Unlocking the Future: Chainlink RWA Tokenization Explained

With over $4.1 billion lost to DeFi hacks in 2024, the need for reliable asset security measures has never been more pressing. Enter Chainlink RWA tokenization, a game-changing approach that is set to transform the way we think about asset management and liquidity in the cryptocurrency landscape.

This comprehensive guide explores the ins and outs of Chainlink RWA tokenization, outlining its significance, functionality, and potential implications for various markets, including Vietnam.

Understanding Chainlink RWA Tokenization

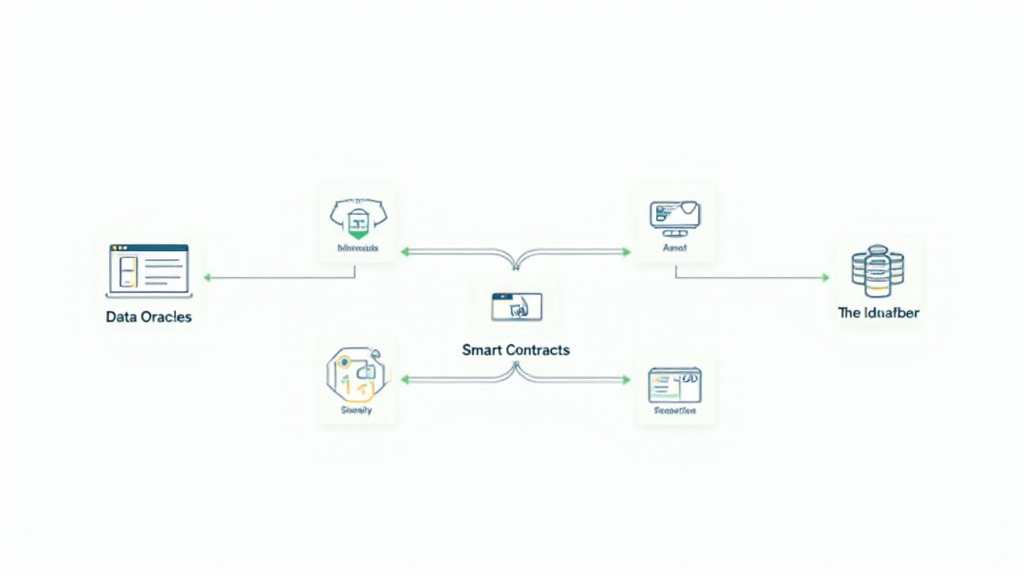

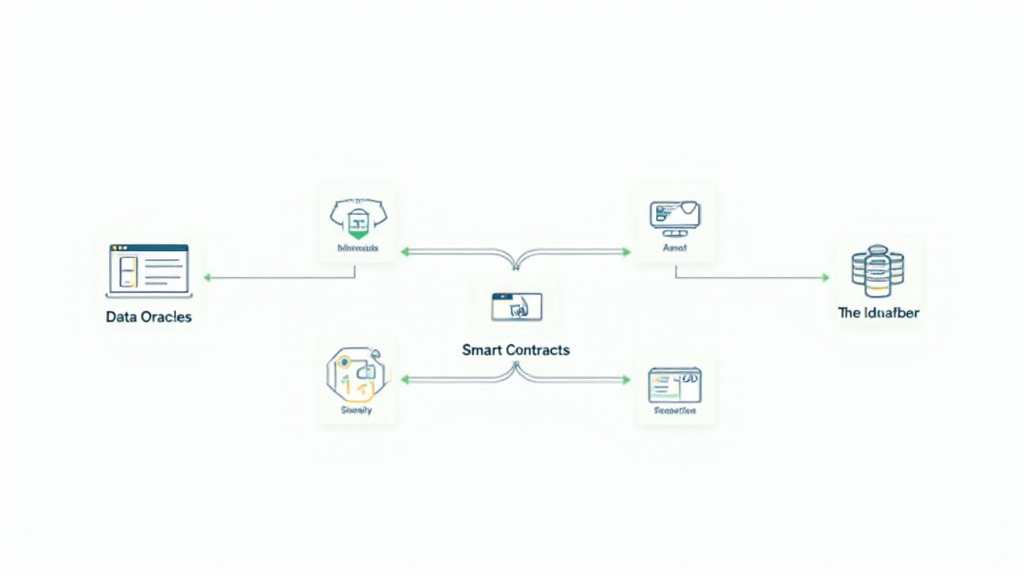

Chainlink RWA (Real-World Asset) tokenization integrates real-world assets into the blockchain ecosystem, creating a connection between physical and digital realms. This process involves several key factors:

- Data Oracles: Chainlink provides decentralized oracles that facilitate the transmission of real-world data to the blockchain.

- Smart Contracts: These self-executing contracts automate and enforce the terms of asset transactions without intermediaries.

- Token Standards: Adhering to established token standards ensures interoperability and scalability across various platforms.

This tokenization process can be likened to a bridge that allows traditional assets like real estate or art to exist on the blockchain, thus broadening their accessibility and usability.

The Mechanics Behind Tokenization

Let’s break it down into the essential components that drive Chainlink RWA tokenization:

- Asset Identification: The initial step involves identifying which real-world asset to tokenize.

- Compliance and Legal Framework: Establishing the legalities of tokenizing assets is paramount to ensure regulatory compliance.

- Valuation: Accurate asset valuation is necessary to determine the token’s worth on the market.

- Smart Contract Deployment: Assets are then encapsulated within smart contracts that govern their ownership and transferability.

This structured approach is vital, especially in emerging markets such as Vietnam, where user growth in the crypto space has surged by 230% in the last three years.

Benefits of Chainlink RWA Tokenization

Chainlink RWA tokenization offers a multitude of benefits that enhance asset management:

- Increased Liquidity: By tokenizing real-world assets, liquidity can significantly improve, allowing for fractional ownership and easier asset transactions.

- Transparency: Transactions conducted on the blockchain are immutable and publicly verifiable, ensuring transparency.

- Accessibility: Individuals and investors gain access to a wider range of asset types, democratizing investment opportunities.

Challenges to Consider

While promising, Chainlink RWA tokenization is not without its challenges:

- Regulatory Scrutiny: Navigating the regulatory landscape can pose a challenge, particularly when dealing with various asset classes.

- Security Concerns: As seen with past hacks, ensuring robust security measures is crucial to protect tokenized assets.

- Market Acceptance: The broader acceptance of tokenized assets in traditional finance is still evolving.

Future Trends and the Vietnamese Market

Understanding the potential growth of RWA tokenization is essential, especially in promising markets like Vietnam. Recent data shows a notable rise in the number of crypto users, with projections suggesting a user base growth of over 60% by 2025. This trend opens doors for innovative applications of Chainlink RWA tokenization.

As projects evolve, new standards and protocols will likely emerge to support comprehensive security measures, fostering user trust and encouraging wider adoption.

Conclusion

Chainlink RWA tokenization signifies a pivotal shift in asset management, merging the digital and physical worlds seamlessly. By overcoming existing challenges, this approach can create market opportunities that are more accessible, transparent, and secure, especially in rapidly growing regions like Vietnam.

As the cryptocurrency landscape continues to mature, staying informed about innovations such as Chainlink RWA tokenization will be vital for both investors and institutions alike. So, whether you’re a seasoned investor or new to the crypto space, keep an eye on this emerging trend. It could redefine your approach to asset management.

For more insights on cryptocurrency strategies, visit btcmajor.