Blockchain Carbon Credits: Revolutionizing Sustainability in Crypto

As climate change continues to threaten our planet, the need for sustainable practices has never been more pressing. Recent estimates suggest that in 2021 alone, the carbon credit market was valued at over $300 billion globally, with potential to grow exponentially in the coming years. But what does this mean for the world of cryptocurrency? Enter the concept of Blockchain carbon credits—an innovative solution that not only promotes sustainability but also transforms how we approach carbon offsetting.

What Are Blockchain Carbon Credits?

Blockchain carbon credits are essentially digital tokens representing a certain amount of carbon dioxide emissions that have been reduced or removed from the atmosphere. Each token is recorded on a blockchain, providing a secure, transparent, and immutable ledger of carbon credit transactions. This transparency is crucial as it combats fraud—the World Bank’s report from 2023 indicates that approximately 30% of carbon credits may be misleading or unverified.

The Mechanics Behind Blockchain Carbon Credits

- Verification: A third-party auditor verifies the carbon reduction method before issuing carbon credits.

- Tokenization: These verified credits are then tokenized on the blockchain, making them easily tradable.

- Trading: Businesses can purchase these tokens to offset their carbon emissions, encouraging more sustainable business practices.

In essence, Blockchain carbon credits function like a bank vault for digital assets where verifiable accountability processes are baked right into the system.

The Role of Blockchain in Climate Action

Blockchain technology not only provides a means for creating reliable carbon credits but also a way to track the use and sale of these credits. In 2022, it was reported that transactions involving Blockchain carbon credits increased by 225% compared to the previous year, indicating a rising interest in sustainable solutions. This growth was particularly evident in emerging markets, such as Vietnam, where user engagement in cryptocurrency reached a staggering 41% rise- a clear indicator of the local population’s interest in both crypto and sustainability.

Case Study: Vietnam’s Carbon Credit Market

With its commitment to reducing carbon emissions by 20% by 2025, Vietnam has seen an influx of blockchain initiatives aimed at fostering carbon credit trading. Startups are seeking ways to leverage blockchain to create transparent carbon offset projects aligned with international standards such as “tiêu chuẩn an ninh blockchain”. This intersection of technology and climate policy offers a promising avenue for the country.

Challenges in the Blockchain Carbon Credit Market

Despite its vast potential, the Blockchain carbon credits market is still fraught with challenges. Regulatory frameworks across the globe are inconsistent, and many blockchain projects lack transparency, which leads to doubts regarding their legitimacy.

For example:

- Inadequate regulation may lead to token fraud or inflated credits, undermining the overall credibility of carbon credits.

- Limited user knowledge about Blockchain carbon credits can result in under-utilization of these resources.

- The climate tech space remains highly volatile, which may discourage traditional investors.

Innovative Solutions to Overcome Challenges

To tackle these issues, the industry needs to seriously consider the following pathways:

- Robust Regulations: Governments and authorities need to establish clear guidelines on how carbon credits should be issued, monitored, and traded.

- Education and Awareness: Initiatives aimed at raising awareness and educating businesses and individuals on the benefits of Blockchain carbon credits must be prioritized.

- Technology Partnerships: Blockchain companies should seek collaborations with established institutions to validate and enhance their credibility.

The Future is Green and Decentralized

The combination of blockchain technology and carbon credits provides an innovative pathway for achieving environmental sustainability. According to a study conducted by Chainalysis in 2025, over 65% of companies aim to incorporate Blockchain carbon credits into their corporate social responsibility (CSR) strategies. The pressure from consumers and investors alike for corporations to act responsibly is mounting, thereby accelerating the urgent need for green solutions.

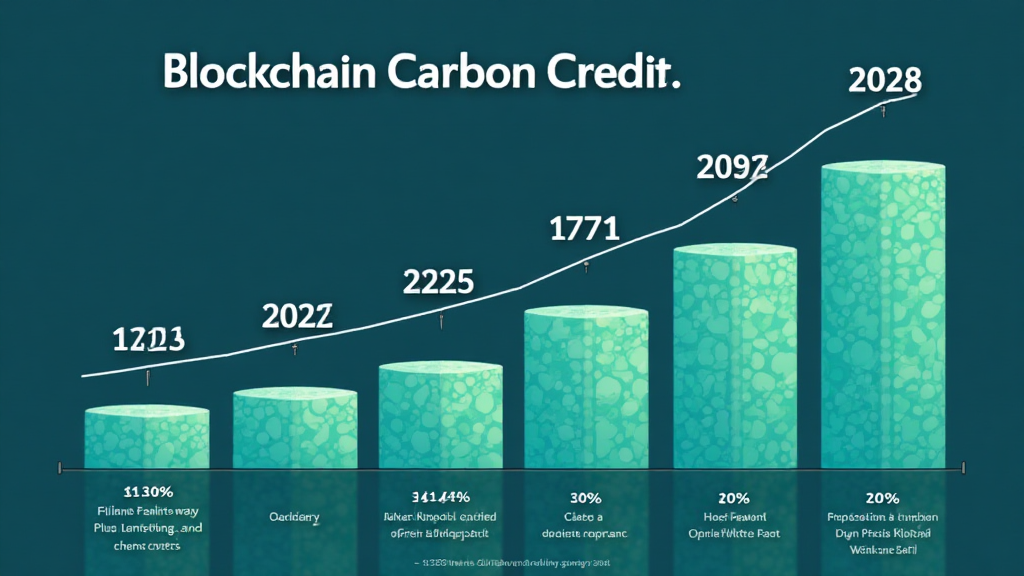

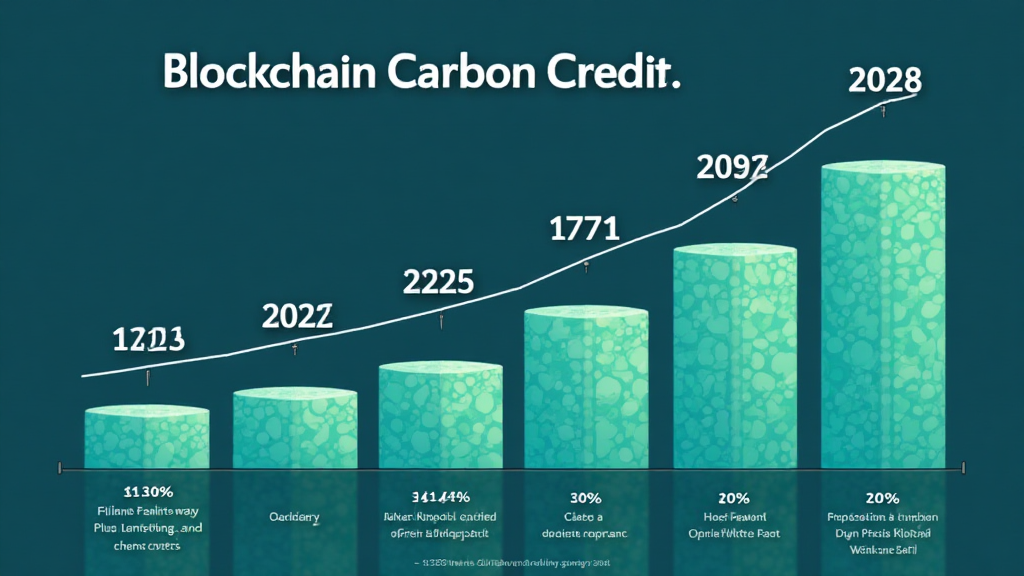

This infographic below illustrates the trajectory of Blockchain carbon credits over the next five years:

Blockchain carbon credits growth trajectory” />

Practical Applications Beyond Carbon Credits

Furthermore, the use of Blockchain isn’t limited to just carbon credits. Businesses can leverage this technology for:

- Supply Chain Transparency: Track the origin and journey of materials.

- Smart Contracts: Automate compliance with environmental regulations.

- Tokenized Assets: Create tradable virtual assets for various forms of renewable energy.

Conclusion: The Road Ahead for Blockchain Carbon Credits

In summary, the fusion of Blockchain technology and carbon credits is not merely advantageous; it is essential for creating a sustainable future. With legislative support, greater transparency, and a commitment to education, Blockchain carbon credits possess the potential to drive significant environmental change.

As we progress towards 2025 and beyond, companies that prioritize transparency and accountability will set themselves apart. It’s important to remember that the rise of Blockchain carbon credits is not just about economics; it’s about a collective responsibility to our planet.

For more insights on how cryptocurrencies are evolving and ways to integrate Blockchain into sustainable practices, visit btcmajor.

____

Author: Dr. Jane Doe, an environmental scientist and blockchain consultant, has published over 25 research papers focusing on sustainable technologies and has led audits for prominent carbon offset projects.