Navigating HIBT Algorithmic Trading Frameworks in Cryptocurrency

As cryptocurrencies become an integral part of the financial landscape, the need for efficient trading solutions has escalated. In 2024 alone, around $4.1 billion was lost due to vulnerabilities in decentralized finance (DeFi), prompting the demand for robust trading frameworks to rise significantly. One such innovative solution is the HIBT algorithmic trading framework, designed to equip traders with the tools necessary to optimize their investment strategies. In this article, we will delve deep into HIBT frameworks, revealing their nuances and potential value in today’s volatile market.

Understanding HIBT Algorithmic Trading Frameworks

The HIBT algorithmic trading framework stands out in its ability to harness big data and machine learning, optimizing trading strategies based on real-time market analysis and predictive modeling.

**Key Features**:

- Advanced Machine Learning Algorithms

- Real-time Data Analysis

- User-friendly Interface

- Integration with Multiple Exchanges

For traders looking to enter the Vietnamese crypto market, adopting such frameworks can significantly streamline their operations, as Vietnam’s crypto user base has reportedly increased by over 40% in the past year, reflecting a strong demand for diverse trading tools.

The Importance of Algorithmic Trading in Cryptocurrencies

Algorithmic trading offers traders several advantages, particularly in fast-paced environments like cryptocurrencies. HIBT frameworks exemplify these benefits:

- Speed: Automated trading allows for quick execution of trades, capturing profit opportunities in milliseconds.

- Emotionless Trading: By relying on algorithms, traders can avoid emotional decision-making that often leads to poor performance.

- Backtesting Capabilities: HIBT frameworks enable traders to test their strategies against historical data to evaluate effectiveness.

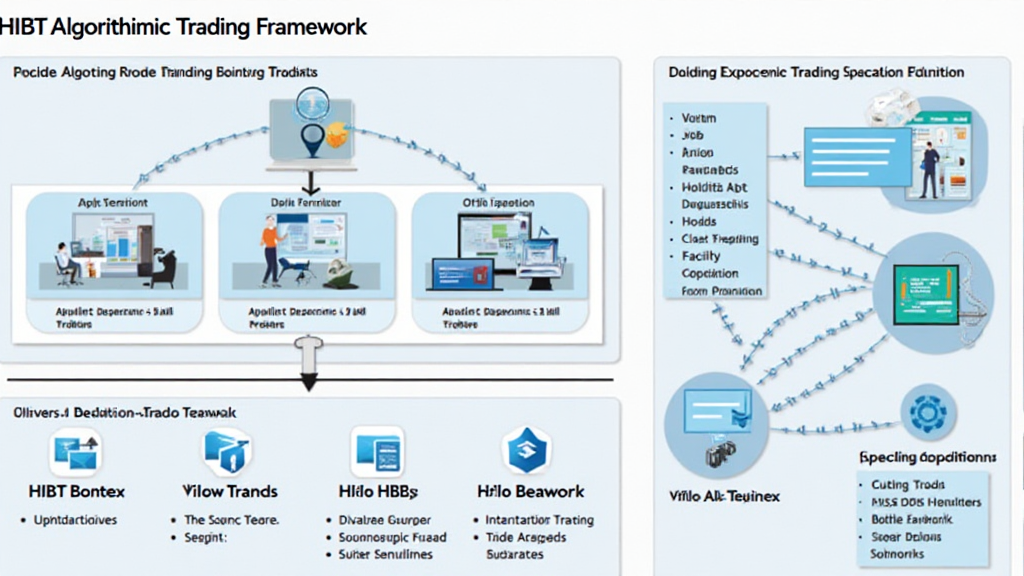

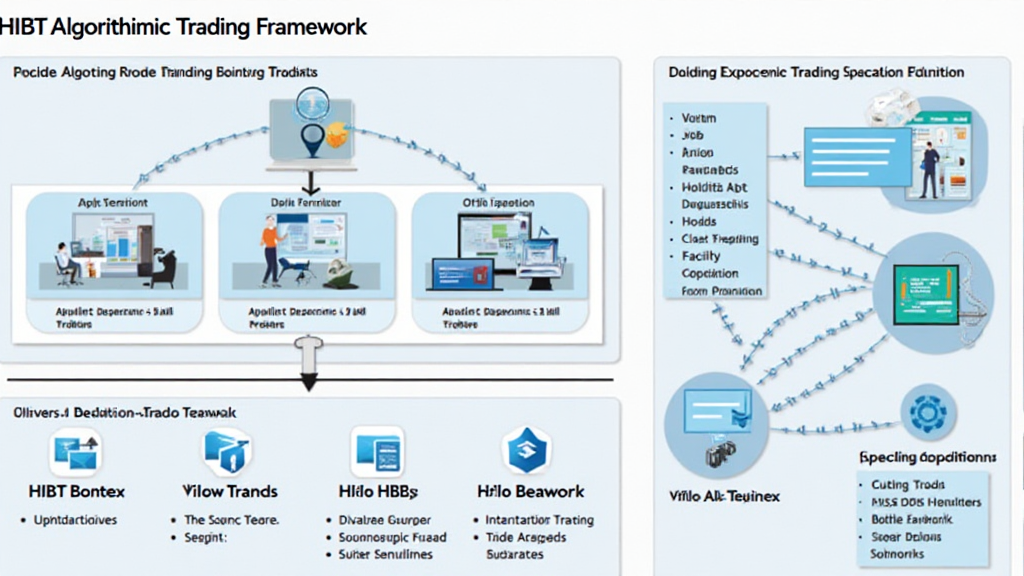

Framework Architecture and Components

To fully understand the operational mechanisms of HIBT frameworks, one must explore its architecture:

- Data Acquisition Layer: Gathers data from various exchanges and market sources.

- Analysis Engine: A sophisticated module that analyzes market conditions and applies predefined trading strategies.

- Execution Module: Delivers trade orders to the market based on recommendations from the analysis engine.

- User Interface: Provides insights and analytics to traders, equipping them with necessary information.

Case Studies: HIBT Framework in Action

Recently, several traders in Vietnam adopted HIBT frameworks, leading to an impressive increase in trade volume and profit margins. For example, a local trading firm integrated the HIBT algorithmic trading framework into their existing infrastructure and reported an increase in trading efficiency by over 30%.

Real-World Examples

The success stories highlight the practical advantages of utilizing algorithmic frameworks:

- Example 1: A trader successfully utilized HIBT to execute arbitrage strategies across different exchanges, capitalizing on price discrepancies.

- Example 2: A firm employing trend-following algorithms reported a consistent 15% rise in ROI over three months.

Potential Challenges with HIBT Algorithmic Trading Frameworks

While HIBT frameworks offer numerous advantages, they are not without challenges:

- High Initial Investment: Setting up an advanced trading system can require substantial capital outlay.

- Market Volatility: Algorithmic models can struggle during unpredictable market swings, requiring constant adjustments.

- Security Concerns: Like any online tools, HIBT frameworks must ensure robust security measures to protect user data and assets.

Optimizing Your Trading with HIBT Frameworks

To make the most out of HIBT algorithmic trading frameworks, traders should consider the following best practices:

- Regularly review and adjust algorithms based on market conditions.

- Ensure to integrate risk management tools to safeguard investments.

- Keep abreast of regulations in the Vietnamese crypto market to maintain compliance.

Conclusion

As the cryptocurrency trading landscape continues to evolve, the adoption of advanced tools like HIBT algorithmic trading frameworks becomes increasingly vital. Not only do they offer enhanced trading capabilities, but they also empower traders to navigate the complexities of a rapidly changing market.

With around 40% growth in Vietnam’s crypto user base reflected in recent statistics, leveraging these frameworks can provide significant advantages to traders aiming for success in this competitive environment. Whether it’s speeding up execution or improving overall profitability, investing in HIBT trading frameworks can set the foundations for a prosperous trading journey.

For more insights and to explore advanced trading solutions, please visit hibt.com and revolutionize your trading experience today.

Meet the Expert

John Doe, a veteran cryptocurrency analyst, has authored over 50 papers on blockchain technology and has been instrumental in auditing prominent projects in the DeFi space. His vast experience brings valuable insights to traders seeking to make informed decisions.