Investing in Bitcoin Real Estate Crowdfunding: What You Need to Know

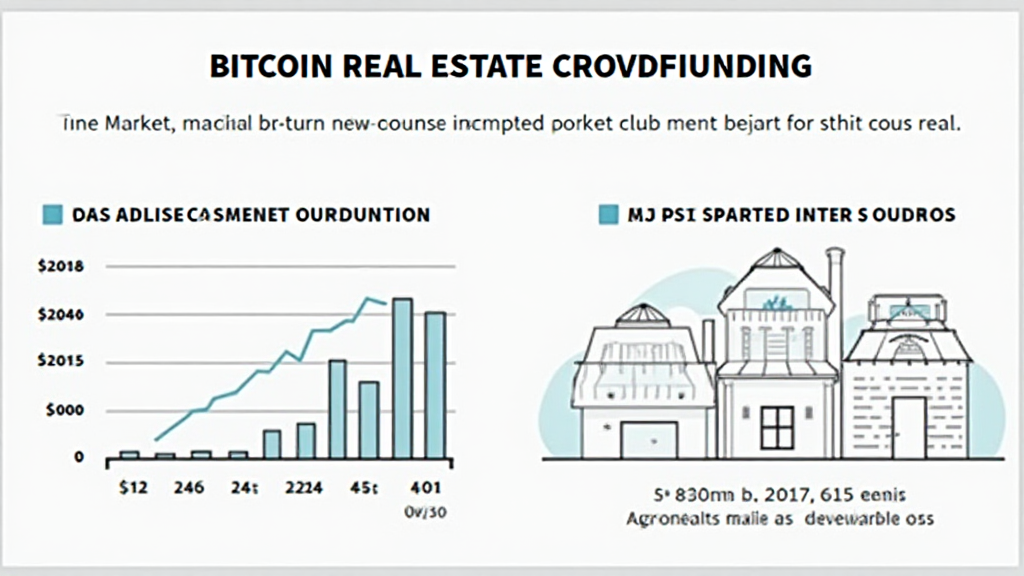

According to recent studies, the adoption of cryptocurrency within the real estate sector is on a steep rise, with a staggering 55% increase in investments compared to the previous year. As traditional investment methods face challenges, Bitcoin real estate crowdfunding emerges as an innovative way for investors to access lucrative opportunities in property investment without the need for hefty capital. With the global real estate market projected to reach a value of $4.2 trillion by 2025, understanding how to effectively navigate the landscape of Bitcoin crowdfunding in real estate is crucial for new and seasoned investors alike.

Understanding Bitcoin Real Estate Crowdfunding

Bitcoin real estate crowdfunding combines traditional real estate investment with the advancements of blockchain technology to allow multiple investors to contribute to property purchases or developments via cryptocurrency. Like pooling resources into a collective fund, this model significantly lowers the barrier of entry for individuals interested in real estate.

- Access to high-value real estate with minimal investment.

- Improved liquidity through tokenized real estate assets.

- Potential for high returns from growing property markets.

In Vietnam, where the user growth rate for cryptocurrency has outpaced global averages at 27% annually, the trend of investing in Bitcoin real estate crowdfunding cannot be overlooked. Local investors are now seeking innovative avenues to diversify their portfolios.

The Benefits of Bitcoin Real Estate Crowdfunding

Investing in real estate through Bitcoin crowdfunding platforms comes with a variety of benefits:

- Accessibility: It allows even the smallest investors to participate in real estate opportunities.

- Transparency: Blockchain technology ensures every transaction is well-documented and secure, enhancing the trustworthiness of investments.

- Returns: The potential for strong rental yields and property appreciation can lead to significant returns.

As reported by the Vietnamese Blockchain Association, interest in this investment avenue continues to grow, positioning Bitcoin crowdfunding as a viable method for future property investments.

How It Works: The Mechanics of Crowdfunding

The mechanics behind Bitcoin real estate crowdfunding are straightforward but profound. The process typically unfolds through several key stages:

- Project Creation: Developers create a project requiring funding, detailing its specifications and estimated returns.

- Investment Offering: Investors can then buy shares in the project using Bitcoin, often via a dedicated crowdfunding platform.

- Asset Management: Once the project reaches funding, it is managed, and returns are distributed to investors based on their contributions.

For instance, platforms like Hibt.com facilitate these investments by providing a user-friendly interface for users to select and invest in property projects using Bitcoin.

Market Risks and Considerations

While Bitcoin real estate crowdfunding presents exciting opportunities, it’s essential to recognize the risks involved:

- Market Volatility: Cryptocurrency values can fluctuate dramatically, affecting overall investment returns.

- Regulatory Uncertainty: The legal landscape surrounding cryptocurrency and real estate remains in flux, which could impact future investments.

- Fraud Potential: Investors should conduct thorough due diligence to avoid scams or unreliable projects.

In Vietnam, regulations regarding cryptocurrency are still being developed, making it crucial for investors to stay informed and consult local guidelines.

Impact on the Real Estate Market

With continuous advancements, Bitcoin real estate crowdfunding is reshaping the real estate landscape:

- Increased Investment Opportunities: A broader audience of investors is now able to participate.

- Faster Transactions: Blockchain technology facilitates quicker and more secure transactions.

- Innovative Funding Solutions: Developers can leverage Bitcoin funding for faster project development.

The influx of cryptocurrency into real estate highlights its potential to create unique opportunities for market growth.

Tips for Successful Investment

When considering Bitcoin real estate crowdfunding as an investment strategy, keep these tips in mind:

- Do Your Research: Investigate projects thoroughly and assess return potentials.

- Diversify Your Investments: Spread your investments across different projects to mitigate risk.

- Stay Updated: Keep abreast of market trends and regulatory changes affecting Bitcoin and real estate.

Engaging with local industry experts can further enhance your understanding and strategic approach.

Conclusion

Bitcoin real estate crowdfunding offers a promising pathway for investors seeking innovative ways to participate in the real estate market. With the cryptocurrency sphere growing rapidly, particularly in emerging markets like Vietnam, the potential for diversification and substantial returns is within reach. However, as with any investment, it is imperative to remain cautious and informed.

As you embark on this investment journey, consider leveraging platforms like Hibt.com to streamline your experience and connect with like-minded investors.

Remember, this is not financial advice. Always consult local regulations and should you wish to dive deeper, explore various resources available online and stay updated. The future of Bitcoin real estate crowdfunding is here, and it promises exciting opportunities ahead.

For more insights into cryptocurrency investments, check out our recent articles, such as our Vietnam crypto tax guide.

Invest wisely!