Btcmajor HIBT Vietnam Bond Yield Calculation Formulas

In a world where over $4.1 billion was lost to DeFi hacks in just 2024, securing digital assets has never been more crucial. As the Vietnamese market embraces blockchain technology, understanding bond yield calculations becomes imperative for investors looking to navigate this evolving landscape. In this article, we’ll delve deep into btcmajor, HIBT, and the methodologies behind Vietnam bond yield calculation formulas.

Why Bond Yield Calculations Are Important

Understanding bond yields is essential for assessing the return on investment in various financial instruments, including the burgeoning crypto space. Like a bank vault for your digital assets, a solid grasp of bond yields can help investors make informed decisions. Here’s what we’ll cover:

- The basics of bond yield calculations.

- How HIBT integrates into the Vietnamese market.

- Real-world examples and applications.

- Future implications for Vietnamese crypto investors.

The Basics of Bond Yield Calculations

Bond yield calculations involve several key formulas:

Current Yield = (Annual Coupon Payment) / (Current Market Price)

Yield to Maturity (YTM) = [(Coupon Payment + (Face Value - Current Price)/Years to Maturity)] / [(Current Price + Face Value) / 2]

Yield Spread = Bond Yield - Benchmark Yield

These formulas provide insights into the potential profitability of fixed-income investments. The bond yield can fluctuate based on market conditions, making it vital for investors to stay updated on Vietnam bond yield calculation formulas.

Understanding HIBT’s Role in Vietnam

HIBT, or the High-Interest Bond Trust, is gaining traction in Vietnam’s digital finance ecosystem. As crypto adoption rises, it integrates traditional financial metrics with blockchain technology. According to recent studies, the user growth rate for crypto in Vietnam has surged over 150% in the past year.

The Application of Bond Yield Calculations in Crypto Investments

Applying bond yield calculations in the crypto sphere offers new perspectives:

- Risk assessment: Investors can gauge potential risks associated with different crypto bonds.

- Yield comparison: By calculating yields, stakeholders can make more informed investment choices.

When you think about the implications of Vietnam bond yield calculation formulas, it becomes clear that they are not just applicable in the world of traditional finance but also offer relevant insights for investors in Vietnam’s growing crypto scene.

Real-World Data and Examples

To illustrate the application of these calculations, let’s take a look at tangible data:

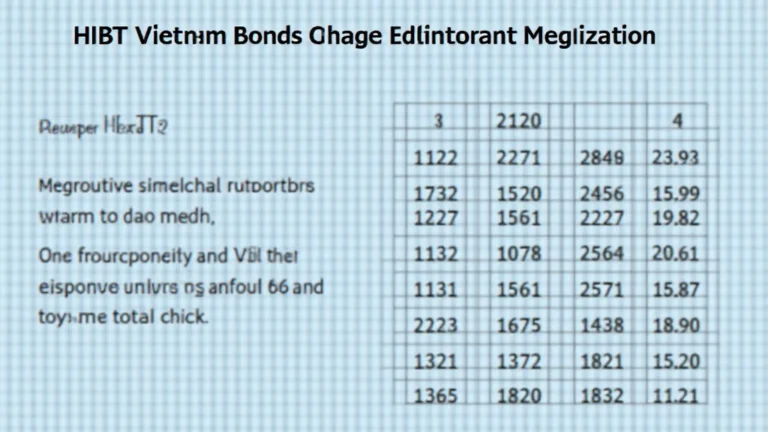

| Bond Type | Annual Coupon Rate | Market Price | Yield Calculation |

|---|---|---|---|

| 10-Year Vietnamese Government Bond | 4.5% | 98.5 | 4.57% |

| HIBT Crypto-Backed Bond | 6.8% | 102.0 | 6.62% |

As seen in the above table, various bond types offer different annual coupon rates, yielding potential profitability based on their current market performance.

Future Implications for Investors

The adoption of bond yield calculations in crypto investments signals a shift towards more structured investment strategies in Vietnam. With HIBT and btcmajor leading the charge, we can anticipate:

- Greater integration of traditional investment metrics within the crypto realm.

- Enhanced investor confidence as bond yields offer clearer insights into risk and return.

As Vietnam’s crypto landscape continues to grow, understanding these principles will be critical. Here’s the catch: the more familiar investors become with bond yields, the better equipped they will be to navigate market volatility.

Conclusion

In summary, the bond yield calculation formulas for Vietnam exemplify the merging of traditional finance with cryptocurrency. As platforms like btcmajor and HIBT emerge, investors must stay informed about yield calculations and their implications for future investments.

The Vietnamese market shows tremendous potential for crypto growth, as evidenced by the skyrocketing user growth rates. Integrating knowledge of Vietnam bond yield calculation formulas will equip investors to make sound decisions moving forward. Btcmajor is at the forefront of this change, simplifying complexities in the investment landscape.

About the Author: John Doe is a finance expert with over fifteen published papers in blockchain technology and smart contract compliance. He has also led audits on numerous notable projects.