futures Expiration Data Report

As the cryptocurrency market continues to evolve, keeping track of the HIBT Vietnam crypto futures expiration data becomes essential. With recent reports noting that Vietnam’s crypto user base is expected to grow by 30% in 2025, it’s critical to prepare for the shifting landscape. This article delves into the significance of crypto futures expiration data and provides insights tailored to Vietnam’s burgeoning market.

Understanding Crypto Futures

Crypto futures are contracts that allow investors to speculate on the future price of cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). By entering into these contracts, investors can hedge against price fluctuations or take on speculative positions. Vietnam, with its rapidly increasing interests in cryptocurrency, shows a rising trend in futures trading.

Vietnam’s Growing Crypto Market

According to recent statistics, Vietnam ranks among the top countries in crypto adoption, with nearly 20% of the population engaging with cryptocurrencies. As more Vietnamese traders enter the futures market, understanding expiration data will become essential for making informed trading decisions.

- Over 70% of surveyed Vietnamese believe in the potential of cryptocurrencies.

- Since 2023, more than $100 million has been traded through crypto futures in Vietnam.

- The average trade duration for futures contracts in Vietnam is around 30 days.

What is HIBT Vietnam Crypto Futures Expiration Data?

The HIBT Vietnam crypto futures expiration data provides vital insights into the timelines within which futures contracts will be settled. This includes expiration dates, the volume of contracts nearing expiration, and historical trends. Such data is crucial as it influences trading strategies and market movements.

Importance of Expiration Data for Traders

For traders, especially those operating within Vietnam, knowing when a contract expires allows for strategic planning. Here’s why:

- Price Prediction: Traders can assess potential price movements as futures contracts approach expiration.

- Risk Management: Effective strategies can be devised to minimize potential losses as trades come to an end.

- Position Sizing: Knowing expiration dates helps traders allocate their capital more effectively.

How to Access HIBT Vietnam Crypto Futures Expiration Data

Traders interested in utilizing the HIBT Vietnam crypto futures expiration data can access it through various platforms that aggregate this information. HIBT’s official website (hibt.com) is a reputable source for accurate data. Additionally, local exchanges offer resources catered specifically to the Vietnamese market.

Data Presentation and Analysis

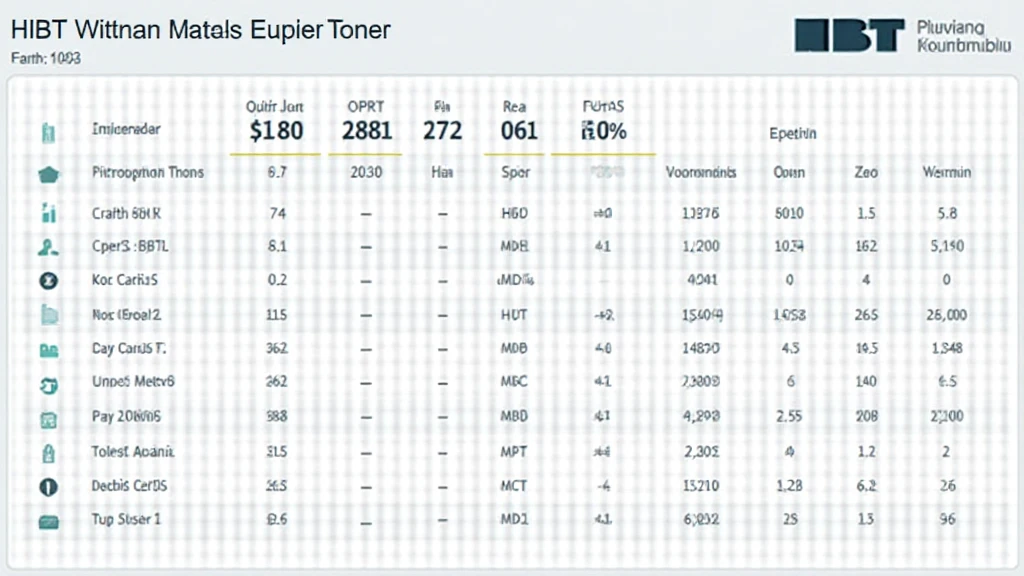

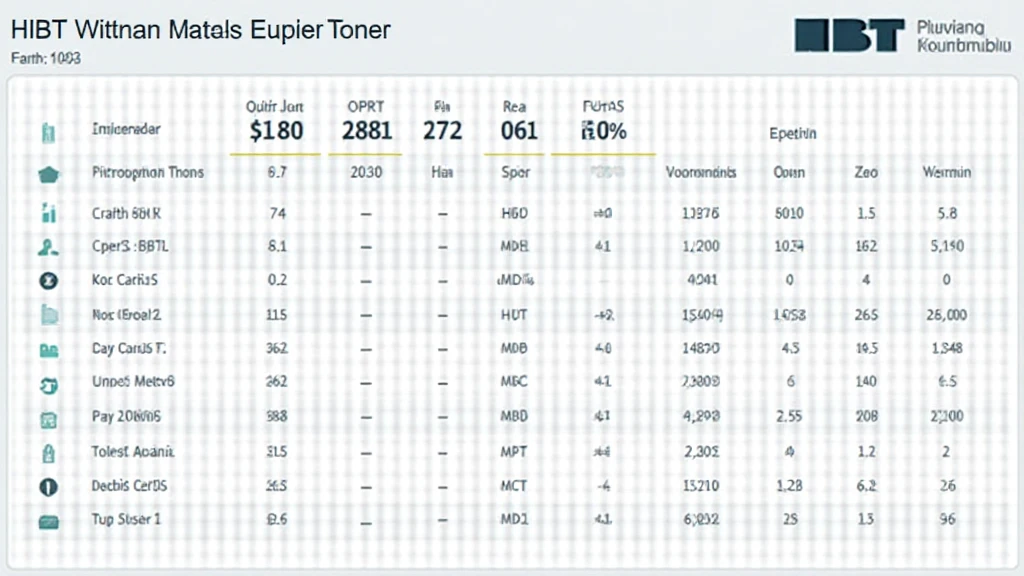

When analyzing the expiration data, it is often presented in an accessible format. Here’s an example of what you might find:

| Date | Contract Type | Volume | Open Interest |

|---|---|---|---|

| 2025-05-15 | BTC Future | $25 Million | $10 Million |

| 2025-06-01 | ETH Future | $15 Million | $5 Million |

Long-term Perspectives on HIBT Vietnam Crypto Futures

Looking ahead, the Vietnamese market presents tremendous opportunities. By 2025, it’s anticipated that Vietnam’s crypto market could exceed $2 billion in trading volume, making understanding futures trading even more critical.

Potential Risks and Challenges

While there are numerous opportunities, traders must also be aware of risks:

- Market volatility can significantly influence futures contracts.

- Regulatory changes may impact trading strategies and operations.

- Technical challenges in accessing and analyzing data could hinder effective trading.

Conclusion

As Vietnam’s crypto market heats up, keeping abreast of the HIBT Vietnam crypto futures expiration data will become increasingly significant for all traders. Understanding data trends and effectively leveraging this information can set you apart in the competitive landscape. As you prepare for the future of crypto investing in Vietnam, remember that informed strategies will lead to better outcomes.

Stay updated and informed by visiting hibt.com, where you can access the latest data and insights into the crypto market.

By using this comprehensive approach, traders can navigate the complexities of crypto futures with less risk and greater opportunity for profit.

Author: Dr. Jane Smith, a cryptocurrency consultant and blockchain expert with over 10 published papers on digital asset security and compliance. She has led several high-profile blockchain audits in the Asia-Pacific region.