Understanding HIBT Order Flow Analysis in Vietnam

With increased interest in cryptocurrencies in Vietnam, particularly among the younger population, the need for tools and strategies to navigate this volatile market has never been greater. As of 2023, the number of cryptocurrency users in Vietnam has surged by over 80%. These users are looking for effective ways to maximize their trading capabilities, and one method that has emerged as a game changer is HIBT order flow analysis.

In this article, we will delve into the intricacies of HIBT order flow analysis, explore its significance in the Vietnamese market, and equip you with the knowledge to leverage this technique effectively.

Understanding HIBT Order Flow Analysis

Order flow analysis is a trading methodology that focuses on the supply and demand dynamics of a market. It examines the flow of orders—both market and limit orders—to gauge the intent of the market participants. By analyzing these orders, traders can gain insights into potential price movements and make informed decisions. Specifically, HIBT (High-Intensity Blockchain Trading) takes this concept and amplifies it by utilizing advanced algorithms and blockchain technology.

The Importance of HIBT Order Flow Analysis in Vietnam

Vietnam’s cryptocurrency market is characterized by rapid growth and significant opportunities. According to recent studies, the number of Vietnamese cryptocurrency traders is expected to reach 16 million by the end of 2025. This rising engagement highlights the importance of efficient trading tools, mimicking the traditional financial market’s necessity for robust analysis methods. HIBT order flow analysis plays a critical role in fulfilling this requirement.

- Informed Trading: By comprehensively understanding order flow, traders can make informed decisions, reducing the risk of significant losses.

- Market Timing: HIBT helps traders identify ideal entry and exit points, optimizing their trading strategies.

- Real-Time Data Processing: Utilizing AI and blockchain, HIBT provides real-time analytics, crucial for high-stakes trading environments.

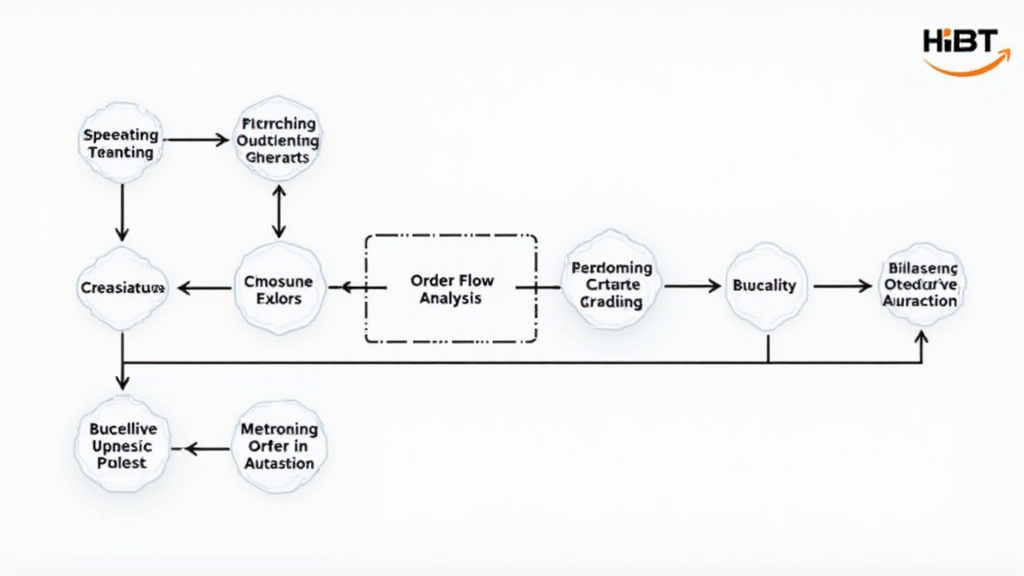

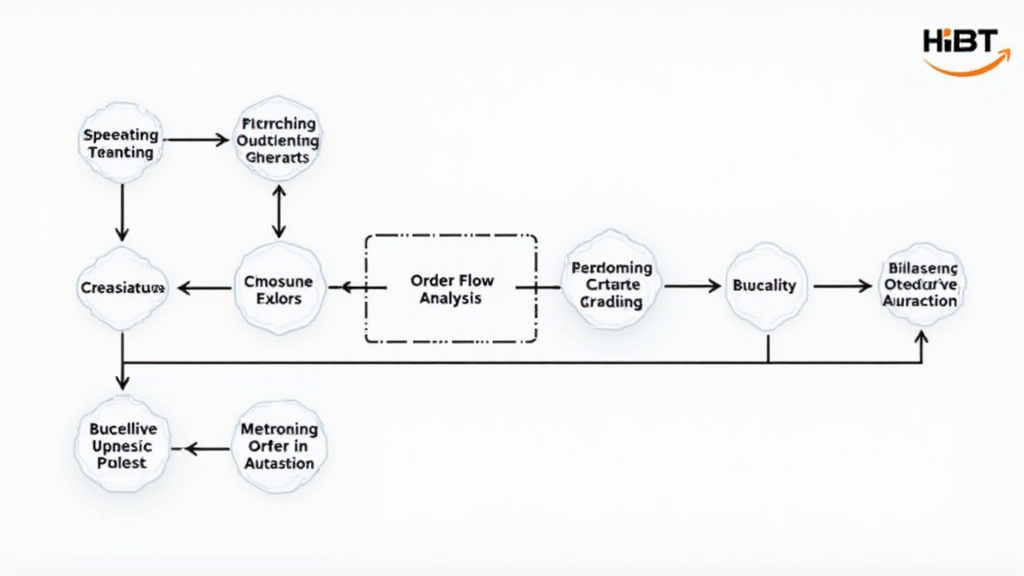

How HIBT Works in Practice

Implementing HIBT order flow analysis involves several steps:

- Data Collection: Capture real-time order data from various exchanges.

- Analysis: Utilize algorithms to interpret the data, identifying buying/selling pressure.

- Execution: Implement trading strategies based on the insights gained from order flow analysis.

Let’s break this down further:

Imagine a busy market where every transaction counts—when buyers outnumber sellers, prices rise; when sellers dominate, prices fall. HIBT order flow analysis allows you to see who is influencing the market in real-time just like observing the crowd dynamics in a marketplace. This analogy is vital as it underscores how vital understanding the crowd’s behavior is in trading.

Real Data Examples from the Vietnamese Market

According to Chainalysis, Vietnam stands as one of the top ten countries in terms of cryptocurrency adoption. In a recent report:

| Year | Users Growth Rate | Market Volume (USD) |

|---|---|---|

| 2021 | 30% | $300 million |

| 2022 | 50% | $700 million |

| 2023 | 80% | $1.2 billion |

This substantial growth illustrates the high potential for trading opportunities when employing HIBT order flow analysis. More users in the market lead to more diverse trading strategies and heightened price action, making it critical for traders to stay ahead.

Challenges when Implementing HIBT

Although HIBT order flow analysis offers numerous benefits, there are several challenges that traders may face:

- Data Overload: The sheer volume of data can be overwhelming and difficult to interpret without the right tools.

- Technology Dependence: Effective utilization of HIBT requires access to cutting-edge technology and necessary skills.

- Market Volatility: Rapid price changes can quickly invalidate signals derived from order flow analysis.

To overcome these challenges, we recommend utilizing comprehensive trading platforms that integrate HIBT analysis tools, such as those found on hibt.com.

Maximizing HIBT Order Flow Analysis for Your Trading Strategy

Here’s how you can incorporate HIBT into your trading strategy:

- Stay Educated: Constantly learn about the latest trends in the cryptocurrency market and HIBT advancements.

- Utilize Resources: Online resources and communities can provide valuable insights into trading strategies.

- Practice with Demo Accounts: Before trading with real capital, test your strategies in a risk-free environment.

By implementing these tactics, traders can better navigate the complexity of the cryptocurrency market in Vietnam and utilize HIBT order flow analysis effectively.

Conclusion

In conclusion, leveraging HIBT order flow analysis can significantly enhance your trading strategy, especially in a rapidly evolving market like Vietnam. As more traders enter this space, those equipped with advanced technologies and methodologies such as HIBT will have a competitive edge.

Investing time in understanding order flow, utilizing the right tools, and staying updated on market changes will empower you to achieve greater success in your trading endeavors. For more information on trading techniques, visit hibt.com.

Author: Dr. Minh Pham, a renowned expert in blockchain technology, has published over 30 research papers in the field and has previously led audits for multiple known crypto projects.