Unlocking Bitcoin Layer: The Future of Blockchain Scalability

In 2024, the crypto industry witnessed the staggering loss of $4.1 billion due to DeFi hacks, raising concerns about security protocols in blockchain technologies. With rapid advancements in layered architectures, Bitcoin Layer has emerged as a pivotal solution for improving scalability and security in the blockchain ecosystem. This article dives deep into understanding Bitcoin Layer — its principles, advantages, challenges, and the way it integrates within the existing infrastructure.

As more users in countries like Vietnam are engaging with cryptocurrencies (with a user growth rate of around 200% in 2024), understanding how Bitcoin Layer can enhance transaction efficiency and security has become essential. This article acts as a comprehensive guide for anyone interested in delving into this revolutionary technology.

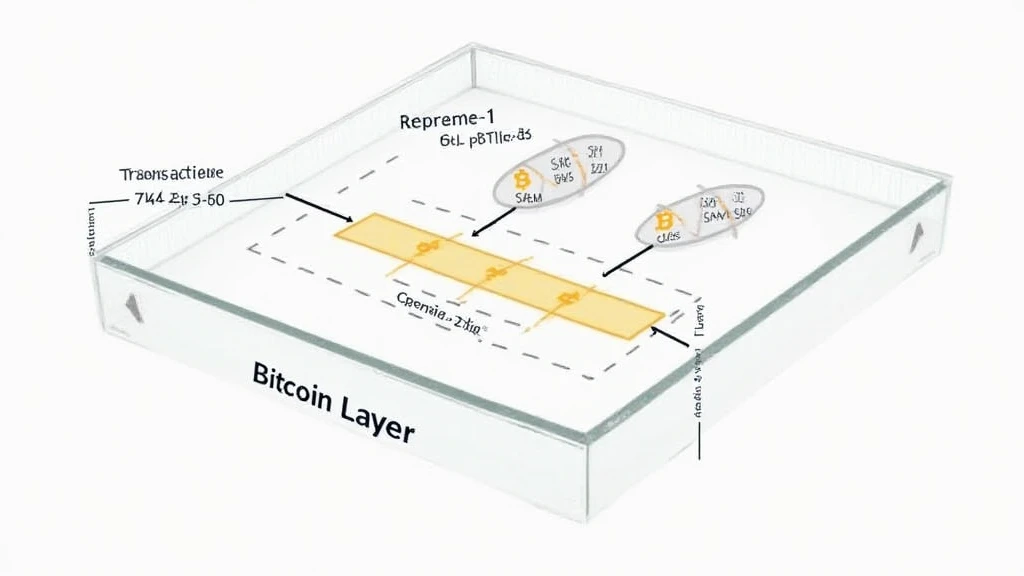

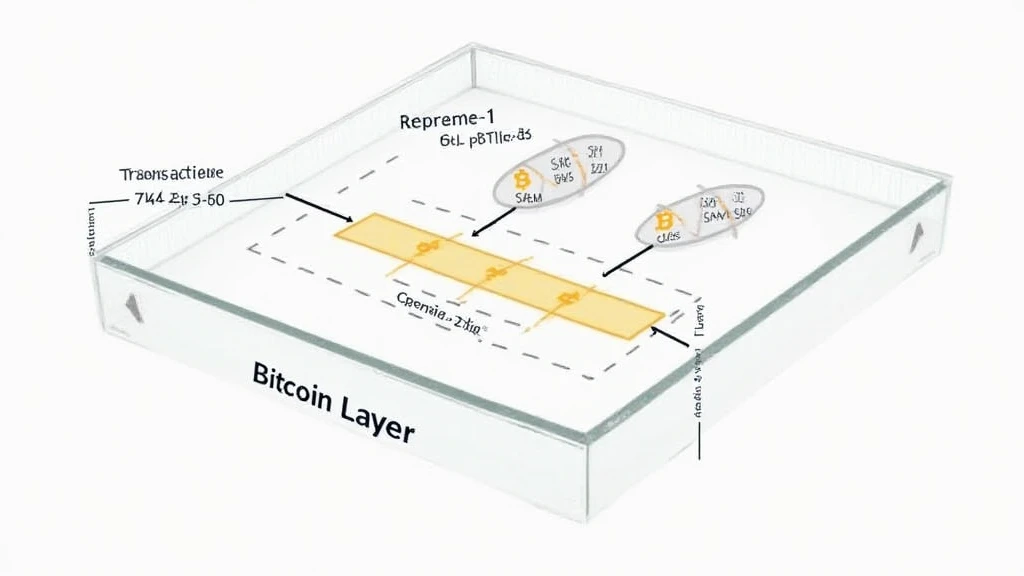

Understanding Bitcoin Layer

Bitcoin Layer refers to a series of proposed upgrades on the existing Bitcoin blockchain that enhance its functionality. Much like adding additional lanes to a highway to relieve traffic congestion, Bitcoin Layer intends to improve transaction speeds and lower costs.

- Layer 1 Solutions: These involve making changes directly to the Bitcoin blockchain to improve its efficiency. Examples include Bitcoin Improvement Proposals (BIPs) aimed at increasing block size or adjusting transaction limits.

- Layer 2 Solutions: Building on top of the existing blockchain, Layer 2 introduces mechanisms such as the Lightning Network, which processes transactions off-chain while ensuring finality on the main chain.

- Interoperability: By enhancing the ability of layer 1 and layer 2 to communicate seamlessly, Bitcoin Layer fosters greater collaboration across different platforms and blockchains.

Benefits of Implementing Bitcoin Layer Solutions

If you’re wondering how Bitcoin Layer can impact user experience and overall transaction efficiency, here are the benefits:

- Faster Transactions: By minimizing on-chain loads via off-chain solutions, users can experience transaction times reduced from over 10 minutes to a matter of seconds.

- Cost-Effectiveness: With lower congestion on the main blockchain, transaction fees are drastically reduced, making microtransactions feasible for everyday use.

- Enhanced Privacy: Layer 2 solutions offer users greater privacy protections by masking transaction details from the public ledger.

Challenges Facing Bitcoin Layer Implementations

While the potential is enormous, Bitcoin Layer isn’t without challenges. Let’s examine some major obstacles:

- Security Risks: Layer 2 solutions can introduce vulnerabilities that may be exploited by malicious actors. These require robust security audits and continuous monitoring.

- User Adoption: For solutions like Lightning Network to thrive, a certain level of user adoption is essential. Education and incentives are crucial in driving this shift.

- Regulatory Concerns: As Bitcoin Layer evolves, regulators are likely to scrutinize these changes, emphasizing the need for compliance with local laws, such as tiêu chuẩn an ninh blockchain in Vietnam.

Use Cases for Bitcoin Layer

Bitcoin Layer‘s versatility opens avenues for various practical applications:

- Micropayments: Utilizing Bitcoin Layer allows for low-cost micropayments in services such as online content access.

- Decentralized Finance (DeFi): Leveraging Bitcoin in DeFi protocols provides opportunities for greater liquidity and reduced fees.

- Gaming and NFTs: Fast-paced gaming applications and NFTs can utilize Bitcoin Layer for seamless transactions and ownership verification.

The Future of Bitcoin Layer

As we gaze into the near future, the integration of Bitcoin Layer into broader blockchain strategies is more than a trend. By 2025, experts project that more than 30% of Bitcoin transactions could be processed via Layer 2 solutions, enhancing both user experience and security measures. According to Chainalysis 2025, the acceleration towards multi-layered architectures could help usher in a new era of cryptocurrency, particularly in fast-growing markets like Vietnam.

Here’s the catch: while Bitcoin Layer holds significant promise, genuine technical understanding and awareness will be vital. As innovations unfurl in real-time, developers and investors need to keep pace with changes and engage in community discussions.

For anyone new to cryptocurrency, remember to conduct thorough research and consult local regulatory bodies before making any financial decisions, as market dynamics can fluctuate rapidly.

In conclusion, Bitcoin Layer represents a paradigm shift in the blockchain landscape, enabling better performance and reducing friction in cryptocurrency transactions. Whether you’re an investor, a developer, or just a cryptocurrency enthusiast, understanding Bitcoin Layer is critical in navigating the digital asset landscape.

Invest in your knowledge and explore how Bitcoin Layer can change the game with platforms like btcmajor.

Author: Dr. Alex Nguyen

A blockchain researcher with over 20 publications and has led audits for notable projects in the cryptocurrency sector.