Bitcoin Market Cycle Management: Enhance Your Cryptographic Strategy

As we delve deeper into the dynamic and often tumultuous world of cryptocurrencies, understanding market dynamics, especially Bitcoin market cycle management, is crucial. In 2024, a staggering $4.1 billion was lost to hacks across the DeFi space, which underlines the importance of robust strategies in investing and securely managing digital assets. In this article, we will explore how to better navigate the Bitcoin market cycles, ensuring you are well-prepared for both opportunities and risks.

Understanding the Bitcoin Market Cycle

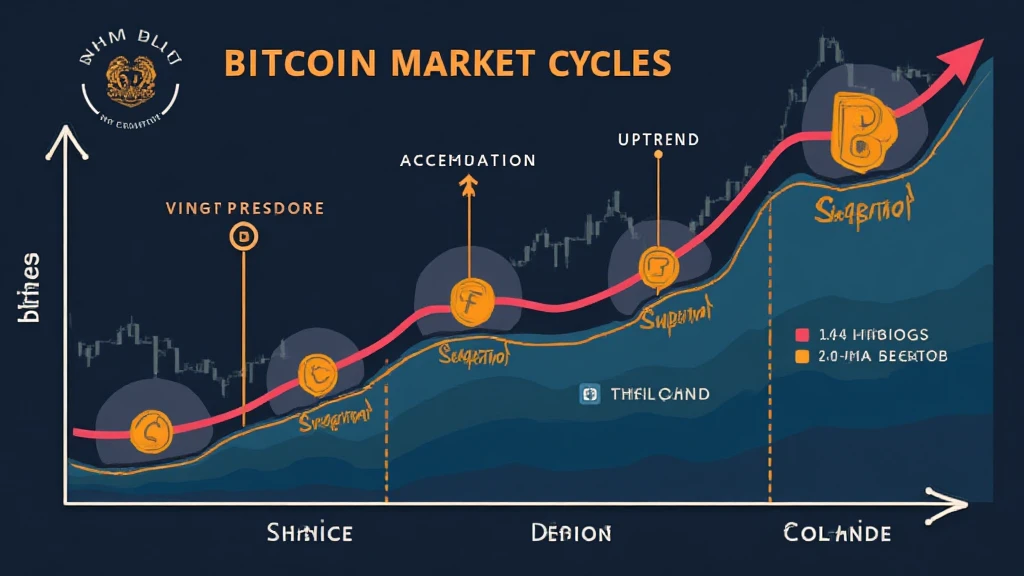

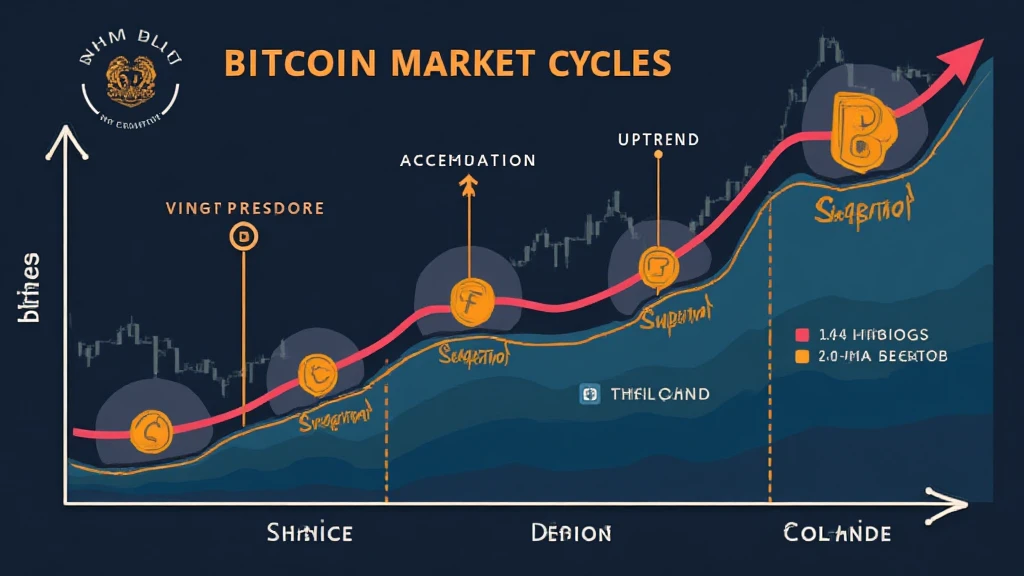

To manage Bitcoin’s market cycles effectively, one must first understand the four primary phases of these cycles: accumulation, uptrend, distribution, and downtrend.

- Accumulation Phase: After a significant downtrend, investors begin accumulating Bitcoin at lower prices. Historical data indicates that the best time to invest often coincides with this phase.

- Uptrend Phase: Prices begin to rise as demand outstrips supply, leading to increased buyer interest. Bitcoin’s price surge attracts mainstream attention, often driving further investment.

- Distribution Phase: Early investors begin selling their assets for profit. This phase often leads to increased volatility as weaker hands sell.

- Downtrend Phase: As investor sentiment shifts, prices fall sharply. This phase often scares off newer investors, consolidating the holdings among long-term believers.

Understanding these phases can guide your decisions in the Bitcoin market cycle management process.

Identifying Market Trends and Signals

One of the core aspects of Bitcoin market cycle management is identifying trends and signals. Metrics such as On-Chain Analysis and Market Sentiment Indicators play a pivotal role.

- On-Chain Analysis: Data from the blockchain can provide insights into trader behaviors, transaction volumes, and wallet movements. For instance, an uptick in wallet creation can suggest an impending market rise.

- Market Sentiment Indicators: Tools like the Fear & Greed Index can indicate public sentiment towards Bitcoin, highlighting potential market reversals.

By accurately interpreting these signals, you can place informed trades and investments.

Applying Bitcoin Cycle Management Strategies

Effective Bitcoin market cycle management involves tactical approaches that incorporate market knowledge and analytics. Here are several strategies to consider:

- DCA (Dollar-Cost Averaging): Regularly investing a fixed dollar amount minimizes volatility effects and allows you to accumulate Bitcoin consistently.

- Profit Taking: At the distribution phase, setting profit-taking strategies helps lock in gains without panic selling.

- Stop-Loss Orders: By implementing stop-loss orders, investors can minimize potential losses during sudden market downturns.

- Portfolio Diversification: While Bitcoin is a significant asset, diversifying into other cryptocurrencies can lower risk and enhance potential returns.

Utilizing these strategies in your Bitcoin market cycle management can significantly enhance your investment security.

Key Trends Impacting Bitcoin in 2025

As we look towards 2025, several emerging trends will likely impact Bitcoin. Here are some notable ones:

- Regulatory Developments: Increasing regulatory clarity, especially in major economies like Vietnam and the U.S., will influence market dynamics significantly.

- Institutional Adoption: More institutional players entering the Bitcoin space could affect price stability and market confidence.

- Technological Advancements: Innovations in blockchain security practices (tiêu chuẩn an ninh blockchain) and improvements in transaction efficiencies are underway, enhancing Bitcoin’s appeal.

By keeping an eye on these developments, you will be better positioned for the forthcoming challenges of the Bitcoin landscape.

Managing Risks and Ensuring Security

With Bitcoin’s growing influence, security and risk management becomes paramount. Some key methods include:

- Hardware Wallets: Utilizing hardware wallets (e.g., Ledger Nano X) reduces the risk of hacking by providing cold storage for your assets.

- Regular Audits: Conducting periodic audits of your holdings and wallets ensures your assets remain secure.

- Education: Ongoing education about Bitcoin’s evolving landscape will help you avoid traps set by market volatility.

Emphasizing risk management in Bitcoin market cycle management is instrumental in safeguarding your investments.

Conclusion: Your Path to Investment Mastery

In wrapping up our examination of Bitcoin market cycle management, it’s essential to remember that success lies in understanding the market cycles, applying effective management strategies, and maintaining a solid security posture. As the cryptocurrency space continues to evolve, staying informed and adaptable will be your greatest assets.

Adopting this framework will significantly enhance your ability to navigate the complexities of cryptocurrency, allowing you to make informed investment decisions. Remember, managing the Bitcoin market cycles is not just about survival; it is about thriving amidst uncertainty. If you want to take your strategies further, visit btcmajor for more insights.