HIBT Vietnam Bond Portfolio Rebalancing Frequency Guides

In 2024, the global financial markets witnessed significant volatility, affecting investment strategies across the board. With reports of losses amounting to $4.1 billion due to DeFi hacks, the demand for robust and reliable investment methodologies has never been greater. Investors are focusing on rebalancing strategies for their portfolios, especially in emerging markets like Vietnam, where cryptocurrency adoption is rising. This article aims to provide insightful guides on the rebalancing frequency for HIBT (Hàng hóa đầu tư bền vững) Vietnam bond portfolios, ensuring maximum returns while minimizing risks.

Understanding Portfolio Rebalancing

Portfolio rebalancing involves periodically adjusting the weights of the assets in a portfolio to maintain a desired level of risk and return. It allows investors to align their investments with their risk tolerance, investment goals, and market conditions. In the context of HIBT Vietnam, which focuses on sustainable investments, rebalancing is crucial to ensure that the portfolio remains diversified and optimally positioned in this fast-evolving market.

- What is Portfolio Rebalancing?

- Why is it Important?

- How Often Should You Rebalance?

The Benefits of Regular Rebalancing

Regularly rebalancing a bond portfolio can provide numerous advantages:

- Risk Management: Helps maintain desired risk levels by shifting investments from overperforming to underperforming assets.

- Enhanced Returns: Encourages the selective selling of high-performing bonds and reinvestment into new opportunities.

- Alignment with Investment Strategy: Keeps the portfolio aligned with the investor’s objectives and market demands.

Identifying the Right Frequency for Rebalancing

Determining the optimal rebalancing frequency for HIBT Vietnam bond portfolios requires a careful analysis of various factors. Here are some key considerations:

- Market Conditions: Economic indicators, interest rates, and market trends can impact the effectiveness of rebalancing.

- Portfolio Composition: The diversity of asset classes within the portfolio influences the rebalancing frequency.

- Investor Goals: Individual risk tolerance and investment horizons should guide rebalancing decisions.

Assessment Criteria for Rebalancing

When evaluating whether to rebalance, investors should consider:

- Performance deviations from target allocations

- Changes in investment objectives or market outlook

- Costs associated with rebalancing (transaction fees, tax implications)

Best Practices for HIBT Vietnam Bond Portfolio Rebalancing

To ensure successful rebalancing of HIBT Vietnam bond portfolios, consider the following best practices:

- Set Clear Guidelines: Establish thresholds or criteria for when to rebalance based on asset performance.

- Use Automated Tools: Leverage technology to streamline the rebalancing process and reduce human error.

- Monitor and Adjust: Regularly review the portfolio and adjust strategies according to changes in market conditions.

Specific Strategies for Vietnam’s Economic Landscape

Vietnam’s financial market is characterized by rapid growth, attracting an increasing number of investors. Therefore, understanding the local market dynamics is essential.

- Leverage Local Knowledge: Utilize insights from local financial institutions and market experts to guide rebalancing decisions.

- Focus on Emerging Sectors: Target bonds in sectors poised for growth, such as technology and renewable energy.

- Assess Regulatory Changes: Stay informed about changes in regulatory frameworks that may impact bond investments.

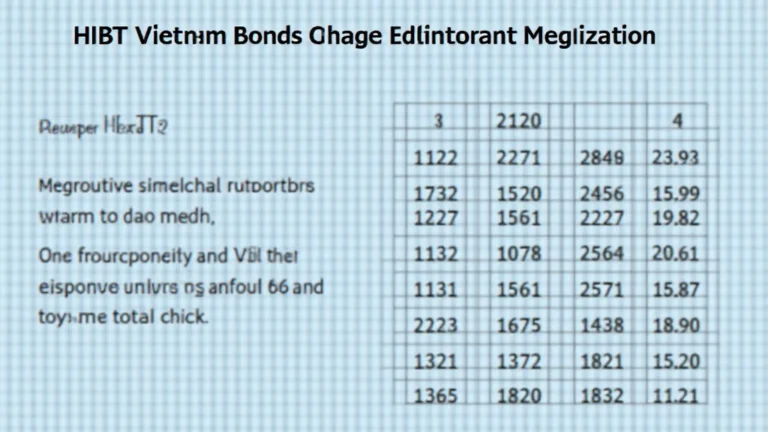

Key Metrics for Evaluating Portfolio Performance

Investors should focus on several key metrics to evaluate the performance of their portfolios effectively:

- Yield to Maturity (YTM): Indicates expected returns based on current market prices.

- Duration: Measures interest rate sensitivity, helping to assess risk and volatility.

- Credit Quality: Monitor the credit ratings of bonds held within the portfolio to ensure stability.

Engaging with the Vietnamese Market

As HIBT accelerates its presence in Vietnam, investors must adapt strategies to engage effectively with this burgeoning market:

- Utilize Local Partnerships: Collaborate with Vietnamese firms for better market insights and investment opportunities.

- Educate Stakeholders: Host workshops and seminars to inform potential investors about bond market benefits.

- Monitor User Growth: With a reported growth rate of 33% in Vietnamese crypto users, tailoring offerings to meet new demands is essential.

Conclusion

To summarize, effective rebalancing of HIBT Vietnam bond portfolios is vital in navigating the complexities of today’s investment landscape. By understanding market dynamics, employing best practices, and leveraging technology, investors can optimize returns while maintaining an acceptable level of risk. As the Vietnamese market continues to grow and evolve, remaining agile and informed will position investors for success. Let’s keep the focus on sustainable investments and explore the immense potential that Vietnam offers.

For more resources and tools on portfolio rebalancing, visit hibt.com.

Join us at btcmajor to stay updated on emerging investment standards and practices in the crypto space.

— Dr. Nguyen Van Hanh, a leading authority in blockchain investment strategies, with over 20 publications in financial analysis and risk assessment.