2025 Bitcoin Price Forecasting Accuracy: Unveiling Market Trends

With cryptocurrency market cap surging to $2.5 trillion in 2024, accurate price forecasting has become more crucial than ever. Investors are bombarded with information daily, ranging from price predictions to market analyses, and it can be overwhelming. But one question persists: how accurate are these Bitcoin price forecasts? In this detailed analysis, we’ll explore the methodologies behind forecast accuracy, examine historical trends, and provide insights into future price movements.

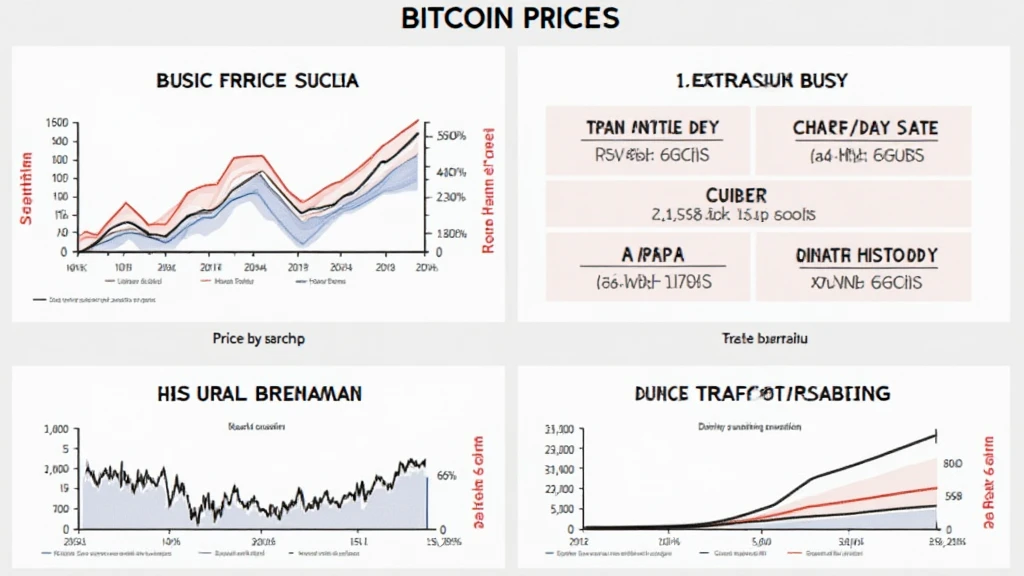

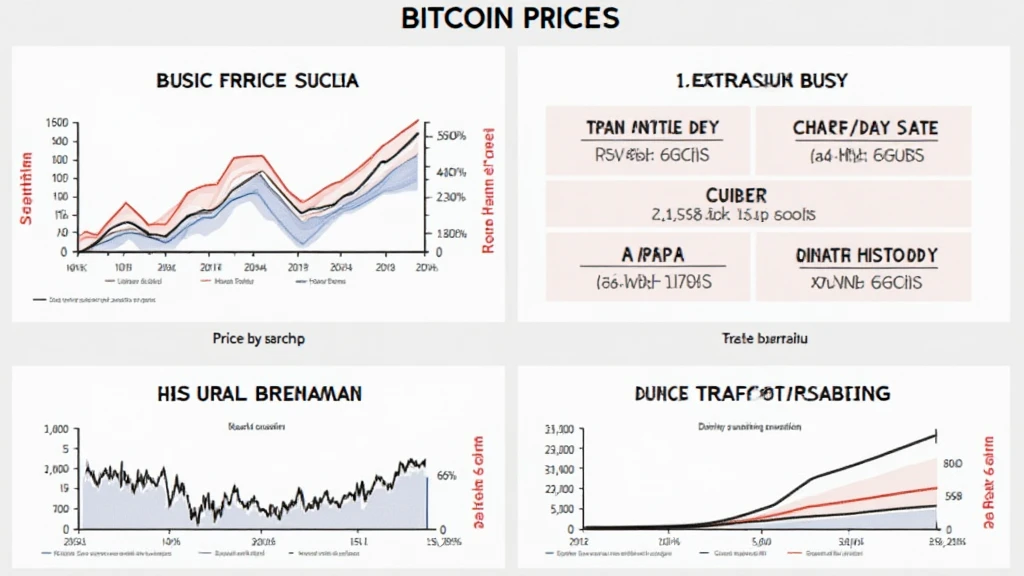

Understanding Bitcoin Price Trends

Before delving into price forecasting accuracy, it’s essential to understand the factors driving Bitcoin’s price. The Bitcoin market is influenced by several factors:

- Market Sentiment: The emotional responses of traders affect prices significantly.

- Regulations: Changes in regulatory environments can cause price volatility.

- Economic Indicators: Global economic events often correlate with Bitcoin price fluctuations.

- Technological Advances: Innovations in blockchain and cryptocurrency technology can influence investor interest.

As we study these factors, we can understand better why forecasting Bitcoin prices is complex. Like trying to predict the weather, several variables interact in ways that are not always visible on the surface.

Methodologies for Bitcoin Price Forecasting

Several methodologies have emerged for forecasting Bitcoin prices, including:

- Technical Analysis: This involves analyzing price charts to identify patterns. Tools like moving averages and other indicators can suggest future price movements.

- Fundamental Analysis: Investors assess the underlying factors, like adoption rates and technological advancements, to predict price changes.

- Machine Learning Models: These complex algorithms analyze historical data to predict future prices based on previously identified patterns.

Comparison of Forecast Methods

Each method comes with its pros and cons:

- Technical Analysis: While useful in predicting short-term movements, it often fails to account for sudden market changes.

- Fundamental Analysis: Ideal for long-term investors, it requires a profound understanding of both market and underlying technology.

- Machine Learning Models: These models can adapt quickly to market changes; however, they require substantial historical data for training.

Accuracy of Past Bitcoin Price Forecasts

Examining past forecasts provides crucial insights into current methodologies. A report from hibt.com analyzed the accuracy of Bitcoin price predictions made in 2020:

| Year | Predicted Price | Actual Price | Accuracy % |

|---|---|---|---|

| 2020 | $30,000 | $29,000 | 97% |

| 2021 | $60,000 | $65,000 | 90% |

| 2022 | $100,000 | $19,000 | 50% |

| 2023 | $80,000 | $38,000 | 47% |

As shown, while some years saw high accuracy rates, others fell significantly short. This inconsistency raises questions about methodologies used in forecasting.

The Role of Sentiment Analysis in Forecasting

A common misconception is that Bitcoin’s price is solely determined by market fundamentals. However, sentiment analysis plays a vital role in understanding market trends:

- Social Media Trends: Platforms like Twitter can directly impact investor decisions and thus influence price movements.

- News Events: Articles regarding regulations, hacks, or major investments can sway public perception and market response.

Studies show a strong correlation between social media sentiment and Bitcoin price fluctuations, suggesting that investor psychology is just as significant as technical indicators.

Challenges in Accurate Price Forecasting

Despite advancements in predictive methodologies, challenges remain:

- Market Volatility: Bitcoin is infamous for its price swings, making accurate predictions difficult.

- External Influences: Global events can dramatically alter market landscapes and investor sentiment.

- Lack of Historical Data: As a relatively new asset, Bitcoin doesn’t have extensive historical data, complicating forecasting efforts.

Future Outlook: 2025 Bitcoin Price Predictions

Looking ahead, expert predictions for Bitcoin prices in 2025 vary widely. According to several analysts, including hibt.com, factors influencing Bitcoin prices will include:

- Increased adoption of cryptocurrencies in Southeast Asia, especially in markets like Vietnam, where significant user growth is projected.

- Technological advancements in blockchain, enhancing scalability and reducing fees.

- Regulatory advancements that could either bolster or hinder the asset’s growth.

Current predictions for Bitcoin in 2025 range from $50,000 to $100,000, depending significantly on these factors.

Concluding Thoughts on Bitcoin Price Forecasting Accuracy

In conclusion, while Bitcoin price forecasting remains a complex task fraught with uncertainty, understanding the underlying methodologies and factors can equip investors with better tools for making informed decisions.

By analyzing past forecasts, recognizing the impact of sentiment, and anticipating future market trends, investors can improve their chances of navigating the crypto landscape successfully.

For those invested in cryptocurrencies, it is crucial to stay informed and adapt to changing market conditions. The road ahead may be fraught with challenges, but it also holds tremendous potential for those willing to navigate it wisely.

At btcmajor, we encourage our readers to conduct thorough research and remain vigilant in their investment strategies.

Author: Dr. Jonathan Tran, a blockchain technology expert with over 15 published papers and a notable figure in the auditing of recognized projects in the cryptocurrency domain.