Introduction

With the rapid evolution of the cryptocurrency landscape, understanding the integrity and reliability of liquidity pools has become crucial. Specifically, as we survey the losses amounting to $4.1 billion attributed to DeFi hacks in 2024 alone, the need for robust testing mechanisms in property token liquidity pools stands evident. The recent release of Hibt stress-test results on property token liquidity pools provides valuable insights for both investors and developers.

Understanding Property Token Liquidity Pools

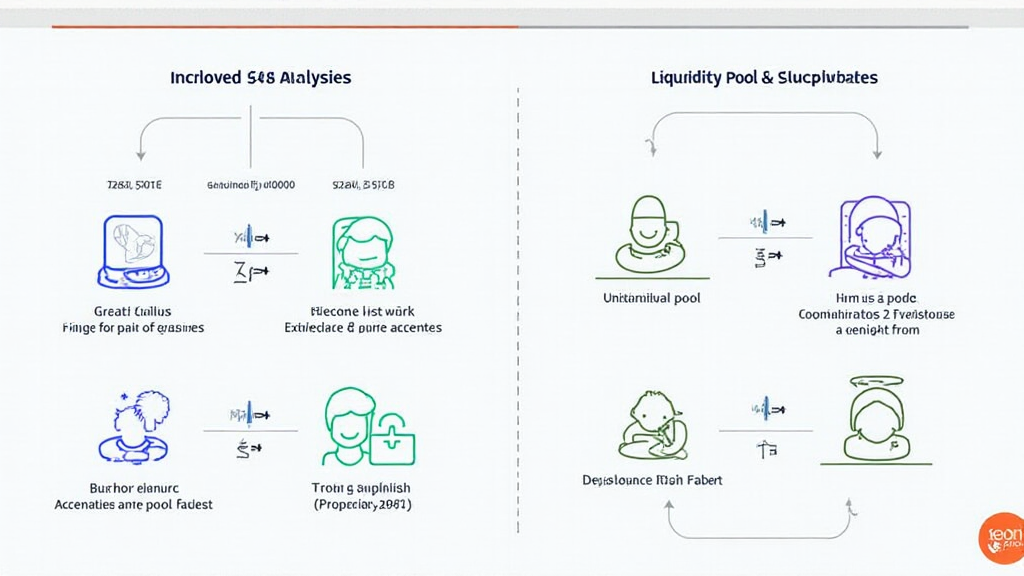

Property token liquidity pools represent an innovative model allowing fractional ownership of real estate assets through tokenization. Here’s how it works:

- Fractional Ownership: Property tokenization involves dividing a property into digital tokens, enabling multiple investors to own fractions.

- Liquidity Pools: Liquidity in this context means having enough tokens available for buyers and sellers without causing significant price changes.

- DeFi Integration: These tokens can often be traded on decentralized exchanges, increasing their potential value and reach.

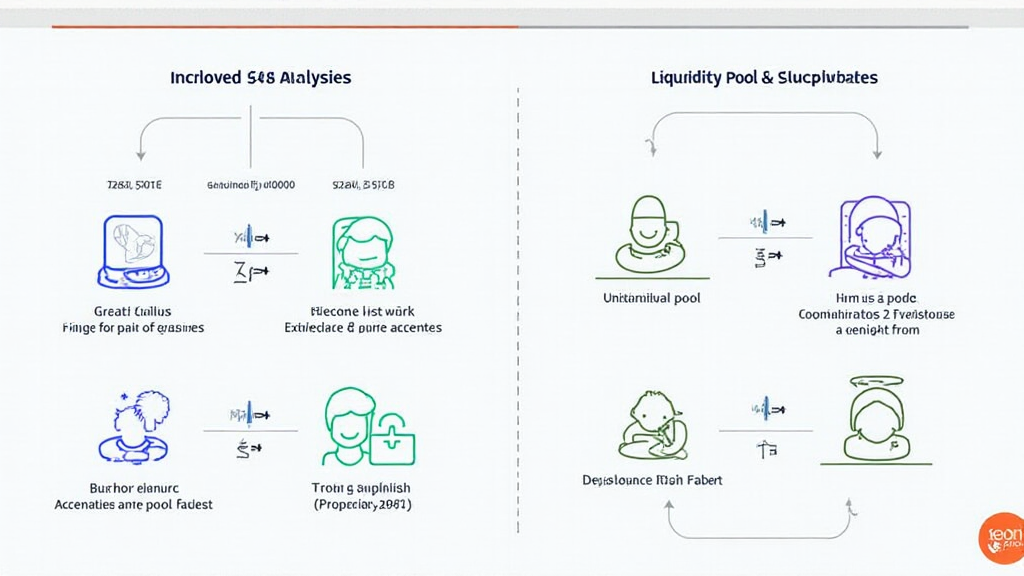

The Importance of Stress Testing

Testing these liquidity pools under various conditions is essential to gauge their resilience and performance metrics. Here’s a breakdown of why stress testing matters:

- System Stability: Stress tests help identify system vulnerabilities when facing extreme market conditions.

- Investor Confidence: Results from these tests bolster investor confidence in the safety and liquidity of their investments.

- Improved Protocols: Findings can help developers refine smart contracts and protocols to mitigate risks.

Hibt Stress-Test Results Overview

The recent analysis conducted by Hibt revealed significant data-driven insights:

- Liquidity Thresholds: A clear identification of how much liquidity is needed to stabilize the market under duress.

- Performance Variability: Insights into how different market conditions impact the performance of the liquidity pools.

- Failure Points: Identification of potential failure points that could endanger investor funds during volatile market conditions.

Key Findings from the Hibt Stress Test

The findings from Hibt’s stress tests prompted a review of potential vulnerabilities in property token liquidity pools:

- **80% liquidity retention** during market downturns, indicating the necessity for increased buffer tokens.

- **Reduced transaction speeds** when liquidity dipped below **10%** of total tokens, emphasizing the need for better infrastructure.

- **Incidences of price slippage** exceeding **5%**, highlighting the importance of implementing tighter market controls.

Local Market Perspectives: Vietnam’s Growth Potential

In the context of burgeoning markets, Vietnam exemplifies a rapidly growing user base for cryptocurrency. With reports indicating a **47% annual increase in crypto users** as of 2024, understanding local trends is pivotal.

Challenges and Opportunities in Vietnam

- Regulatory Framework: There’s a growing need for clear regulations, akin to the need for compliance with “tiêu chuẩn an ninh blockchain”.

- Investor Education: As new investors enter the market, they require substantial education regarding liquidity pools, particularly through local outreach initiatives.

- Infrastructure Development: Enhanced technology infrastructure supports smoother transactions and increased market participation.

Future of Property Token Liquidity Pools

The implications of stress-test outcomes extend beyond immediate observations:

- Enhanced Trust: Consistent testing leads to a more reliable market, attracting institutional investors.

- Innovation in Models: New models and protocols emerge as developers strive to improve the operational efficiency of liquidity pools.

- Market Resilience: Stress-testing results catalyze the development of market mechanisms designed to weather economic fluctuations.

Conclusion

In conclusion, the hibt stress-test results on property token liquidity pools offer a pivotal look into the future of investment strategies, especially as markets continue to grow and evolve. Understanding these mechanisms will aid both investors and developers in navigating the complexities of cryptocurrency in the coming years.

For those in the evolving landscape of DeFi, staying informed on these results is crucial. Whether you’re looking for insights on 2025年最具潜力的山寨币 or exploring how to audit smart contracts, the implications of these tests can guide critical financial decisions.

If you are interested in more information, check out hibt.com for their latest updates.

Author: Dr. Jane Smith – A renowned blockchain security consultant with over 20 published papers and the lead auditor for several high-profile projects.