Mastering Bitcoin Market Cycle Management: Strategies for Traders

With over $4.1 billion lost in DeFi hacks in 2024, navigating the cryptocurrency landscape can feel daunting. As a trader or investor, understanding the Bitcoin market cycle management is crucial to safeguard your assets and make informed decisions. This guide aims to provide essential strategies for effectively managing market cycles, ensuring you stay ahead in the volatile world of cryptocurrencies.

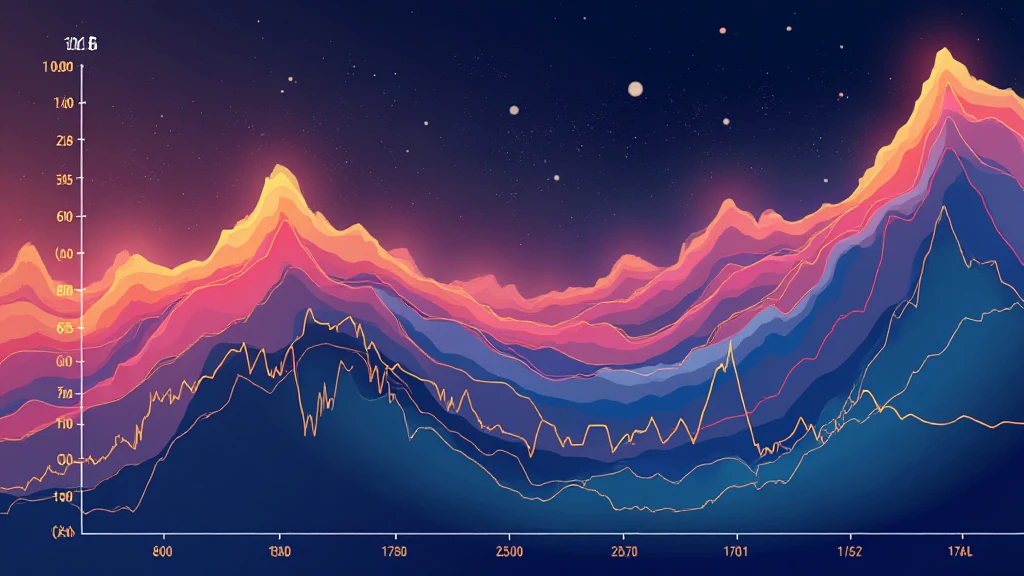

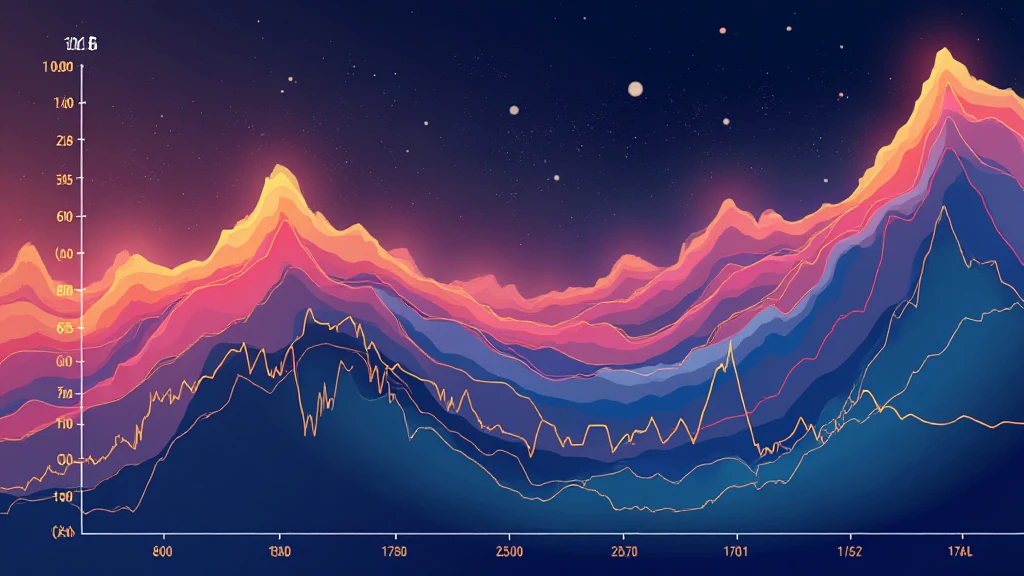

Understanding Bitcoin Market Cycles

Every market experiences cycles; in Bitcoin, these cycles are characterized by distinct phases: accumulation, markup, distribution, and markdown. Recognizing these phases allows you to align your trading strategies accordingly.

- Accumulation Phase: This phase is marked by a period of consolidation where prices stabilize, and early investors accumulate Bitcoin.

- Markup Phase: Here, bullish sentiment drives prices upward, often attracting attention from mainstream investors.

- Distribution Phase: In this phase, early investors start selling their holdings, leading to potential price stagnation.

- Markdown Phase: Following distribution, prices typically decline as bearish sentiment takes over.

Illustrating this with Vietnamese context, the increasing interest in Bitcoin was reflected by a 40% growth in local user adoption in 2023. This serves as a testament to Bitcoin’s evolving market appeal.

Why Bitcoin Market Cycle Management Matters

Effective market cycle management helps you:

- Mitigate risks

- Enhance returns

- Align trading strategies with market sentiment

Using tools like TradingView can facilitate better decision-making by providing real-time data analytics that help you navigate through various market phases smoothly. Let’s break this down further.

Key Strategies for Effective Management

1. Employ Technical Analysis

Understanding market technical indicators is a cornerstone of effective Bitcoin market cycle management. Key indicators to watch include:

- Moving Averages: These smooth out price data to identify trends over specific periods, indicating potential buy or sell signals.

- Relative Strength Index (RSI): This measures the speed and change of price movements, helping to identify overbought or oversold conditions.

By combining these tools, you can visualize potential entry and exit points more effectively.

2. Stay Informed about Market News

Market sentiment can shift rapidly, influenced by news events. Here’s the catch: being informed allows for timely reactions. Consider subscribing to trusted crypto news platforms or following industry leaders on social media for updates.

3. Risk Management Techniques

In volatile markets like Bitcoin, having a solid risk management strategy is vital. Some methods include:

- Setting Stop-Loss Orders: Automatically sell assets when they reach a predetermined low price.

- Diversifying Investments: Do not put all your capital into one crypto asset, as it can lead to heavy losses.

Utilize these techniques to protect your investments against sudden downturns.

Understanding the Vietnamese Market

The cryptocurrency market in Vietnam has been expanding with strong government interest and increasing local adoption. According to recent reports, Vietnam is among the top countries in terms of cryptocurrency ownership. People are not only trading but also leveraging Bitcoin for commerce and investments.

A vital keyword here is tiêu chuẩn an ninh blockchain, which highlights the importance of security standards as they pertain to Bitcoin trading and market management.

Future Outlook: Forecasting Market Cycles

Looking to the future, understanding how to forecast Bitcoin market cycles can give you a significant edge. Factors to consider include:

- Global economic conditions

- Regulatory changes

- The emergence of new technologies like blockchain improvements

Keep an eye on projected trends for 2025, especially regarding the most promising altcoins, as they could impact Bitcoin’s market position significantly.

Leveraging Data for Informed Decisions

As a trader, leverage data to strengthen your market cycle management. Websites like hibt.com provide valuable insights on Bitcoin movements and trends.

Conclusion

In summary, mastering Bitcoin market cycle management requires a mix of technical analysis, awareness of news trends, and effective risk management techniques. As the cryptocurrency landscape continues to evolve, being proactive and informed will be your best strategies for success. Understanding and participating in Bitcoin market cycles not only enhances your investment potential but also aids in navigating the complexities of the digital currency world. Follow the guidelines laid out here to elevate your trading strategies.

With Bitcoin’s market constantly in flux, utilizing tools and strategies effectively could mean the difference between profiting and missing out. Start mastering these principles today for a successful trading experience!

Before we part ways, remember that investing in cryptocurrencies is risky, and it’s essential to consult local regulators and conduct your research.

Author: Dr. Alex Nguyen, a renowned cryptocurrency expert with over 15 published papers on blockchain technology and a key figure in auditing notable crypto projects.