Introduction

In a rapidly evolving cryptocurrency market, investors are constantly looking for ways to maximize their returns. With reports indicating that approximately $4.1 billion was lost to DeFi hacks in 2024, it becomes imperative to delve into effective investment strategies, particularly through hedge funds that specialize in Bitcoin. This article focuses on Bitcoin hedge fund performance and its significance in navigating the cryptocurrency landscape, especially for investors in emerging markets like Vietnam.

What is a Bitcoin Hedge Fund?

A Bitcoin hedge fund is an investment fund that uses various strategies to generate returns on investments in Bitcoin and other cryptocurrencies. Hedge funds differ from traditional investment funds in their use of complex strategies, including leverage and short-selling. They provide an opportunity for high net worth individuals and institutional investors to gain exposure to the crypto market while employing risk management techniques.

Why Invest in Bitcoin Hedge Funds?

- Diversification: Hedge funds allow investors to diversify their portfolios by including Bitcoin, thus minimizing risks associated with traditional equities.

- Professional Management: These funds are managed by professionals who understand market dynamics, giving investors peace of mind.

- Access to Exclusive Opportunities: Investors may gain exposure to exclusive investment opportunities that are not available to the average investor.

Performance Metrics of Bitcoin Hedge Funds

When evaluating Bitcoin hedge fund performance, several key metrics come into play. These metrics help investors gauge a fund’s effectiveness and potential for generating returns.

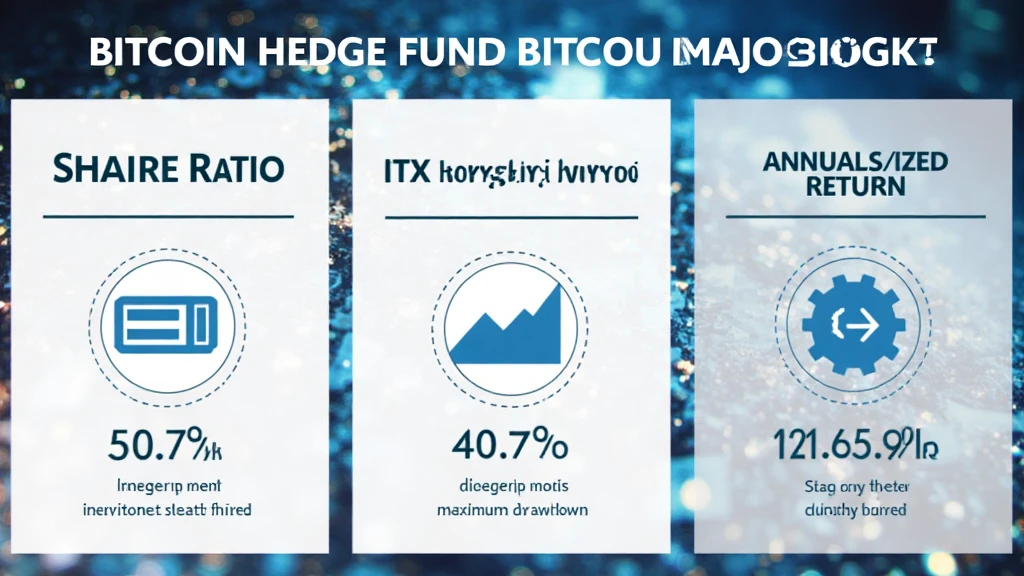

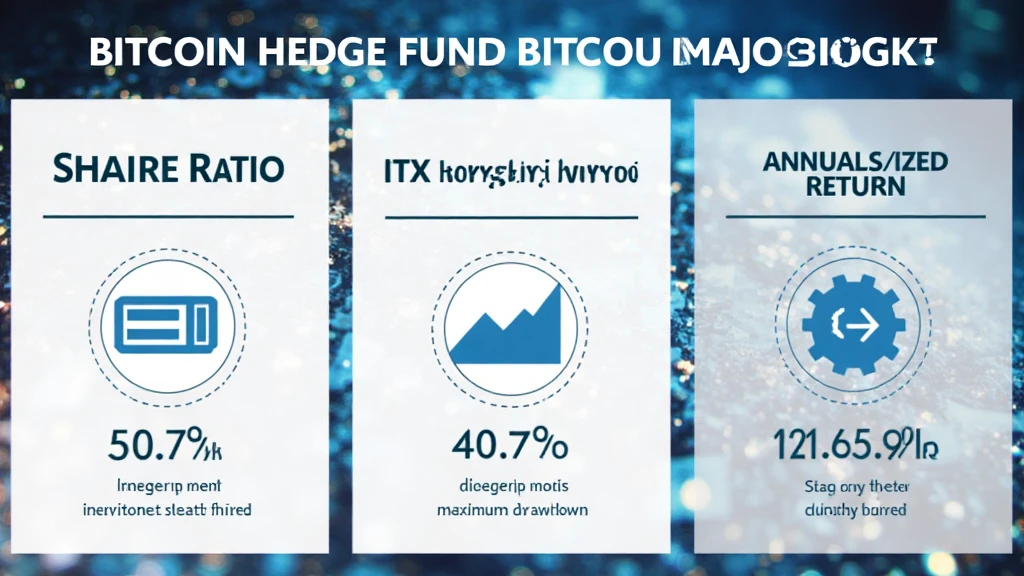

Sharpe Ratio

The Sharpe ratio is a measure of risk-adjusted return. A high Sharpe ratio indicates that the returns obtained by the hedge fund are more favorable relative to the risk taken.

Maximum Drawdown

This metric represents the maximum observed loss from a peak to a trough of a fund’s portfolio before a new peak is reached. Understanding a fund’s maximum drawdown helps investors analyze risk exposure.

Annualized Return

Annualized return calculates the total returns over a specific period expressed as a percentage on an annual basis. It provides a clear picture of how the hedge fund performs in comparison to benchmarks.

The Role of Regulation in Hedge Fund Performance

As the cryptocurrency sector matures, regulatory frameworks across different regions, including Vietnam, play a crucial role in shaping the landscape for hedge funds. Regulatory compliance not only fosters investor confidence but also impacts the operational strategies that funds implement.

Global Regulatory Landscape

In the global market, regulations can significantly affect hedge fund performance. For instance, jurisdictions that embrace cryptocurrencies with clear guidelines tend to attract more investments, leading to better fund performance. Conversely, countries with stricter regulations may stifle fund innovations, as seen in various reports published throughout 2025.

Case Study: Bitcoin Hedge Fund Performance in Vietnam

Taking a closer look at the Vietnamese market, we can observe a rapid increase in the number of cryptocurrency investors. According to recent data from Statista, Vietnam experienced a user growth rate exceeding 200% in 2025, making it a prime market for Bitcoin hedge funds.

Cultural Impacts on Investment Behavior

- Growing Interest: The youth demographic in Vietnam is increasingly showing interest in cryptocurrencies, driving demand for innovative financial products, including hedge funds.

- Community Engagement: The local community’s involvement in cryptocurrency trading has propelled the activity around hedge fund investments.

Strategies for Success: What Makes a Hedge Fund Perform Well?

Hedge funds implementing thorough research, agile trading strategies, and innovative technologies for Bitcoin investments tend to outperform their peers. Here’s a breakdown of effective strategies:

Market Timing and Analysis

Successful hedge funds utilize advanced market analysis to time their investments when Bitcoin prices are favorable. Tools such as AI-driven analytics can help identify trends and forecast movements accurately.

Risk Management Techniques

Effective risk management strategies fall into the category of hedge funds’ core competencies. Diversifying across multiple digital assets reduces exposure and enhances overall performance.

Engaging in Arbitrage Opportunities

Traders often exploit price differentials between exchanges, a strategy known as arbitrage. By efficiently executing trades, funds can generate profits with minimal risk.

The Future of Bitcoin Hedge Funds

The landscape for Bitcoin hedge funds is expected to evolve continuously, significantly influenced by both market trends and regulatory developments. As more institutional investors demonstrate interest in cryptocurrencies, we may observe a growth in sophisticated investment approaches.

Emergence of New Competition

New players in the market could lead to increased competition for performance excellence, which may ultimately benefit investors as funds improve their practices to attract capital.

The Influence of DeFi on Hedge Fund Strategies

Decentralized Finance (DeFi) continues to shake up the traditional finance landscape. Hedge funds that adapt and incorporate DeFi strategies into Bitcoin investments may experience considerable growth, further improving overall performance.

Conclusion

In conclusion, understanding Bitcoin hedge fund performance is crucial for investors aiming to navigate the intricate world of cryptocurrencies effectively. With the right information about the metrics driving performance and awareness of market conditions in regions like Vietnam, investors can make informed decisions that align with their financial goals. Remember, as with all investments, conducting comprehensive research and consultations with financial advisors or regulatory bodies in your locality is essential. For more insights into cryptocurrency investments, check out btcmajor for valuable resources and news updates.