Understanding HIBT Vietnam Crypto Futures Liquidation Thresholds

With the increasing adoption of crypto in Vietnam, particularly in futures trading, understanding the liquidation thresholds within the HIBT trading platform becomes crucial. In 2023 alone, crypto trading volumes in Vietnam surged by over 50%, indicating a growing interest among traders. This article delves into the intricate details of liquidation thresholds, offering insights into their significance for both new and experienced traders.

What is Liquidation in Crypto Trading?

Liquidation refers to the process of closing out a trader’s position by the exchange when it falls below a certain threshold, often defined by margin requirements. For instance, if a trader borrows funds to trade more than their initial capital, the exchange requires a certain level of equity to maintain the position. Should the equity fall below this level, the position is at risk of liquidation.

Why Liquidation Thresholds Matter

- Risk Management: Liquidation thresholds help traders understand their risk levels and manage their investments accordingly.

- Market Stability: By enforcing liquidation thresholds, exchanges can maintain market stability, reducing the chances of massive market fluctuations.

- Strategic Entry and Exit: Knowledge of these thresholds allows traders to plan their entry and exit strategies effectively.

Navigating HIBT’s Liquidation Thresholds

The HIBT platform in Vietnam defines specific thresholds that traders need to monitor closely. Understanding these parameters is essential for effective trading. The following are key aspects to consider:

1. Margin Requirements

Each trader must maintain a minimum margin level while trading futures. HIBT sets these requirements based on market volatility and user trading behavior.

2. Leverage Impact

Higher leverage increases potential profits but also magnifies losses. Traders using HIBT should be aware of how much leverage they are taking on and how it affects their liquidation threshold.

3. Volatility and Market Trends

Vietnamese crypto markets are known for their volatility. A sudden price dip can trigger liquidations across the board, making it imperative for traders to stay informed on market trends.

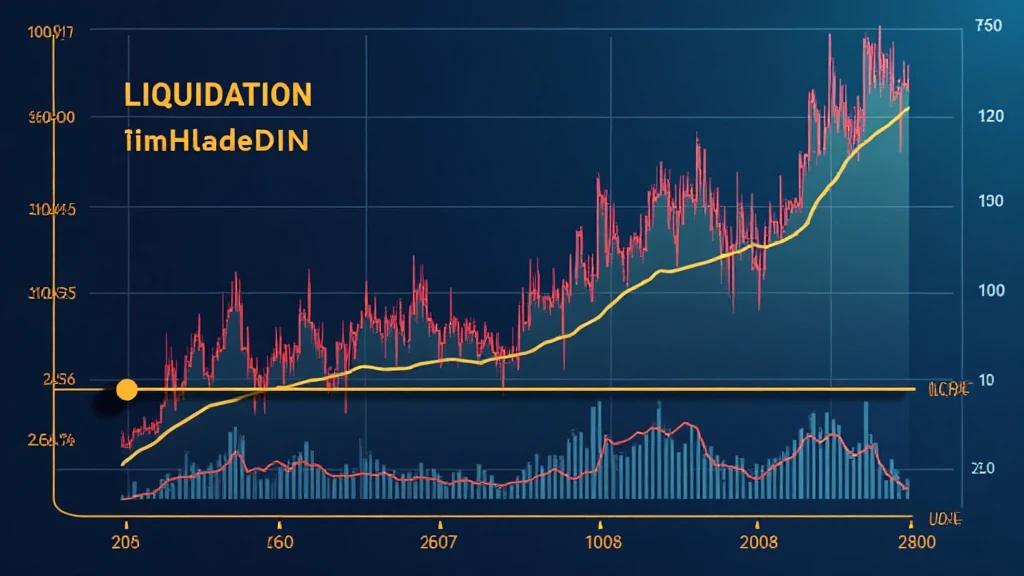

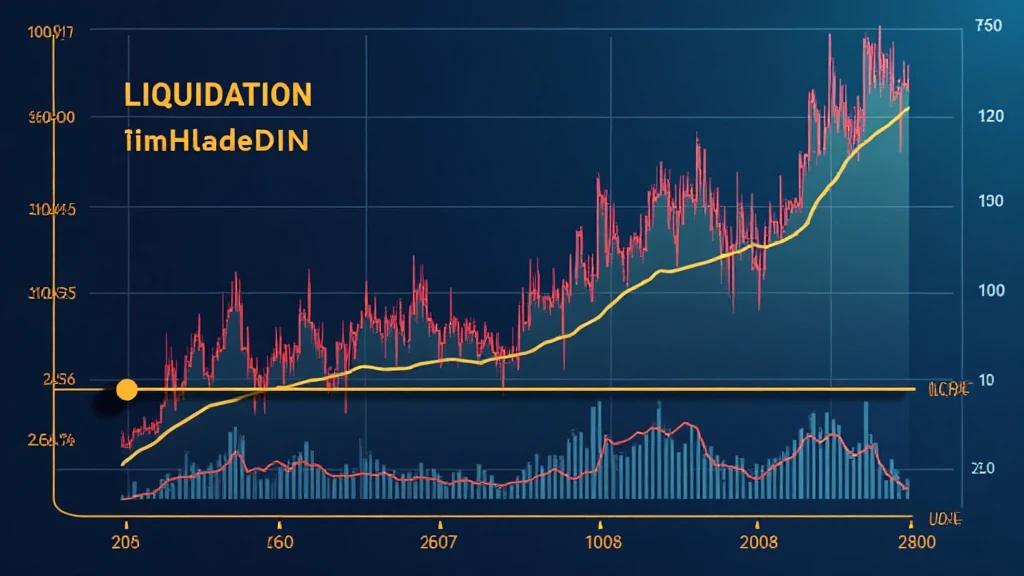

Analyzing Liquidation Thresholds in Vietnam

In Vietnam, the acceptance of cryptocurrencies for trading has seen an upward trajectory. Recent studies indicate that approximately 25% of Vietnamese internet users aged between 20-35 are involved in crypto trading, highlighting the importance of understanding liquidation mechanisms.

Factors Influencing Liquidation Thresholds

- Regulatory Environment: Vietnam’s regulatory stance on crypto assets affects trader behavior and market stability.

- Technological Advancements: As trading platforms evolve, so do the techniques traders use to mitigate risk.

- Market Sentiments: Understanding trader psychology and market sentiments can provide insights into possible liquidation events.

Strategies to Avoid Liquidation

To navigate the complexities of liquidation, traders on the HIBT platform can implement effective strategies, such as:

1. Setting Stop-Loss Orders

Utilizing stop-loss orders can help traders exit positions before they reach the liquidation threshold, limiting their losses.

2. Monitoring Market Signals

Being aware of market indicators and trends ensures traders can make timely decisions, reducing the likelihood of liquidations.

3. Adjusting Leverage and Margin

Traders should evaluate their use of leverage, balancing potential gains with the risks involved. Adjusting margins according to current market conditions is crucial.

Real Case Studies from HIBT

To illustrate the impact of liquidation thresholds on trading, let’s examine case studies from the HIBT platform:

Case Study 1: Volatile Market Response

In early 2023, a significant market correction led to numerous liquidations across platforms. Those who maintained a keen awareness of their thresholds were able to either exit their positions successfully or utilize them as a buying opportunity.

Case Study 2: Over-leveraging Risks

Another instance noted traders who opted for high leverage without fully understanding their liquidation thresholds faced substantial losses when the market turned against them.

Future Trends in Crypto Trading in Vietnam

The Vietnamese crypto landscape is evolving rapidly. With the introduction of stricter regulations and more advanced trading technologies, traders on platforms like HIBT will need to adapt continuously. Expectations forecast a 30% increase in crypto adoption by 2025, emphasizing the need for robust risk management strategies, especially regarding liquidation thresholds.

Conclusion

Understanding HIBT Vietnam’s liquidation thresholds is critical for any trader looking to maximize their success in crypto futures trading. With the appropriate knowledge and strategies, traders can mitigate risks and navigate the volatile nature of the crypto market effectively. Always remember that awareness and preparation are your best tools to avoid liquidation pitfalls.

As a final note, it’s essential to stay updated with market developments and continuously refine your trading strategies.

For more information, visit href=’https://hibt.com’>HIBT.com.

Written by Dr. Alex Thompson, a seasoned blockchain analyst with over 15 published papers and auditing experience on notable crypto projects.