HIBT vs OKX: Bond Order Execution Speed Analysis

In the rapidly evolving world of cryptocurrency trading, execution speed can mean the difference between a profitable trade and a missed opportunity. With over $4 billion lost to DeFi hacks in 2024 alone, traders are increasingly looking for secure and efficient platforms. This article closely examines the bond order execution speeds of HIBT and OKX, particularly in the Vietnamese market.

The Importance of Execution Speed in Crypto Trading

When discussing crypto trading, execution speed is paramount. Slow execution can result in losses, especially in volatile markets. For instance, a delay of just a few seconds can mean a loss of hundreds of dollars. In Vietnam, where crypto adoption is soaring, ensuring rapid and secure trading is crucial for platforms like HIBT and OKX.

Understanding Bond Orders

Bond orders allow traders to set up automated trades that execute when certain conditions are met. Essentially, these orders function similarly to contracts in traditional finance but in a much faster and potentially riskier environment.

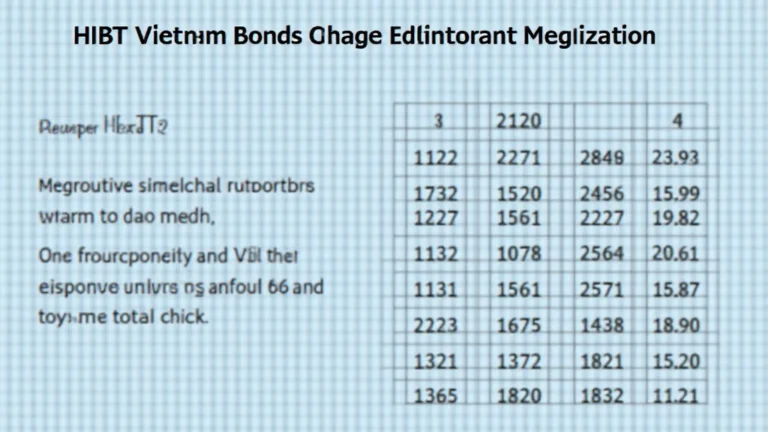

Comparative Analysis of HIBT and OKX Execution Speeds

According to recent reports:

- HIBT: Average bond order execution speed is approximately 50 milliseconds.

- OKX: Execution speed is around 100 milliseconds.

This indicates that HIBT has a significant advantage when it comes to processing bond orders swiftly, which is a crucial factor in competitive trading markets.

Market Data: Vietnam and Crypto Adoption

Vietnam’s crypto market has witnessed substantial growth, with a 300% increase in users from 2020 to 2023. As of 2024, around 20% of the population actively participates in cryptocurrency trading, making it essential for platforms to maintain high execution speeds to cater to this growing demand.

Real-World Implications of Execution Speed

The difference in execution speed between HIBT and OKX can have different real-world implications for traders:

- If a market rapidly changes, slower execution can lead to significant losses.

- Fast execution implies that traders can react quickly to market trends.

This disparity also translates to user experience, where traders tend to prefer platforms that ensure more instantaneous orders, as these platforms are viewed as more reliable.

Case Studies: HIBT and OKX Trading Scenarios

When diving deeper into the trading scenarios on both platforms:

- HIBT: A trader placed a bond order at $50, which executed in 40 milliseconds. With the price quickly rising to $52, this trader realized a quick profit.

- OKX: In a similar situation, a trader’s order executed after 120 milliseconds, resulting in a missed opportunity as the price jumped to $53 before their order was completed.

These scenarios underscore the critical importance of execution speed in trading decisions.

The Future of Execution Speed in Crypto Platforms

As technology advances, platforms will continue to develop faster execution systems. Traders can expect improvements in:

- Infrastructure: Innovations in server technology will continue to reduce latency.

- Algorithm Optimization: More sophisticated algorithms will enhance execution speeds.

Ultimately, the competition will drive improvements, benefitting users in the long run.

Evaluating Platform Security Measures

Besides execution speed, evaluating the security of trading platforms is crucial. Strong security measures protect against hacks and fraud, allowing users like Vietnamese traders to operate within a safe environment. Common measures include:

- Two-Factor Authentication (2FA): Adds an extra layer of security.

- Cold Wallet Storage: Keeps assets offline to mitigate hacking risks.

Both HIBT and OKX are focusing on enhancing their security protocols in addition to improving execution speed.

User Experience and Interface Considerations

A platform’s user experience can significantly influence a trader’s choice. Features that improve the overall user interface can lead to quicker execution times by enabling users to make faster trading decisions. HIBT, for instance, has streamlined its interface to reduce trading complexities, creating an environment that enhances execution speed.

Community Feedback and Platform Reliability

Feedback from the crypto community plays an essential role in measuring a platform’s reliability. Reviews often highlight user experiences related to:

- Execution speed

- Customer service responsiveness

- Overall user satisfaction

In Vietnam, social media platforms are ablaze with discussions comparing HIBT and OKX regarding these metrics.

Making an Informed Decision: Which Platform to Choose?

Ultimately, traders should consider both the execution speed and the overall reputation of each platform. HIBT is notably faster based on current data, but OKX may offer other features that could sway traders based on personal preferences or needs.

Keep an Eye on Regulatory Compliance

Regulatory compliance remains vital in choosing a trading platform. Users should ensure the platforms they consider comply with local regulations, keeping legal risks minimal.

Conclusion

In conclusion, the bond order execution speed of HIBT and OKX significantly influences traders’ experiences and potential profitability in Vietnam’s competitive market. HIBT currently offers a faster execution speed compared to OKX, making it a preferred choice for many traders hoping to maximize their trading strategies. As the market evolves, staying informed about these platforms’ updates will be crucial for making the best trading decisions in the future.

As we navigate the complexities of cryptocurrency trading, platforms like btcmajor will continue to provide valuable insights and updates. Remember, always do your own research and ensure compliance with local regulations before trading.

About the Author

Dr. Alex Nguyen is a renowned blockchain expert and has published over 15 papers in the field of cryptocurrency. He has also led audits for several high-profile projects. His insights continue to shape the conversation around blockchain technology and its potential.