Introduction to Bitcoin Market Cycles

As the cryptocurrency landscape continues to evolve, understanding the Bitcoin market cycle prediction becomes increasingly important for investors. In 2024 alone, $4.1 billion was lost to DeFi hacks, reinforcing the need for sound investment strategies. This article aims to provide comprehensive analysis and insights into the cyclical nature of Bitcoin markets, particularly as we look toward 2025.

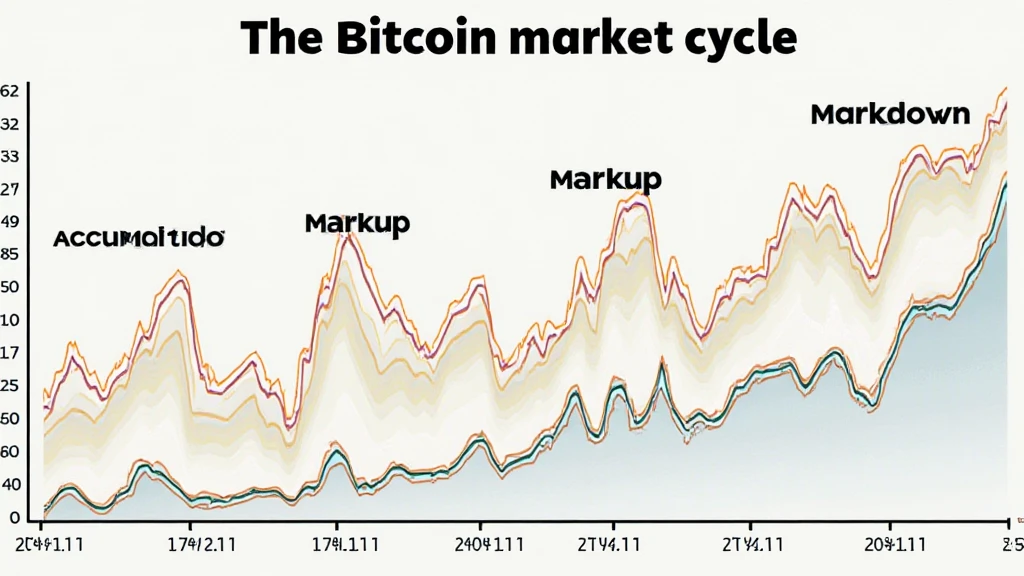

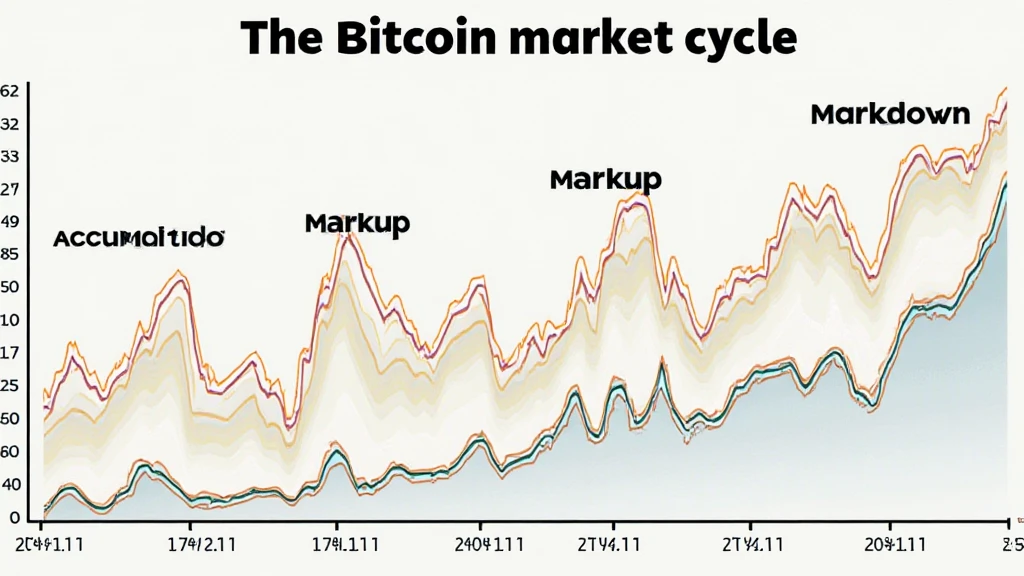

The Nature of Bitcoin Market Cycles

Like the tides of the ocean, Bitcoin experiences cycles of ups and downs. These cycles are influenced by market sentiment, investor activity, technological advances, and macroeconomic factors. Each cycle can be broadly categorized into four phases:

- Accumulation Phase: This phase occurs after a significant price drop, where smart investors begin to buy in.

- Markup Phase: Here, positive sentiment takes hold, leading to a rapid price increase as retail investors join the market.

- Distribution Phase: In this phase, early investors start to sell off their assets, leading to price stagnation.

- Markdown Phase: Prices begin to decline as negative sentiment takes over, often linked to external factors.

According to data from Chainalysis in 2025, these cycles have shown to repeat approximately every four years, correlating with Bitcoin’s halving events.

Factors Influencing Bitcoin Cycles

Several factors play critical roles in shaping the Bitcoin market cycles:

- Market Sentiment: Investor psychology drives speculation. Bullish sentiment can lead to drastic price jumps.

- Regulatory Changes: As governments across the globe adapt their legislation regarding cryptocurrencies, investor confidence may be affected.

- Technological Advancements: New advancements in blockchain technology can either boost Bitcoin’s usage or hinder it.

- Global Economic Trends: Economic factors such as inflation rates and monetary policy also significantly impact Bitcoin cycles.

The Vietnam Market and Bitcoin Predictions

As cryptocurrency adoption increases globally, Vietnam presents a unique landscape. With over 50% of the population familiar with digital currencies, the growth rate in Vietnamese users has surged by 30% from 2022 to 2023. This interest opens doors for Bitcoin investments in the region.

Key Insight: The demand among Vietnamese investors could lead to accelerated Bitcoin market cycles, given the country’s young and tech-savvy population.

Understanding Local Trends

Market research indicates that 2025 may witness a surge in altcoin popularity in Vietnam. Specifically, investors are looking toward:

- Stablecoins: Providing a safer harbor in volatile conditions.

- DeFi projects: Offering decentralized financial services to underbanked populations.

- NFTs: Tapping into the creative economy.

Long-Term Investment Strategies with Bitcoin

For those looking at Bitcoin long-term and considering the Bitcoin market cycle prediction, here are some practical strategies:

- Dollar-cost Averaging: Invest a fixed amount regularly, which can reduce the impact of volatility.

- Portfolio Diversification: Combine Bitcoin with other assets to spread risk.

- Keep Up with Market News: Stay informed on regulatory changes and technological advancements affecting Bitcoin.

Conclusion: The Future of Bitcoin in 2025

As we look toward 2025, the prediction for Bitcoin remains optimistic, contingent upon various influencing factors. Smart investors need to be aware of market cycles and the external factors that could affect their investments. Despite the volatile nature of cryptocurrency, informed strategies can lead to significant returns.

In summary, understanding Bitcoin market cycle prediction can empower investors to navigate the complex and fluctuating world of cryptocurrencies successfully. As always, it’s essential to do thorough research and consult local financial advisors for personalized investment advice.

For more information on cryptocurrency investments and trends, visit hibt.com. Not financial advice. Consult local regulators before investing.