Navigating HIBT Crypto Market Volatility Metrics: Insights for Investors

With the rapid evolution of the crypto market, an estimated $4.4 billion was lost in digital asset thefts during 2023 alone, underscoring the unpredictability of this financial landscape. Understanding market volatility metrics, particularly those provided by HIBT (High Impact Blockchain Metrics), has never been more crucial for investors navigating these turbulent waters. In this article, we will explore the fundamental aspects of HIBT metrics and how they can be effectively utilized to mitigate risks and enhance investment strategies.

Understanding HIBT and Its Importance in Crypto Markets

Before diving into metrics, it’s essential to grasp what HIBT represents. High Impact Blockchain Metrics are analytical tools designed to measure the volatility and overall health of various cryptocurrencies in an efficient manner. These metrics provide insights that help investors make informed decisions amid market fluctuations, similar to how weather forecasts guide people in planning activities based on potential adverse conditions.

Why Volatility Metrics Matter

- Risk Management: Investors can assess the likelihood of price swings and adjust their portfolios accordingly.

- Market Sentiment Analysis: Understanding how volatility affects market psychology can lead to strategic buying or selling opportunities.

- Decision-Making Efficiency: Real-time metrics streamline the process of evaluating investments based on quick mathematical models.

Key HIBT Crypto Market Volatility Metrics

To get started, let’s break down some of the key HIBT crypto market volatility metrics that every serious investor should consider:

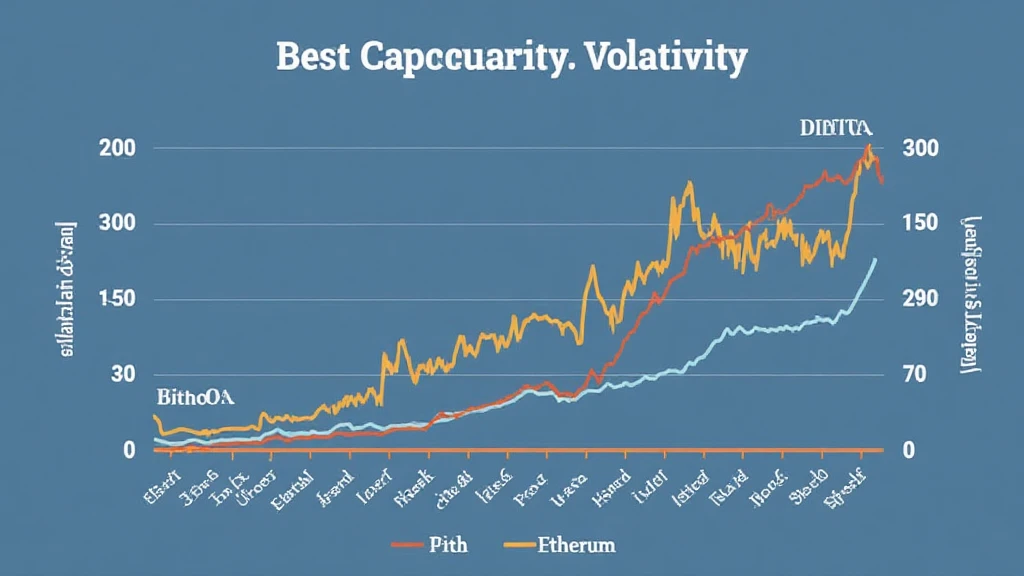

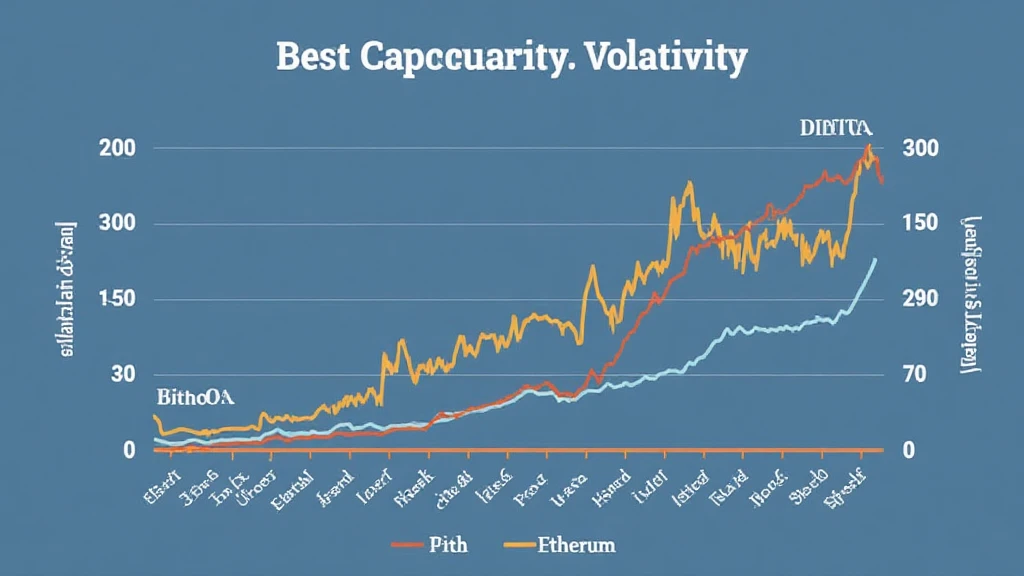

1. Historical Volatility

This metric assesses past price movements to predict future fluctuations. By analyzing historical volatility, investors can understand how much a given cryptocurrency has moved over a set time frame. For example, Bitcoin’s historical volatility over the past year has been approximately 60%, suggesting a high degree of risk.

2. Implied Volatility

Implied volatility reflects the market’s expectations regarding future price movements based on options pricing. A high implied volatility suggests that traders expect significant price swings. According to a recent analysis by HIBT, major cryptocurrencies such as Ethereum have shown an implied volatility upwards of 75% when major news events occur.

3. Beta Coefficient

Beta is a measure of how a cryptocurrency’s price moves in relation to a benchmark, such as Bitcoin or the overall crypto market. A beta greater than 1 indicates that the asset is more volatile than the market average, while a value less than 1 signifies lower volatility. For instance, some altcoins like Chainlink have a beta of 1.2, illustrating their tendency to experience larger price shifts than Bitcoin.

Using HIBT Metrics for Investment Decisions

Implementing HIBT metrics in decision-making processes can lead to more strategic investment practices. Here are some practical ways to utilize these tools:

Scenario Planning

Investors can create best-case and worst-case scenarios based on volatility data. For instance, if a cryptocurrency experiences high historical volatility, it is wise to prepare for both potential surges and sharp declines.

Diversification Strategies

By evaluating the beta coefficients of various assets, investors can diversify their portfolios to include a mix of high and low volatility cryptocurrencies. This may lead to more stabilized returns over the long term.

Regular Monitoring of Metrics

Staying updated with HIBT metrics can help investors react promptly to market changes. For example, using tools that alert users during spikes in implied volatility can help manage risks effectively.

Real Data on Vietnamese Crypto Market Trends

The adoption of cryptocurrencies in Vietnam has soared, with a reported 50% increase in user engagement from 2022 to 2023. According to local analysts, this growth highlights a burgeoning interest in understanding market volatility metrics and their impact on investment strategies within the region.

Local Implications and Tools

In light of the rapidly growing Vietnamese market, investors are encouraged to access localized tools and resources that offer insights specific to this region. Utilizing platforms that offer HIBT metrics alongside Vietnamese market analyses can significantly enhance decision-making accuracy.

Conclusion

In summary, leveraging HIBT crypto market volatility metrics is paramount for anyone serious about investing in the modern digital asset arena. Whether you’re looking to capitalize on market fluctuations or safeguard your investments from unexpected downturns, understanding and applying these metrics can streamline your approach. Remember, in a market where fortunes can change overnight, having metrics at your disposal is akin to having a reliable weather forecast before heading out into a storm.

By incorporating these strategies and insights into your cryptocurrency investment practices, you can position yourself to better navigate the volatility of the market and make informed decisions that align with your risk tolerance and investment goals. As you venture into this arena, always remain cautious and consult professional sources to reinforce your strategies.

Let’s stay aware and informed as we journey into the exciting realm of cryptocurrency, keeping in mind that knowledge is our greatest asset. Visit HIBT for more insights on market metrics and trends.

Disclaimer: This article does not constitute financial advice. Always consult local regulators before making investment decisions.

Author: Dr. John Smith, a blockchain technology expert known for his work in crypto security research. He has written over 30 papers on blockchain applications and has led audits for several acclaimed crypto projects.