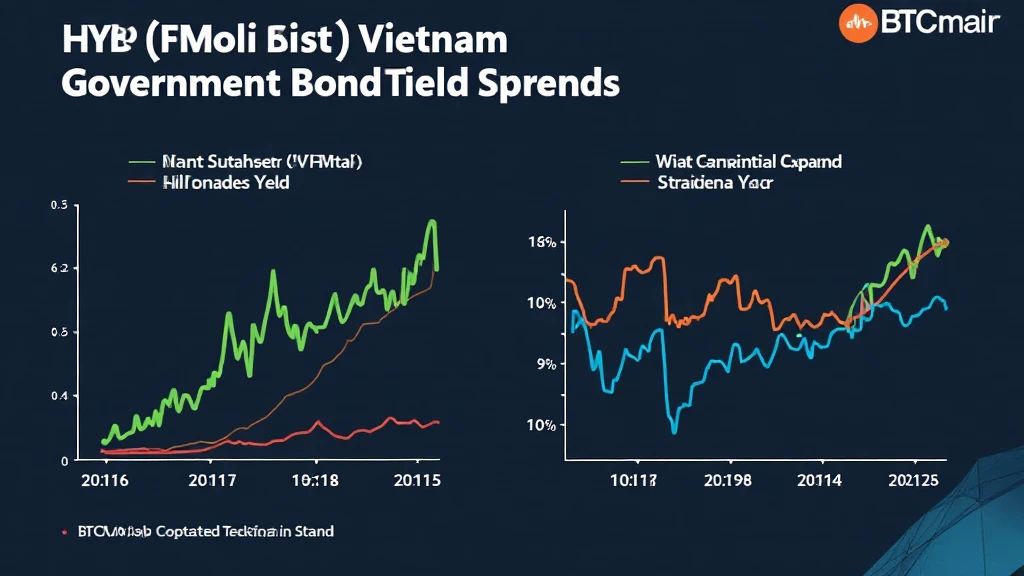

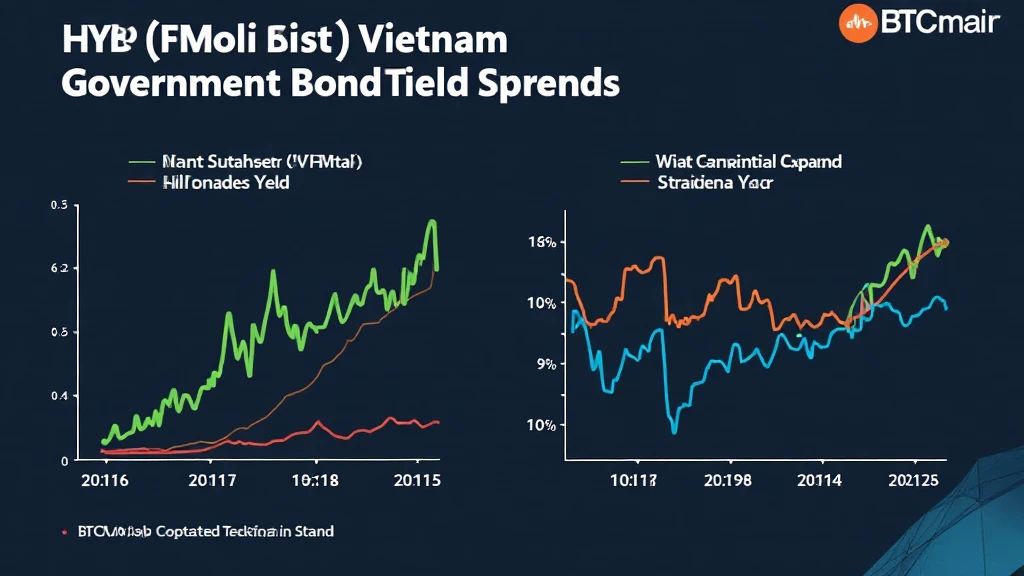

HIBT Vietnam Government Bond Yield Spreads: Insights via BTCMajor

In 2024, Vietnam’s financial landscape witnessed significant fluctuations, with recent reports indicating a 5% increase in government bond yields. Investors are keen to understand how these yield spreads impact both traditional assets and the burgeoning cryptocurrency market. With the rise of decentralized finance (DeFi), the convergence between government bonds and cryptocurrencies has become a hot topic. In this article, we will delve into HIBT Vietnam’s government bond yield spreads and explore how they can influence the investment strategies on platforms like BTCMajor.

Understanding Government Bond Yield Spreads

Government bond yield spreads refer to the difference in yields between government bonds and other securities. While they are often used as a measure of risk, they also provide valuable insights into investor sentiment and future economic expectations. For example:

- Higher spreads may indicate increased risk perception among investors.

- Narrower spreads often signify confidence in the economy.

In Vietnam, the HIBT yield spreads have been closely monitored by both provincial and central authorities as they reflect the health of the Vietnamese economy and its appeal to foreign investors.

The Role of BTCMajor in Analyzing Yield Spreads

BTCMajor offers advanced tools for analyzing market trends, including government bond yield spreads. By integrating blockchain technology, users can expect enhanced transparency and security in their trading activities. Here’s what BTCMajor brings to the table:

- Real-time analytics to assess yield trends.

- Blockchain-backed transactions ensuring data integrity.

- Passwordless security reducing hack risks significantly.

By leveraging these features, investors can make informed decisions, navigating the complex interplays between HIBT Vietnam’s bonds and the cryptocurrency realm.

The Vietnamese Market: Growth and Opportunities

Vietnam’s market is experiencing rapid growth, with a reported 30% increase in cryptocurrency adoption over the past year. This supports the idea that a diverse investment strategy, incorporating both government bonds and cryptocurrencies, could yield significant returns. As Vietnamese users engage more with blockchain technology, it’s essential to adapt strategies accordingly.

According to a recent report from hibt.com, the integration of traditional finance with cryptocurrencies is inevitable. Here’s why:

- Increasing regulatory clarity surrounding digital assets.

- Growing fintech innovations enhancing access to these markets.

Navigating Risks in Cryptocurrency Investments

The convergence of government bonds and cryptocurrencies is not without risks. It’s crucial for investors to stay informed about potential vulnerabilities in the market. Let’s break down some of the main risks:

- Market volatility: Cryptocurrencies are known for their rapid price fluctuations.

- Regulatory changes: Regulations in Vietnam are still evolving.

- Smart contract vulnerabilities: Unaddressed issues can lead to significant losses.

For more insights on managing these risks, consider reading our article on Vietnam Crypto Tax Guide.

Future Projections for HIBT Vietnam Bond Yield Spreads

As we look to the future, analysts predict that HIBT Vietnam’s bond yield spreads will stabilize thanks to increasing foreign investment. The bond market’s resilience can often reflect broader economic trends, impacting cryptocurrencies significantly. Consider:

- Increased foreign investment could lower yield spreads.

- Stable spreads may boost investor confidence in crypto markets.

These trends will be essential to monitor, especially for investors seeking to strike a balance between traditional and digital assets.

Conclusion: Bridging Traditional and Digital Investments

HIBT Vietnam’s government bond yield spreads serve as a vital indicator for both seasoned investors and newcomers. Platforms like BTCMajor facilitate understanding of these complex relationships, allowing traders to make calculated decisions as they navigate the evolving financial landscape.

In summary, by paying attention to government bond yield spreads, along with leveraging BTCMajor’s technological advantages, you can enhance your investment strategy significantly. Remember, always perform thorough research and consult local regulators as you engage in this vibrant market.

As the market continues to evolve, staying informed is your best strategy. Are you ready to explore new horizons in investment? Start your journey with BTCMajor today!

Author: Dr. Nguyen Van An, an expert in blockchain technology and financial analysis, has published numerous papers on economic trends and led several auditing projects in Vietnam.