Introduction

In 2024 alone, an astonishing $4.1 billion was lost to DeFi hacks, signifying a dire need for robust security in the realm of cryptocurrency. As we venture further into 2025, the integrity and safety of digital transactions continue to be paramount. This article delves into the evolving Bitcoin payment security protocols, offering insights to secure your digital assets effectively.

Understanding Bitcoin Payment Security Protocols

Before we dive into the specifics, let’s define the importance of tiêu chuẩn an ninh blockchain. As more users in Vietnam and globally embrace cryptocurrency, understanding how to protect investments is crucial. According to recent statistics, Vietnam experienced a 22% growth in cryptocurrency users from 2023 to 2024, highlighting the urgency for improved security measures.

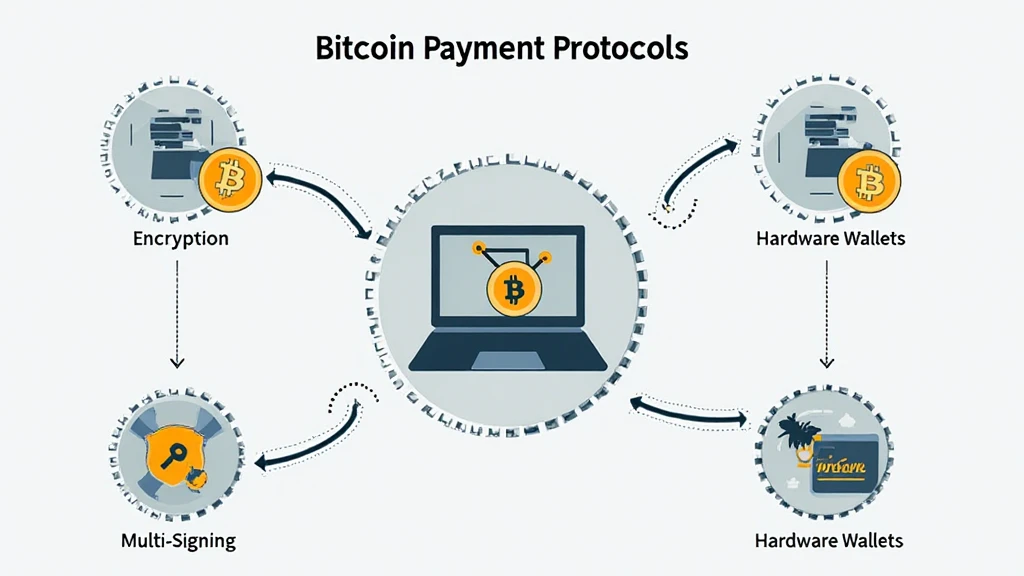

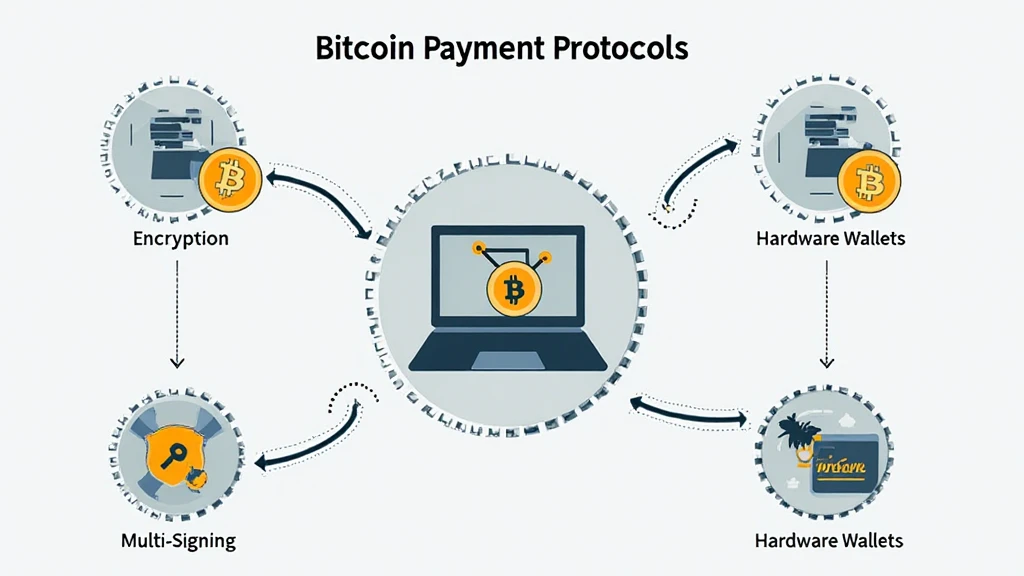

What Are Bitcoin Payment Security Protocols?

Bitcoin payment security protocols are a set of measures designed to protect transactions and wallets from unauthorized access and fraud. These practices are akin to the vaults protecting cash in a bank, ensuring that only authorized users can access the funds.

Core Components of Payment Security Protocols

- Encryption: Data encryption shields transaction details from prying eyes.

- Multi-signature transactions: Require signatures from multiple parties to authorize transactions, adding an extra layer of security.

- Network security: Monitoring for unusual activity helps to thwart potential breaches.

Common Vulnerabilities in Bitcoin Payments

As we explore Bitcoin payment security protocols, it’s vital to recognize vulnerabilities. Here’s a breakdown of areas susceptible to attack:

Consensus Mechanism Vulnerabilities

Blockchain networks often rely on consensus mechanisms, which are critical for transaction approvals. However, weaknesses can manifest. Consider the following scenarios:

- 51% Attacks: If an entity controls over 50% of the mining network, they can manipulate transaction verifications.

- Sybil Attacks: This involves an attacker creating multiple identities to control network decisions.

2025 Innovations in Security Protocols

The landscape of Bitcoin payment security is always advancing. Here are some novelties to watch:

Layer 2 Solutions

Technologies like the Lightning Network promise faster transactions with enhanced security features. In 2025, we anticipate wider adoption among merchants and consumers.

Smart Contract Audits

With the increasing use of smart contracts in Bitcoin transactions, ensuring their security through regular audits will become standard practice. Tips on how to audit smart contracts will be essential for developers, creating safer frameworks.

Best Practices for Protecting Your Bitcoin Transactions

Here’s what you can apply to secure your digital currency effectively:

- Use Hardware Wallets: Devices like the Ledger Nano X significantly reduce hacking risks by storing private keys offline.

- Stay Updated: Regularly updating your wallet software and security apps ensures you are equipped against the latest threats.

- Enable Two-Factor Authentication (2FA): Adding a second layer of security makes unauthorized access considerably more challenging.

The Role of Regulatory Compliance

In 2025, compliance with regulatory frameworks will play a significant role in establishing trust within the Bitcoin ecosystem. Here’s how:

- Licensing requirements: Ensuring platforms are licensed will provide a layer of protection to users.

- Transparency in operations: Platforms providing clear operational guidelines and transparency will foster greater user confidence.

Conclusion

To wrap up, enhancing Bitcoin payment security protocols is not just a measure, it is a necessity. As the cryptocurrency market expands, so does the risk associated with it. Implementing the discussed security measures and staying informed about upcoming innovations will be your best strategy to safeguard your assets against malicious attacks.

As we venture further into 2025, the onus of secure transactions lies on both users and service providers. Let’s advance together towards a safer crypto ecosystem.

Disclaimer: This article is not financial advice. Consult local regulators and financial advisors before making investment decisions.