Bitcoin Halving Technical Analysis: Navigating the Market Shifts

With approximately 1.2 million Bitcoin that are already in circulation and rapid technological innovations influencing market trends, many cryptocurrency enthusiasts are eagerly awaiting the next Bitcoin halving expected in 2024. Halving events have crucial implications for the Bitcoin price and broader cryptocurrency market. Understanding how to analyze these technical patterns can empower traders and investors to make informed decisions. This article serves as a comprehensive analysis to guide you through Bitcoin halving technical analysis.

What is Bitcoin Halving?

Bitcoin halving is an event that occurs approximately every four years, specifically every 210,000 blocks mined. This event cuts the reward for mining Bitcoin in half. Initially, miners received 50 BTC for each block mined in 2009; this reward halved to 25 BTC in 2012, 12.5 BTC in 2016, and 6.25 BTC in the latest halving event that occurred in May 2020.

Investors often view Bitcoin halving as a bullish signal due to the asset’s supply-side dynamics. With decreased rewards, miners need to sell less Bitcoin to cover operational costs. As demand often remains consistent or increases, this can lead to upward price pressure.

Understanding the Technical Analysis of Bitcoin Halving

Technical analysis involves using price charts and market data to predict future price movements. Here’s a breakdown of how to analyze Bitcoin’s price trends following each halving event:

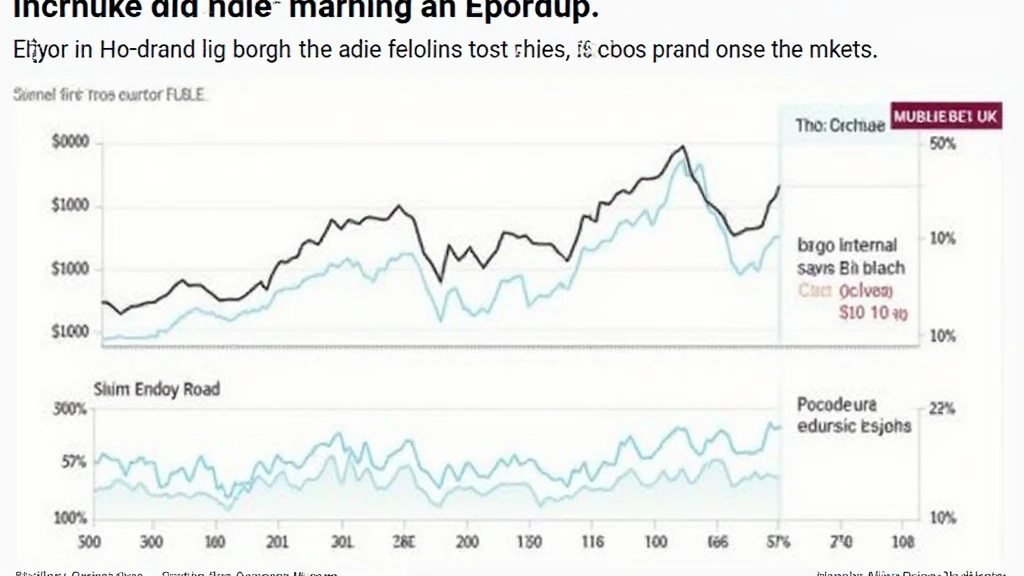

Historical Performance After Each Halving

Let’s dive into the historical price performance following past Bitcoin halving events.

- 2012 Halving: In November 2012, Bitcoin’s price was around $12. It surged to over $1,100 in late 2013.

- 2016 Halving: Near $650 before the event, Bitcoin reached nearly $20,000 by December 2017.

- 2020 Halving: Seeing a price around $8,500, Bitcoin’s peak hit around $64,000 in April 2021.

This historical context indicates a potential pattern of price increases post-halving, leading to surges driven by demand combined with diminishing supply.

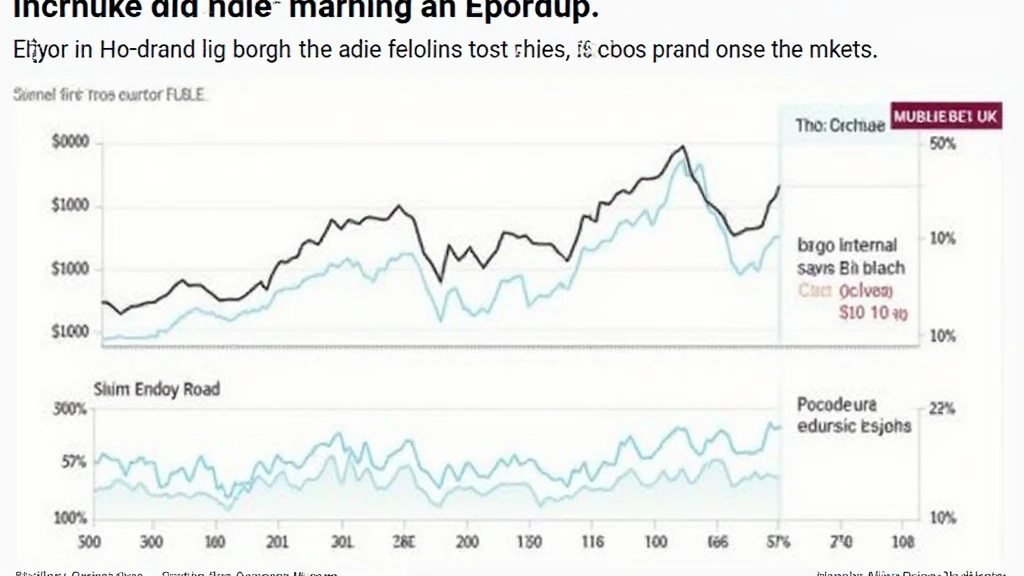

Key Support and Resistance Levels

Identifying support and resistance levels can be key in technical analysis as Bitcoin approaches its halving. Support levels are price points where buying interest tends to emerge, while resistance levels are where selling interest often peaks.

For instance, prior to the recent halving, Bitcoin maintained strong support around $30,000. Observing such levels helps traders set entry and exit points around halving dates.

Market Sentiment and Indicators

Market sentiment during halving events can be gauged using various tools:

- Fear and Greed Index: This index quantifies market sentiment on a scale from fear to greed, helping gauge whether Bitcoin is undervalued or overvalued.

- Volume Analysis: Monitoring trade volume helps determine market enthusiasm; increased volume often signals strong interest.

Awareness of these factors creates a more complete picture when anticipating price movements during upcoming halving events.

Bitcoin Halving and Vietnamese Market Dynamics

Vietnam is witnessing robust growth in the cryptocurrency sector, with a user growth rate surpassing 20% annually. As the Vietnamese market engages with Bitcoin and other cryptocurrencies, understanding how Bitcoin halving impacts this local landscape becomes essential.

Investors in Vietnam can leverage Bitcoin halving technical analysis to adapt strategies better suited to market conditions. The Vietnamese government also recognizes cryptocurrencies, ensuring compliance while focusing on security and transparency.

Prospective Impact on Altcoins

After each Bitcoin halving event, many altcoins often follow suit, exhibiting significant price movements and volatility. Here’s what to look for in the aftermath:

- Increased Altcoin Activity: Investors tend to diversify their holdings, exploring high-potential altcoins after Bitcoin rallies.

- Correlation Effects: Understanding how Bitcoin price movements affect the broader cryptocurrency market will help in making sound investment choices. For example, during the last halving, altcoins like Ethereum saw a noticeable uptick in their price performances.

In light of high-growth altcoins expected post-halving, consider researching options like 2025’s most promising altcoins to capitalize on trending growth sectors.

Conclusion

In summary, comprehending Bitcoin halving technical analysis is essential for anyone participating in the cryptocurrency market. The intertwining of diminished supply, market sentiment, and historic trends provides insight into Bitcoin’s potential price trajectory post-halving events. Incorporating local insights, particularly in emerging markets like Vietnam, further enhances the analytical approach. As we navigate through the nuances of Bitcoin halving, staying informed and reactive can equip every investor with the tools needed for success in a rapidly evolving landscape.

Stay tuned to btcmajor for continuous updates on cryptocurrency events, including the upcoming Bitcoin halving and its implications.