Centralized Finance (CeFi) vs DeFi Comparison: Which is Right for You?

In 2024, the crypto industry witnessed a significant uptick in interest, with global investments reaching over $100 billion. But what does this mean for Centralized Finance (CeFi) and Decentralized Finance (DeFi)? With $4.1 billion lost to DeFi hacks last year and growing skepticism about centralized platforms, the debate is more relevant than ever.

This article aims to provide a detailed comparison of CeFi and DeFi, exploring their strengths, weaknesses, and practical implications for users. Whether you’re a seasoned investor or new to the crypto space, understanding the differences can guide you toward making informed choices.

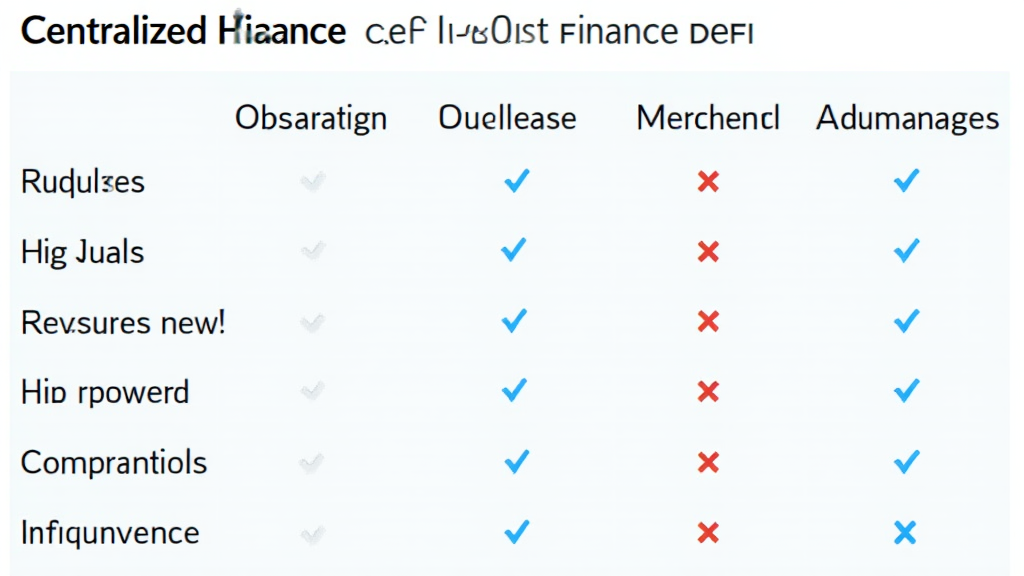

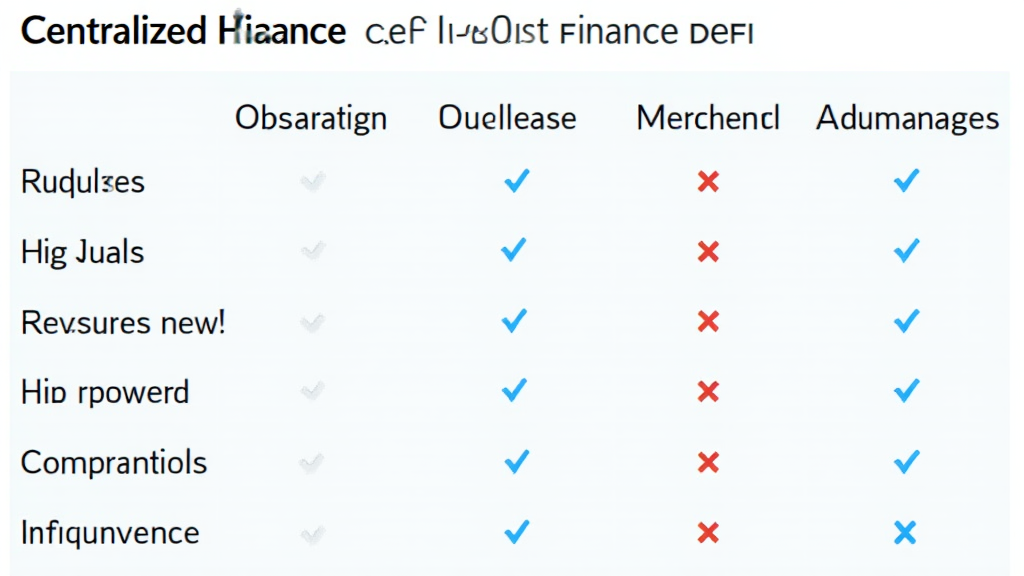

Understanding CeFi and DeFi

Centralized Finance, or CeFi, refers to financial services that are operated and managed by centralized institutions. Meanwhile, Decentralized Finance, or DeFi, represents a financial ecosystem built on blockchain technology that operates without intermediaries.

- CeFi: Operated by central authorities like banks and exchanges. Trusted entities hold users’ funds.

- DeFi: Operates on smart contracts, enforcing agreements without needing a central authority, which gives users complete control over their assets.

Trust and Control: The Core Differences

Trust is a pivotal element in finance. In CeFi, users must trust the institution handling their funds. Conversely, DeFi allows users to maintain control through smart contracts—self-executing contracts with the terms of the agreement directly written into lines of code.

For instance, in CeFi, when a user deposits their funds into a centralized exchange, they are trusting that the exchange will not mismanage the funds. While regulations exist, they aren’t foolproof. In 2023, hibt.com reported that nearly 30% of users had experienced losses due to exchange hacks.

In DeFi, a user can directly interact with protocols like Uniswap or Aave without a middleman. This direct engagement eliminates trust-based risks but introduces challenges like smart contract vulnerabilities.

Scalability and Performance: Which Offers More?

Scalability is crucial for any financial system. CeFi platforms can process thousands of transactions per second due to the centralized nature of their operations. They rely on their servers, allowing for swift transactions.

On the other hand, DeFi platforms, typically built on Ethereum, face scalability challenges. During peak times, network congestion can lead to delayed transactions and increased fees. For instance, during the NFT craze of 2023, Ethereum gas prices surged, making transactions costly.

Centralized Exchanges (CEX) vs. Decentralized Exchanges (DEX)

- CEX: Faster, more user-friendly, ideal for beginners. Examples include Binance and Coinbase.

- DEX: Allows for peer-to-peer trading without a middleman, but often more complex. Popular DEXs include Uniswap and SushiSwap.

Regulation: The Battle of Compliance

Regulation remains a hot topic in the crypto space. CeFi platforms operate under existing financial regulations, which can instill confidence in users but may also limit the flexibility of services offered. For example, in Vietnam, the government is actively exploring regulations related to cryptocurrency, influencing how exchanges operate.

In contrast, DeFi operates in a largely unregulated environment. This lack of oversight presents opportunities but poses risks as well. With the rise of rug pulls and hacks in the DeFi space, users are advised to conduct thorough due diligence. In Vietnam, 52% of crypto users have experienced at least one scam in DeFi.

Security: Navigating Risks

CeFi platforms often employ robust security measures, yet they are not immune to breaches. The theft of billions in user funds from exchanges highlights the inherent risks.

In DeFi, security hinges on the integrity of the smart contracts. However, with a staggering $4.1 billion lost to hacks in 2024 alone, it’s evident that vulnerabilities exist. Tools like Ledger Nano X can mitigate these risks by letting users store their assets offline, reducing the chances of hacks.

A Breakdown of DeFi Hacks (2024)

| Protocol | Loss (in $ billion) | Type of Attack |

|---|---|---|

| Compound | 1.2 | Smart Contract Vulnerability |

| Aave | 0.9 | Flash Loan Attack |

| PancakeSwap | 0.8 | Rug Pull |

Data source: hibt.com

Fees and Costs: What You Need to Know

CeFi often involves trading fees and withdrawal fees, which, while usually affordable, can add up over time. However, they offer substantial liquidity, allowing for quicker trades.

With DeFi, fees arise from transactions on the blockchain. When network congestion hits, these fees can skyrocket, making smaller transactions impractical. In Vietnam, many users report that DeFi fees during peak times impede their trading.

The Global Perspective: CeFi and DeFi Trends

As of 2024, the global market for cryptocurrency in Vietnam has grown significantly. Approximately 75% of the population is aware of crypto assets, with many actively participating in DeFi protocols. The demand for financial inclusivity drives growth, particularly in regions with limited access to traditional banking.

According to Chainalysis 2025 report, the global DeFi market is expected to reach $20 billion by the end of this year. Vietnam’s growing user base indicates rising interest in decentralized solutions.

Conclusion: Navigating Your Financial Journey

When weighing Centralized Finance against Decentralized Finance, consider your priorities. CeFi provides ease of use and regulatory trust but exposes users to certain risks inherent in centralized systems. On the other hand, while DeFi champions independence and transparency, it poses unique risks that require understanding and vigilance.

In 2025, as the landscape of crypto evolves, it’s essential to stay informed. Whether engaging with CeFi or DeFi, prioritize secure practices, and consider consulting with local regulators for compliance. Remember, informed choices lead to fruitful investments!

For more information and insights on the evolving crypto landscape, visit btcmajor.

Author: Dr. Alex Tran, a blockchain technologist and finance expert with over 15 published papers in decentralized finance and advisor to several blockchain projects.