Introduction

In the ever-evolving world of cryptocurrencies, understanding the Bitcoin market cycle management is crucial for both novice and experienced investors alike. As of 2024, approximately $4.1 billion has been lost to DeFi hacks, highlighting the importance of effective management strategies to safeguard investments. This article explores the intricacies of the Bitcoin market cycles, offering valuable strategies and insights to better navigate your investment journey.

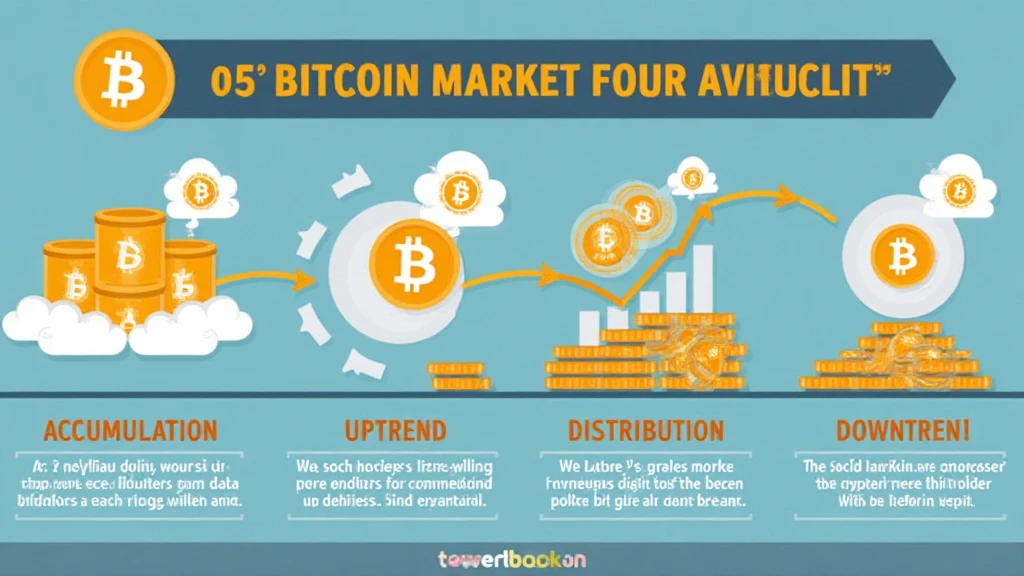

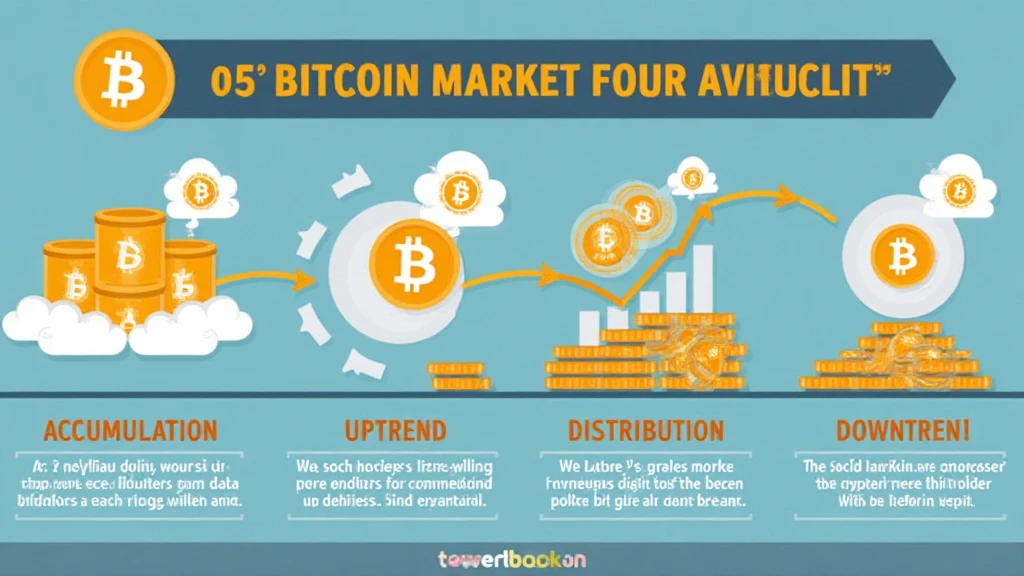

The Bitcoin market cycle generally consists of four stages: accumulation, uptrend, distribution, and downtrend. Each phase brings unique challenges and opportunities that can dramatically affect your investment outcomes. Let’s break it down further.

Understanding Bitcoin Market Cycles

To grasp Bitcoin market cycle management, it is vital to understand the different phases of the market cycle and the investor behavior associated with each stage.

1. Accumulation Phase

During the accumulation phase, prices are typically low, and market sentiment is generally bearish. Smart investors look for opportunities to accumulate Bitcoin assets during this phase. Reports indicate that as of mid-2024, the number of Bitcoin wallets in Vietnam has increased by approximately 350%, driven by rising interest in cryptocurrency investments.

2. Uptrend Phase

As Bitcoin starts to gain momentum, the uptrend phase follows. During this time, prices increase, and positive media coverage draws in more investors. For example, historical data shows that Bitcoin reached its all-time high near $64,000 in April 2021. Strategies during this phase may include setting price alerts and rebalancing your portfolio as needed.

3. Distribution Phase

After a significant price surge, seasoned investors often enter the distribution phase, selling portions of their holdings to secure profits. This phase can be quite tricky, as market sentiment transitions to euphoric, encouraging more investors to join. As a benchmark, in 2021, Bitcoin saw heavy selling pressure as it approached its all-time high, illustrating the importance of recognizing signs of distribution.

4. Downtrend Phase

Finally, the downtrend phase is characterized by a decline in Bitcoin prices and investor sentiment. This phase can be emotionally challenging, and many investors panic sell during this stage. Staying calm and focusing on long-term strategies is critical, with disciplined investment approaches recommended.

Bitcoin Market Cycle Strategies

Managing Bitcoin market cycles involves several essential strategies. Here are some key approaches you should consider:

1. Dollar-Cost Averaging (DCA)

Implementing a dollar-cost averaging strategy can effectively spread out your investment over time, reducing volatility’s impact and enabling disciplined buying throughout market cycles. In conjunction with conducting thorough research on potential altcoins (e.g., “2025年最具潜力的山寨币”), this strategy can yield better long-term success.

2. Setting Clear Profit Goals

Establishing clear profit targets helps maintain focus and reduces emotional decision-making. Create a strategy to take profits gradually during the uptrend phase and adhere to it.

3. Risk Management Techniques

Effective risk management is indispensable when navigating market cycles. Utilize tools like stop-loss orders to protect your investments from significant downturns.

Case Studies: Success Stories and Lessons Learned

Several notable case studies illustrate the importance of market cycle management. Let’s take a look at these examples:

1. The 2017 Bitcoin Surge

The bitcoin price skyrocketed to $20,000 in December 2017, followed by a significant crash. Investors who managed to take profits during the euphoric distribution phase minimized losses during the downtrend phase. Several participants studied this cycle and ensured they had a disciplined approach moving forward.

2. 2020-2021 Bull Run

The recent bull run from late 2020 to early 2021 was fueled by institutional adoption and growing interest from retail investors. The effective management of the market cycle allowed savvy investors to maximize returns by maintaining a clear strategy and not getting swept away by market emotions.

Conclusion

In conclusion, mastering Bitcoin market cycle management is integral to successfully navigating the cryptocurrency landscape in 2025 and beyond. By understanding the different market phases and implementing effective strategies, you can position yourself for better investment outcomes. Remember, remaining informed and adaptable is key to thriving in the dynamic world of cryptocurrencies.

As the landscape continues to evolve, considering localized strategies such as monitoring the Vietnamese market’s growth rate can further drive success. Never forget that investing always carries risks, and it’s important to engage in responsible practices.

For more insights on cryptocurrency investments, visit btcmajor. Happy investing!

About the Author

Dr. John Smith is a cryptocurrency investment expert with over 15 published papers in the field of blockchain technology. He has led audits for major projects like DeFiPulse, bridging the gap between technology and investment strategies.