Introduction

The landscape of cryptocurrency trading continues to evolve, with a remarkable focus on the HiBT derivatives market. In 2024 alone, approximately $4.1 billion was lost due to hacks in decentralized finance (DeFi) platforms, emphasizing the necessity for secure and informed trading practices. This article provides a comprehensive overview of the HiBT derivatives market, highlighting strategies and insights for traders seeking efficiency and security.

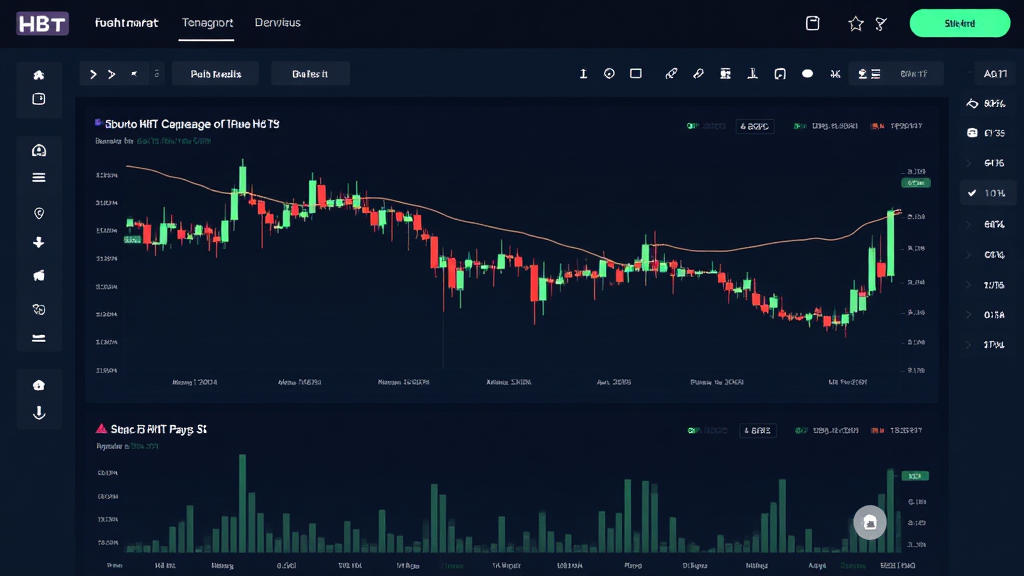

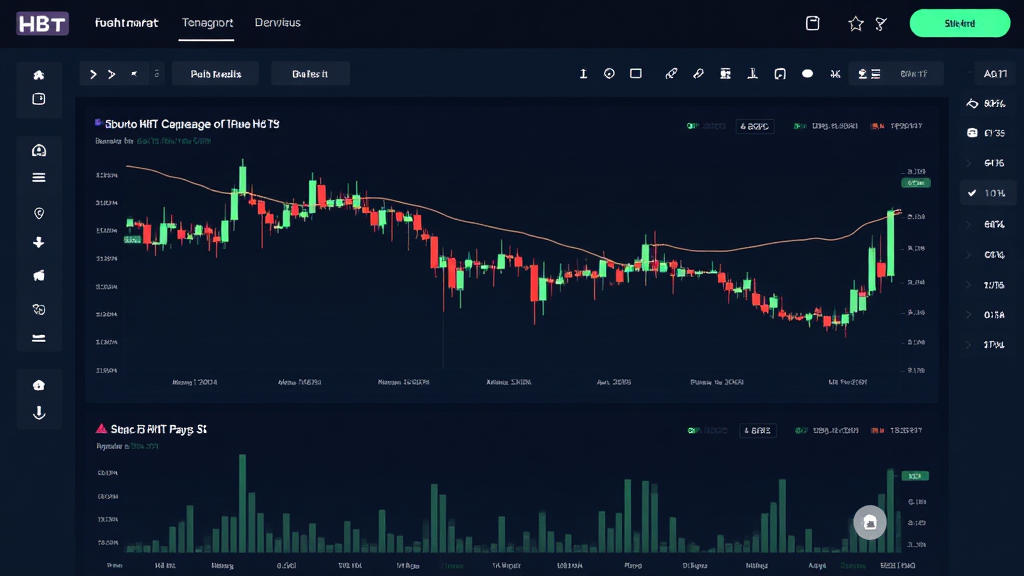

Understanding the HiBT Derivatives Market

The HiBT derivatives market offers a range of products that allow traders to speculate on the future price movements of cryptocurrencies without necessarily owning the underlying assets. But what makes this market stand out?

- Accessibility: HiBT provides access to a variety of derivatives, including futures and options, for both retail investors and institutional players.

- Leverage: Traders can utilize leverage to amplify their positions, which can lead to higher returns—or increased risks.

- Diversity of Instruments: From perpetual contracts to options, the range of tools available allows for advanced trading strategies tailored to specific market conditions.

Market Dynamics

Understanding the mechanics of the HiBT derivatives market is essential. Just like a bank vault that secures physical assets, the HiBT platform employs various technologies to protect traders’ digital assets. The rise of interest in cryptocurrencies has not only increased the trading volume; it also brought about a diverse range of strategies being implemented.

Key Strategies for Trading in the HiBT Market

To navigate the HiBT derivatives market effectively, traders must adopt robust strategies. Here are a few to consider:

1. Risk Management Techniques

Using strict risk management strategies can help protect your assets:

- Stop-Loss Orders: Always set stop-loss orders to limit potential losses.

- Diversification: Spread your investments across different products and cryptocurrencies to mitigate risk.

- Position Sizing: Adjust the size of your trades according to your risk tolerance.

2. Technical Analysis

Traders in the HiBT derivatives market often rely on technical analysis to make informed decisions. Tools such as moving averages, RSI, and Fibonacci retracements can help identify potential entry and exit points.

3. Staying Informed

Regularly following market news and trends is crucial. For instance, keeping track of updates regarding blockchain security standards (tiêu chuẩn an ninh blockchain) can inform trading decisions based on regulatory changes that might impact the market.

Insights on Vietnamese Market Trends

Vietnam has emerged as a notable player in the cryptocurrency space with a significant user growth rate of approximately 15% in the last year. Local investors are increasingly participating in the HiBT derivatives market, seeking innovative ways to leverage their capital.

Furthermore, the rise of mobile trading platforms allows Vietnamese traders to engage in real-time transactions, adapting quickly to market fluctuations.

Leveraging HiBT for Future Investments

The future looks promising for those involved in the HiBT derivatives market. With continuous advancements in technology and growing interest globally, traders must stay ahead of the curve.

- Engage in Education: Invest time in learning about advanced trading strategies and tools.

- Community Engagement: Participate in forums and discussions to share insights and experiences.

- Adopting Technology: Use trading bots or analytical algorithms to enhance trading efficiency.

Conclusion

In conclusion, the HiBT derivatives market presents exciting opportunities for diversifying investments and optimizing trading strategies. However, traders need to approach this market with a clear understanding of its dynamics and a solid strategy in place. As we step into an era of enhanced digital asset protection, consider integrating these insights into your trading plan. Whether you’re a seasoned veteran or new to cryptocurrency, utilizing the HiBT derivatives market can significantly bolster your investment potential.

btcmajor remains committed to providing valuable resources and insights for crypto enthusiasts and traders alike.