Liquidity Provision in DeFi: A Comprehensive Guide

With the total value locked (TVL) in DeFi exceeding $100 billion by the end of 2023, the importance of liquidity provision in decentralized finance (DeFi) cannot be overstated.

In this article, we will explore what liquidity provision in DeFi is, its significance, how it works, and the risks involved. We’ll discuss best practices, provide actionable insights, and highlight the growing significance of this aspect for Vietnamese users engaged in the crypto space.

Understanding Liquidity in DeFi

Liquidity refers to the availability of assets to be bought and sold in a market. In DeFi, liquidity enables efficient trading and pricing of tokens without causing drastic price swings.

- Liquidity ensures that users can enter or exit positions at desired prices.

- A solid liquidity base enhances the stability of DeFi protocols.

- Liquidity pools allow users to contribute to the market and earn fees.

Just as a bank provides liquidity to its customers by facilitating transactions, DeFi protocols utilize liquidity pools—smart contracts that hold funds. Users supply these funds to earn staking rewards or transaction fees, contributing to the overall liquidity.

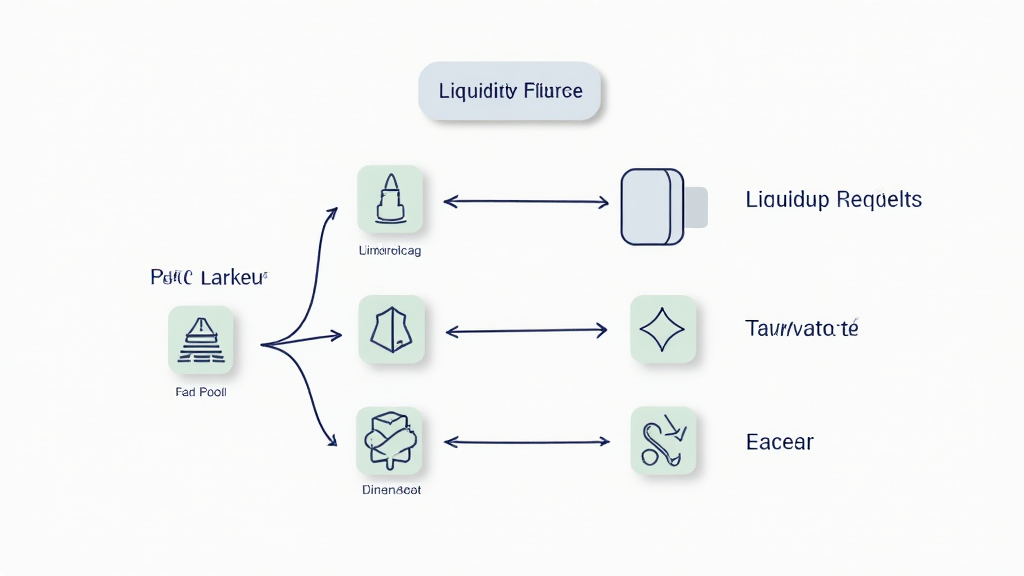

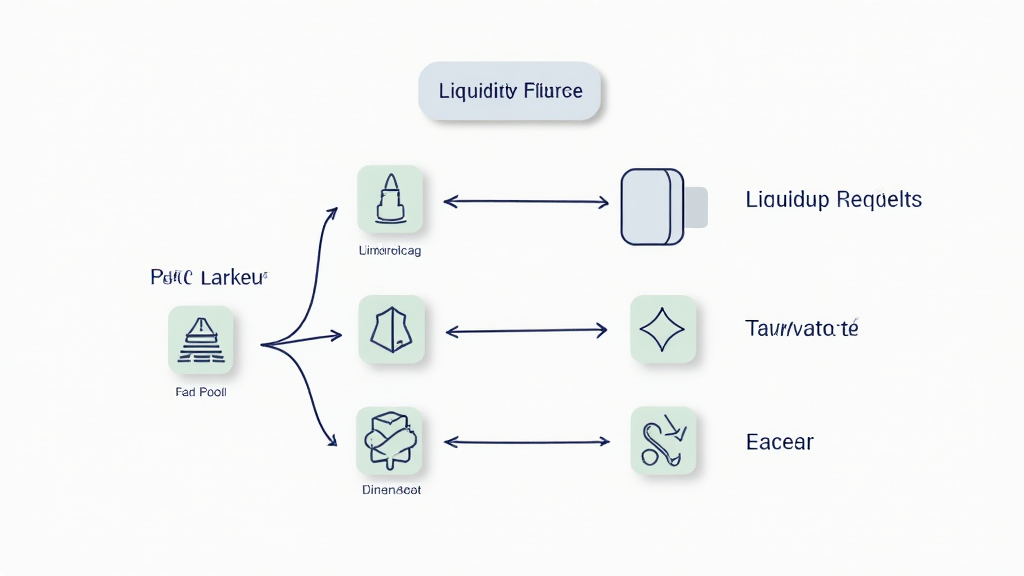

The Mechanics of Liquidity Provision

Liquidity is typically provided via liquidity pools, such as those found on Uniswap or Balancer, which pair two tokens. Here’s how it works:

- Deposit Tokens: Users deposit equal values of two tokens into a pool.

- Earn Fees: As traders swap tokens, liquidity providers earn a portion of the fees.

- Impermanent Loss: If the price of tokens diverges significantly, liquidity providers may experience impermanent loss.

This system supports decentralized trading, allowing users to trade assets directly without relying on intermediaries.

Key Risks Associated with Liquidity Provision

While providing liquidity can be profitable, it’s essential to understand the risks:

- Impermanent Loss: When providing liquidity, if the price of the tokens diverges significantly, you may end up with less value than you initially deposited.

- Smart Contract Risk: Bugs or vulnerabilities in smart contracts could lead to loss of funds.

- Market Risk: Sudden market fluctuations can impact the value of pooled assets.

By understanding these risks, especially in the context of the Vietnamese market, users can make informed decisions.

Best Practices for Liquidity Providers

To maximize returns and minimize risk, liquidity providers should consider the following best practices:

- Research the Platform: Always investigate the protocol’s security measures and past performance.

- Diversify Pools: Don’t put all your assets into one pool, spread them across various protocols.

- Monitor Market Conditions: Stay updated with market trends to understand liquidity demands.

The Future of Liquidity in DeFi

As we look towards 2025 and beyond, liquidity provision in DeFi is expected to evolve significantly. Improved protocols and solutions that address existing risks can lead to higher participation rates, especially in rapidly growing markets like Vietnam.

According to recent data, the Vietnamese cryptocurrency market saw a user growth rate of over 200% in 2023, highlighting the potential for liquidity provision and decentralized trading among local investors.

As DeFi protocols develop, offering features like insurance against impermanent loss or enhancing liquidity efficiency, users will be more inclined to participate.

Conclusion

In conclusion, liquidity provision in DeFi plays a critical role in the ecosystem, enabling seamless trading and fostering market stability. By understanding the mechanisms, risks, and best practices, you can make informed decisions as a liquidity provider.

As the DeFi space continues to evolve and expand, especially within the context of the burgeoning Vietnamese market, the demand for effective liquidity solutions will only grow stronger. Stay informed and be part of this transformative financial landscape.

For further insights into liquidity strategies and the DeFi market, check out hibt.com. Remember, while DeFi holds immense potential, it’s crucial to consult local regulators and conduct thorough research before diving in.

Author: Nguyễn Văn Minh, a leading blockchain researcher with over 15 published works, specializing in decentralized finance and auditing major smart contract projects.